Transparency concerns

Transparency concerns

Nuwagaba, however, said that in the event that insurance firms partner with other businesses entities to extend insurance to the consumers, then, they also need to exercise transparency.

“A customers should be told from the onset that the price of the product or mortgage in the event of a bank has a component of insurance. But as things stand at the moment, banks are simply forcing customers to buy insurance through the products and services that they offer,” he added.

Denise Garth, a senior vice president strategic marketing at Majesco, a US-based provider of software solutions for the insurance industry said insurers must reimagine the scope of what they offer to customers – to include not only the risk product, but also value-added services from a broad ecosystem.

“Customers, especially Gen Z and Millennials, are a growing fan base for embedded insurance (especially with auto and life insurance) products,” she said.

She says that though the traditional purchase methods from agents or brokers or direct via an insurer’s website are still the most popular channels, there is strong interest in purchasing insurance included as part of another product or service.

She cites the US-based AXA XL, a division of AXA that has collaborated with Slice Labs and Microsoft to help improve cyber health and mitigate risks for Microsoft 365 Business, Office 365 Business Premium and Office 365 Business customers.

Under the collaboration, qualifying Microsoft customers will be given discounted access to Slice on- demand, cloud-based cyber insurance offered by AXA XL. Customers are expected to benefit from what is claimed to be a holistic end-to-end solution that will not only help them in securing their environment, but will also offer them critical services and the support they need for incident response and remediation in an event of cyber-attack.

She also cites that the London-based insurtech firm Wrisk that has teamed up with BMW Group Financial Services to offer three months of free car insurance to purchasers of all new MINIs.

According to the arrangement, all new MINIs are sold with three months of free insurance to eligible retail car buyers in the UK through BMW Group Financial Services’s new insurance product, MINI Flex Car Insurance.

Other insurance companies offering embedded insurance products are the Sure that extends micro- duration life insurance coverage during air travel, bsurance that provides buyer protection, bike, mobile device, boat charter deposit and travel insurance at point of sale, and Mylo that has partnered with concierge service MooveGuru, a provider of real estate brokerage services to offer insurance to clients for home and renters.

But why do customers like this approach? The answer lies in the psychology of simplicity, Garth said.

“Embedded insurance is easier to buy, creates a better customer experience, contributes to insurer growth, and helps close the large protection gap of the uninsured or underinsured,” she said.

“Embedded insurance is easier to buy, creates a better customer experience, contributes to insurer growth, and helps close the large protection gap of the uninsured or underinsured,” she said.

Overall, Uganda’s industry remained on a positive trajectory, recording a 13.2% growth in gross

underwritten premiums to Shs973.58bn.

Non-life insurance business recorded an increase in underwritten premiums from Shs572.79bn in 2018 to Shs621bn last year.

Life insurance business recorded an increase in underwritten premiums from Shs217.97bn to Shs

276.32bn during the same period under review.

Similarly, Health Membership Organisation (HMO’s) and micro-insurance specialist company recorded

9% and 1,131% growth in premiums to Shs75.26bn and Shs299million, respectively, during the same

period under review.

Uganda’s insurance industry has 32 insurance companies, one micro insurance firm, one re-insurer, and

five HMOs.

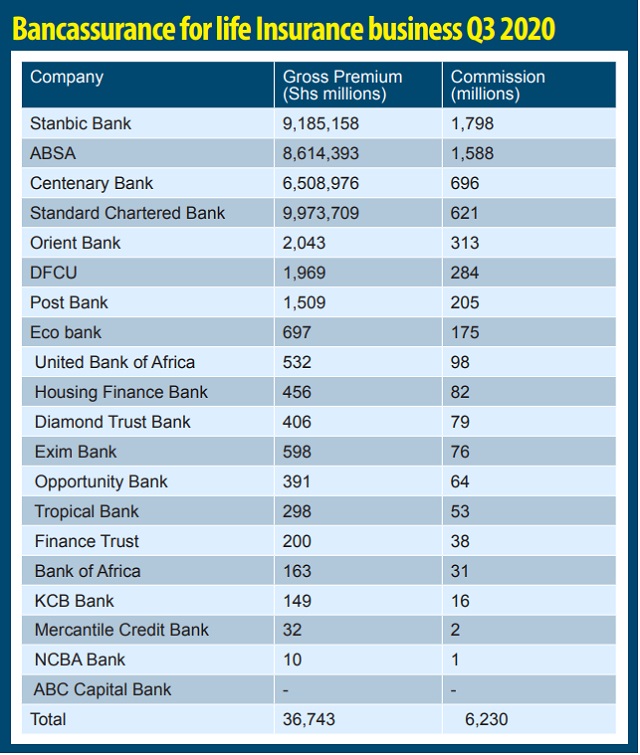

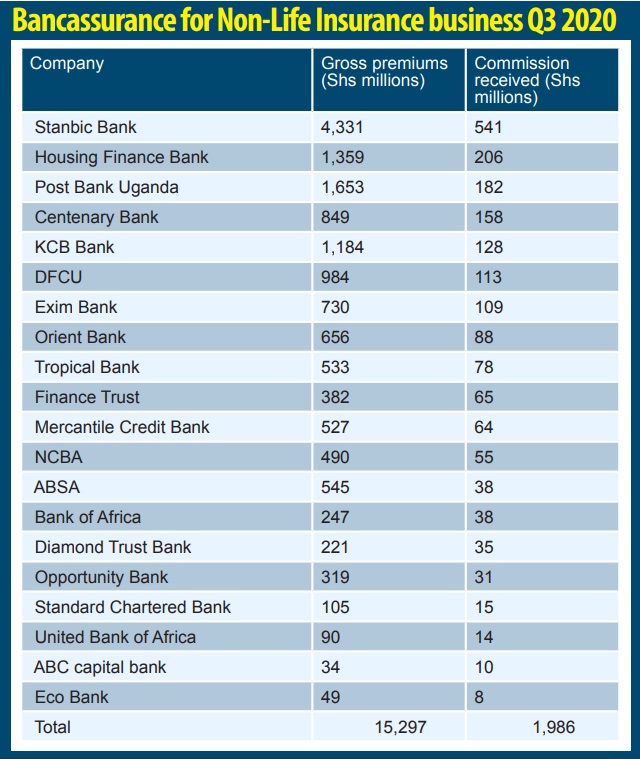

In addition, the industry has 18 commercial banks and two credit institutions that have been granted

licences to sale insurance products in partnership with the insurance firms.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price