Kampala, Uganda | THE INDEPENDENT | The Uganda Revenue Authority-URA has revealed that Value Added Tax (VAT) of more than sh40 billion has not been remitted by different retail businesses since the electronic fiscal receipt invoicing system -EFRIS system was instituted.

In the bid to maximize tax mobilization in the country, URA introduced EFRIS, and it started with at least 40 prominent supermarkets in the country.

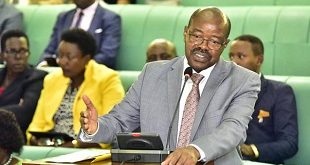

Denis Kugonza the commissioner for tax investigation, says that this amount has been established out of their investigations made in the last month.

Kugonza adds that among all the taxes, VAT is the most non-complied with, and there is a lot of fraud in the measure put up for its administration, and under the particular scheme they have so far established sh40 billion defaulted.

For a long time, the tax body has not been meeting its targets, and non-compliance has been at the forefront as one of the leading factors of this failure.

According to him, the tax is mainly lost through deliberate refusal to use the system, and invoice trading among other malpractice.

Kugonza says that VAT is not a tax to the business, but rather they are collecting agents and there is no reason why they don’t remit it yet they collect it.

“When these people do not remit their tax to URA, that is broad day robbery, since it doesn’t affect their profits in any way,” he explains.

Documents from URA show that up to 4 people have been arrested for enabling businesses not to remit this money. Out of the four, one was convicted to three years in prison, two asked for a plea bargain in court and the other is also in court. So far 12 billion has been recovered and another nine billion have also been identified.

Agnes Nabwiire the assistant commissioner of intelligence, says that though URA had given businesses options on how can join EFRIS, the new measure now is that businesses are going to be connected to the URA system such that they can be closely followed up.

According to Nabwiire, URA is moving to strengthen its online systems and to enable them to mitigate such occurrences, adding that since this is a new system they are learning on the job.

She adds that many businesses have failed to appreciate EFRIS until now when they have started its enforcement, yet to them, it is a great system that has helped them discover a lot of evasions.

“Even the discoveries we are making are an indication that the system works, if it was not we wouldn’t have discovered these gaps,” Nabwiire reasons.

She calls upon Ugandans to help them streamline the collection of this tax by demanding an EFRIS receipt when they make a purchase.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price