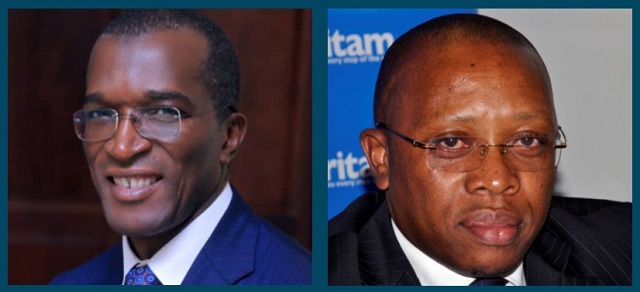

Ibrahim Kaddunabbi and Allan Mafabi

IRA boss tips sector executives on managing scams that could haunt performance

Kampala, Uganda | JULIUS BUSINGE | Insurance companies must put in place feasible policies to manage fraud that could easily jeopardize their good performance.

This is the summary of what Ibrahim Kaddunabbi Lubega, the Chief Executive Officer for Insurance Regulatory Authority (IRA) told sector executives on Oct.24.

The executives had met at the 44th CEOs breakfast meeting held at Kampala Serena Hotel. The theme for the meeting was “evolving market conduct challenges, impact and way forward – fraud in insurance”

Kaddunabbi said fraud is a big risk. He cited the KPMG East Africa Insurance Fraud report, 2015 that says…in Uganda, fraud adds 10% extra amount to the premium/the amount of money an individual or business pays for an insurance policy.

In addition, he said, insurance fraud is a real risk in today’s business environment, and businesses of all sizes can find themselves a target. He said risks increase as businesses become more complex.

“Elimination of the risk of fraud is difficult,” he said, “But it is possible to mitigate the risk and reduce the opportunity for would-be fraudsters to target your business,” he added.

He said companies should formulate feasible policy on fraud which should be consistently implemented to reflect the relevant operational procedures and controls. He said risk management policies should target products, clients, staff, outsourced firms, claim handling and dealings with intermediaries.

Fraud can be internal and external. Internally, it is characterized by falsification of claims, theft of information, intellectual property fraud, and false employment history. Externally, it takes the form of staging thefts/robbery, arson, forgeries, cash premium suppression, premium inflation and misrepresentation of the risk to reduce premiums. The other external types of fraud are related to suppliers and cyber of information technology systems.

According to the IRA data, fraud cases reported and investigated for the years 2018 and 2019 totaled to Shs3bn and Shs4.9bn respectively. The most common reported cases with higher amounts include issuing fake policies and forgeries, motor related schemes, fidelity guarantee claims and credit bond guarantees. Others are, fake death schemes, domestic policy schemes, cash in transit schemes, burglary schemes and more.

More solutions

Kaddunabbi urged companies to perform pre-employment and in-employment screening of staff, establish a clear dismissal policy for internal fraud cases in order to deter other potential perpetrators, establish internal complaints procedures for disgruntled staff, observe the four eye principle, to involve more than one person in decision making for validation, proper governance, transparency and control.

He also told them to improve and strengthen information systems to limit data breaches, reduce on human contact and enhance information technology systems.

The other solutions are; quickly report and share information within and to the relevant authorities on fraud incidents like IRA, Uganda Insurers Association. Also carrying out hacking tests to improve on systems security and quality assurance of the different software in place and holding policyholders or beneficiaries liable for their duties when taking out insurance or reporting a loss/claim could also help. Companies were also advised to deal with only licensed intermediaries for proper standards and adequate safeguards in the conduct of sound business.

Kaddunabbi added that fraud can also be eliminated through education and awareness targeting different sector players, establishment of shared databases among insurers like Insurance Fraud Register and Motor claims database. In addition, cooperation with supervisors such as Financial Intelligence Authority and professional bodies such as chartered accountants, forensic auditors, law society, loss assessors. Above all, there should be punitive sanctions against the perpetrators.

Kaddunabbi said, by leveraging on existing institutional structures, there are opportunities for building strong risk frameworks that could improve the overall control of fraud.

“Fighting alone can deliver, but only to a limited extent,” he said. He added that players that embrace the right mix of tools, staffing, training and technologies are better suited to fight fraud.

That notwithstanding, Kaddunabbi said, fighting insurance fraud is a collective responsibility and requires collective effort. But, he added that the first step is taken individually through detection, prevention, sharing and reporting to the relevant authorities.

Chief Executive officers did not disagree with their regulator but instead said, already they were moving fast to fighting fraud.

Allan Mafabi, the Chief Executive Officer at Britam Insurance Company (Uganda) Ltd said on the sidelines of the meeting that they had recorded some cases of fraud which they reported to the IRA.

He however said that internally, they have built systems to fight feared scams that could negatively impact on their performance.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price