COMMENT:

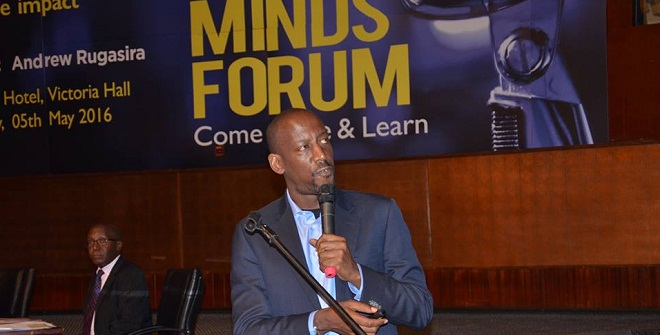

By Andrew Rugasira

Economists used to consider the informal sector a “shadow economy”, a relic from the underdeveloped past that would be replaced by formal activities and better paid jobs. Not anymore. The informal sector has in many ways superseded the formal sector and is now the face of modernity rather than its antithesis.

In the informal economy, jobs and business activities are not registered or protected by the state. The enterprises don’t exist on any business or tax register; they don’t enjoy any social benefits, and often have no titled or registered assets. This means that they are inherently vulnerable, highly mobile, and insecure. As a consequence, these unregulated entities don’t pay taxes, their employees are excluded any social safety nets and they lack the protection accorded by formal labour contracts.

It is easy to underestimate the contribution this sector can make on an economy. In Uganda, over 50% of GDP (UBOS, 2014) is attributed to the informal sector, up from 43% in 2002. Up to 80% of the labour force works in the informal economy and most of this is essentially “underemployment” since most of the workers still don’t earn enough to escape poverty.

It shouldn’t be an invisible force to be `captured’ but a transitional stage with visible impact

The highest informality is in the agricultural sector. Typically, farmers don’t have property rights in the form of a land titles, they lack access to extension support, social security and formal credit markets.

With only 11% of credit in Uganda going to the rural economy (Bank of Uganda) and with 1 in 10,000 entrepreneurs able to successfully obtain credit (World Bank), the rural farmer is essentially consigned to relying on unregulated loan sharks whose repayments include the farmers produce. This jeopardises the next season’s productivity and output. Inability to obtain credit represents a major structural impediment to capital accumulation in the rural economy.

Similarly, the informal urban entrepreneur will tend to be unskilled. Although a large segment of the informal sector is increasingly comprised of graduates, they will have no titled assets or documented inventory, lack credit and are vulnerable to the enforcement measures of the regulatory authorities.

What drives informality or rather the choices entrepreneurs and job seekers make to enter the informal market?

Informality has several distinct realities that inform the choices entrepreneurs or job seekers make in deciding sector participation.

One is urban bias. Because most public and private resources are invested in the urban areas, rural dwellers look to the urban centres as ‘beacons of light’. With more than 70% of non-agricultural economic activity and non-agricultural jobs located in urban areas this draws many of our young in search of opportunities.

Two, it is difficult and costly to register a new business. According to the World Bank “Doing Business 2016” report, it takes over 27 days to set up a new business in Uganda. Compare this to the 48 hours it takes to do this in Rwanda which is even faster than the average 8 days in the OECD countries.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Basically informal sectors are being owned by females than males . And there is a need to sensitize women on what are the benefits of formalizing the business , teach them how to keep their books of accounts or records properly, and sentintise them on what it takes to register your business .this will help them understand what there are missing out and individuals and the same time as the government.