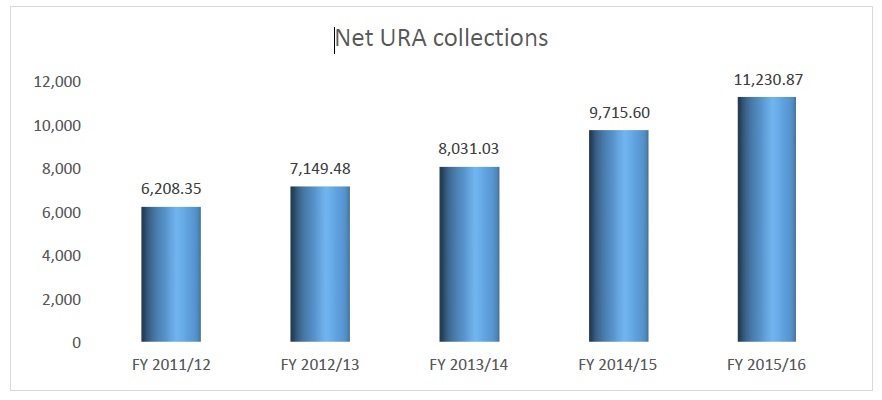

Uganda Revenue Authority (URA) collected sh11.23 trillion, 400 billion less than targeted for the fiscal year 2015/16.

Despite the shortfall on the target, the tax figures represented a growth of 15.60% (sh1.5 trillion) from the previous year’s figure of sh9.7 trillion collected in revenue. URA has now been taxed to collect 13.18 trillion this financial year.

URA Commissioner General Doris Akol on Wednesday broke down the figures for the press in a her end of financial year statement. Domestic tax collected was 6.3 trillion, performing at 95.63% while international trade contributed sh 4.8 trillion, performing at at 97.27%.

“I am happy to report that despite the numerous economic challenges faced during the concluded financial year including slower economic growth, reduced import volumes, depreciation of the Ugandan shilling and relatively subdued investor confidence due to nervousness surrounding the political period, we tried our best to collect Uganda shilling 11.23 trillion,” CG Akol told the press.

Domestically, corporate tax, VAT, PAYE and Local Excise Duty performed below target. For customs VAT at importation, import duty also performed below target – with the exception of petroleum duty.

“There has been a decline in revenue growth rate in Financial Year 2015/16 compared to that of last year by about 5 percentage points. There are a number of factors that have contributed to this performance and thus a shortfall,” Akol told the press at the URA headquarters.

Akol explained that, “elections factor coupled with a number of multiple public holidays during this financial year further affected the revenue collections.”

In her end of year report, Akol listed a number of other financial factors that affected performance:

- GDP growth of 4.6% vs. the projected 5.4%; 8

- An average 14.2% depreciation of the UGX to the USD from a projected outturn of 3,009 to 3,435.95. The shilling depreciated by 25% in 2015 alone.

- Lower than anticipated fuel volume growth of 7.0% vs. the projected 9.2%;

- A decline in non-fuel import value in USD of -7.6% vs. an anticipated growth of 8.4%;

- Head line inflation growth of 7.6% vs. the projected 6.6%.

Reducing cost of doing business

Akol outlined initiatives URA took to reduce cost of doing business and improve efficiency. She focussed on the One-stop-shops, operationalizing the One stop Border Posts (OSBPs), companies that received Authorised Economic Operator (AEO) status and the implementation of the Single Customs Territory (SCT).

While it took 18 days to move cargo from Mombasa to Kampala prior to implementation of SCT, it now takes 4-6 days

On the Single Customs Territory, she said the initiative enabled lodgement of declarations before cargo arrives at Mombasa. It has also resulted into the use of a single declaration for bulk cargo that would otherwise require multiple declarations.

This, she said, has reduced time taken to move goods from Mombasa to Kampala. While it took 18 days to move cargo from Mombasa to Kampala prior to implementation of SCT, it now takes 4-6 days.

She also mentioned the construction and operationalization of One Stop Border posts at border points Malaba, Mutukula, Busia, and Mirama Hills. Construction of OSBPs is on-going at two border points of Katuna, and Elegu.

Under the OSBP framework, government border agencies of two given countries share a common border, operate under one roof and are involved in clearance of goods; traffic crossing the border need only to stop at one side of the border. Each border post handles incoming traffic only, with exit and entry procedures completed in the same building. This initiative has ensured quicker border clearance, limited duplication of border agency interventions, cutting cargo transit time by 50% among others.

Akol listed visiting of taxpayers, rewarding and complimenting loyal taxpayers, a new receipt campaign, fostering tax awareness, the Open Minds Forum (OMF) to discuss with the public and a new Intelligence Enterprise as some initiatives done to enhance compliance.

E-Initiatives being implemented

Akol mentioned E-services as one of many initiatives being implement to help improve tax collection and awareness, and help hit the new target of f 13.18 trillion.

“In order to tap into the informal sector and help taxpayers meet their obligations timely and conveniently, URA launched services catalogue, which offers information about all URA services and eservice payment method known as PayWay in addition to the existing payment platforms such as MTN mobile payment, Mobile App and banks.”

“The PayWay aims to enable the reduction of turnaround time for the taxpayers and hence increase their efficiency and profitability,” she said.

Fighting corruption

In her report, Akol said URA have partnered with the Anti-Corruption coalition Uganda (ACCU), Transparency International Uganda chapter, Strengthening Uganda’s anti-corruption response (SUGAR), East African Revenue Authorities integrity Forum, Inter-Agency Forum (IAF) and Anti-corruption Court to fight corruption and thus enhance compliance.

Akol said partnering with the above institution is one way of sharing experiences on how best corruption can be fought and also reach larger audiences.

“In the same vein of fighting against corruption, a shame-list was introduced to publicize cases for deterrence purposes. As URA, we are ready to take legal action on persons who contravene with anti-corruption laws without fear or favor.”

“We also pledge to make sure that all cases of suspected or reported fraud, misconduct or non-compliance are thoroughly investigated after which disciplinary actions are taken. We have carried out internal integrity drives and financial literacy-to boost financial independence among our staff.”

FULL STATEMENT BELOW

URA FY 201516 _27th July 2016 by The Independent Magazine on Scribd

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Powerful break down of the performance Independent team.