Reforms spur social security services but still lag behind peers and standards in developed countries, writes Isaac Khisa.

Things are changing for the better in the pension sector. Five years ago, the government enacted the Uganda Retirements Benefits Authority Act that created the Uganda Retirement Benefits Regulatory Authority (URBRA).

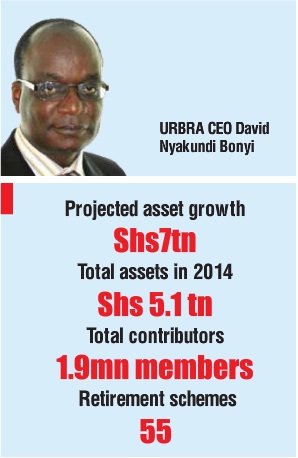

According to the latest data, which the authority released several weeks ago, the total assets under management amounted to Shs 5.1 trillion ($1.5 billion), with Shs 62 billion ($18.2 million) recorded as liabilities in 2014.

Three years after the start of its operations, URBRA has collected and analyzed industry data from the schemes as well as developed and a released a financial reporting and disclosure requirements for the retirement benefits schemes to clearly spell out the earning/collections and expenditure professionally.

The data shows that bonds are a popular asset class due to their attractive return-risk characteristics, good liquidity, and relatively long durations. Direct holdings of government debt securities comprised 57.8 %of total investments, fixed and term deposits 14.4 % and immovable property 9 %.

With the core aim of protecting the interests of members and beneficiaries of the retirement schemes alongside seeing development of the schemes, URBRA is optimistic of more growth in the sector.

Benjamin Mukiibi, the senior research and sector development officer at the URBRA, says the industry is projected a northward trend in the value of assets as more firms comply with the law.

“We are hoping that pension assets are likely to reach Shs 7 trillion as more schemes come on board in a rush to comply with the law and the projected increase in the assets held by the National Social Security Fund (NSSF),” Mukiibi told The Independent, adding that the two-account reporting periods – whose year ends in June and others in December – is slowing down data compilation.

Out of the 55 legally registered schemes, NSSF is the largest licenced retirement benefits scheme, now valued at Shs 5.8 trillion ($1.7billion).

In addition, the country has 367 trustees, 11 administrators, 7 fund managers, and 4 custodians. According to the Act, trustees are entities responsible for managing a retirement benefits scheme, keeping proper books of accounts; give beneficiary information and explanations to the investment’s decisions and dealings conducted whereas administrators are persons appointed by trustees to administer a scheme.

On the other hand, fund managers are persons appointed by the trustees to advice on the investment of the assets of the scheme while custodians are financial institutions responsible for safe custody of funds, securities, financial instruments and documents of title of the assets of scheme’s funds, and are mainly commercial banks.

Now, the authority is looking at conducting a public awareness campaigns on pension savings, which shall include training of service providers, trustees and scheme members to steadily grow the pension industry. It is also looking forward to the enactment of the Liberalization Bill, currently under discussion in Parliament, to avail more products in the market.

Analysts argue that with a mere 1.5 million members in a population of 35 million, it will be a very long time before NSSF builds the institutional capacity to shoulder social security burden for the entire population if it remains a monopoly.

“I am happy with the progress so far made by URBRA especially in licensing these schemes because by doing so, they ensure that that what is in their records is actually what their savings kitty is,” says Hamza Mutebi, the general manager of Mutts Insurance Services.

Mutebi says having a regulator in the industry would ensure that the funds are managed professionally and will always available to members on demand. Uganda had 1.9 million contributors under some form of cover, representing 14% share of the national labor force (13.9 million people) as of 2014, according to URBRA.

Kenya’s pension industry is expecting to register a 25% growth in assets to KShs1trillion ($9.69 billion), according to the Retirement Benefits Authority (RBA). According to a 2014 report compiled by the Commonwealth dubbed, ‘Pension Funds and Private Equity: UnlockingAfrica’s Potential,’ Pension funds in Sub-Saharan countries cater for only a tiny fraction of the pensionable population compared with their counterparts in developed countries.

For example, only 5%-10% of the populations in sub Saharan Africa are thought to be covered by pension funds compared with 80% in North Africa. Pension funds are only about 5% of GDP in Nigeria, compared to 170% of GDP in Netherlands, 131% in UK and 113% in the US.

Mathias Katamba, the managing director at the Housing Finance Bank, told The Independent that the financial sector is moving in the right direction with URBRA’s move to regulate the industry in spite of the challenges.

“Normally, there are always challenges at the beginning of any new idea…but I think we are in the right direction,” said Katamba, whose financial institution also operates a retirement benefits scheme.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price