COMMENT: By Milly Kyolaba

One of the biggest challenges Non Profit Organisations (NGOs) and development agencies operating in countries like Uganda face is getting the balance right between managing their budgets administrative and overhead costs versus the amount of money they actually use to support the intended beneficiaries.

Critics often argue that far too much money is spent on luxurious air conditioned offices, endless cocktail parties, and high end four wheel drive transportation, leaving the intended recipients virtually unaided.

Whilst this argument might seem valid the counter argument is that in order to attract the quality of human resources needed to manage an effective countrywide development programme requires certain perks and operating standards which cannot be compromised.

Short of this, the wrong type of individuals would be employed to manage the projects, lacking the skills and moral compass needed to manage huge amounts of money and within a given period of time through a combination of embezzlement and mismanagement with the project funding, the money would be misspent.

Prudent management of even the most basic expenses is important in making a difference to those they support

Whichever side of the argument you stand, the reality is that prudent management of even the most basic expenses is an important aspect all NGOs need to be mindful of if they want to make a difference to the lives of the communities they are supporting and secure their long term funding.

So the question therefore is where do you start? Where should an NGO look at making savings in order to fulfil its mandated objectives? Should it get rid of their offices, cut back on events, and other projects?

Perhaps the most logical place to start would be the most important resource an NGO has beyond the people who run it, money. Here I am talking about where it comes from, how much it costs to handle, and how easily can it be moved from the NGO account to the end beneficiaries.

Global studies indicate the biggest challenge facing NGOs; once they are set up and are operational, is financial management and money related expenses. A typical NGO can spend as much as 1-5% of their overall budget just on receiving, transferring, or maintaining money on their accounts. If a budget is huge as is common with the large NGOs this can be a ridiculous amount of money that should otherwise be spent on the intended beneficiaries.

Where an NGO keeps its money, therefore, and the advantages it enjoys from keeping it there as opposed to doing something else with it is of the upmost importance. If a bank charges you a given percentage for receiving money, transferring to it beneficiaries or just letting it sit in your account then you know there is a problem.

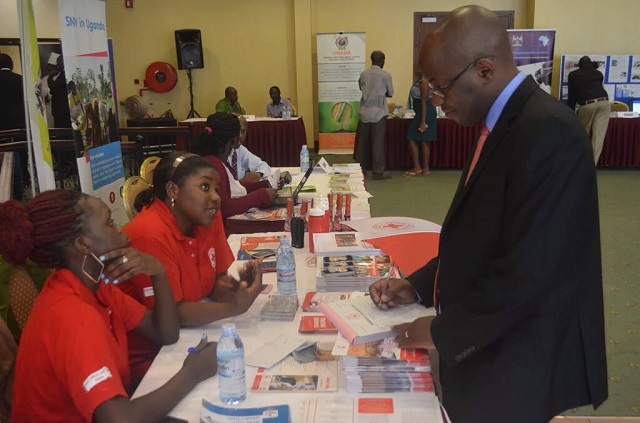

All is not lost, however. At the recent 6th National NGO forum held in Kampala; Stanbic Bank launched a product aimed at addressing this very challenge. It is called `Community Banking’. The product was created because the bank came to the conclusion that far too many of their non-profit customers such as NGOs were being charged costs normally associated with companies in the business of making profits.

The offering is unique in that the NGO does not incur any bank charges usually associated with corporate business accounts such as, a fee for the inward/outward transfer of funds, account maintenance charges, and cash deposit charges. This specific NGO account which we call the Community development account is connected to mobile money allowing for direct transfers to mobile wallets and is housed on our secure online platform which allows administrators, including donors to access the account from anywhere in the world.

While the community bank product is a breath of fresh air, it clearly does not solve all expense problems of an NGO. What it does is to demonstrate that they need to be creative and look out for options as they look towards bringing down the cost of delivering services.

Outsourcing of non-core professional services is another alternative. Going back to the controversial high end 4 X 4 cars, does a mid-size NGO for example really need a huge fleet of off-road vehicles many of which are idle a lot of the time when it can retain the services of a professional transportation company? Is it really necessary for an NGO to have a dedicated in house IT team when for a small fee a specialised local firm can be hired on a retainer at a lot less than then the entire internal team’s salaries to do the same work?

The answer to both these questions is probably no and the good news is many NGOs are already moving in this direction. The real question, however, is whether all such actions make the NGO more efficient and give it greater impact in its area of operation? If the answer is yes as in the case of Community banking where more money is saved for the end beneficiary, then more NGOs should look at adopting such ideas.

***

Milly Kyolaba is the Head Public Sector, Stanbic Bank Uganda

***

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price