Patrick Mweheire, the chief executive officer of Stanbic Bank revealed this to Journalists on March 29 while announcing the Bank’s annual performance at Kampala Serena Hotel.

Mweheire said a mix of factors, including investment in higher yielding governments securities, higher yields from loans and advances, and good returns from investment of excess liquidity into the interbank market contributed to the good performance.

He pointed out, however, that lending which has previously contributed approximately 54% of the banking revenue recorded less than 2% net growth in 2016 and the bank’s growth had to come from the non-traditional drivers.

He said a reduction in earnings from loans and advances resulted from reduced lending to the private sector as a result of high interest and exchange rates and political instabilities in South Sudan.

Last year, the country’s average interest rates went up as high as 25.1% at the beginning of the year in response to a high Central Bank Rate (CBR) of 17%. This discouraged uptake of private sector credit.

The on-going political instability in South Sudan, which is the biggest export destination of Ugandan good, affected the country’s economic growth performance. Normally, South Sudan accounts for 30% of the country’s total export market.

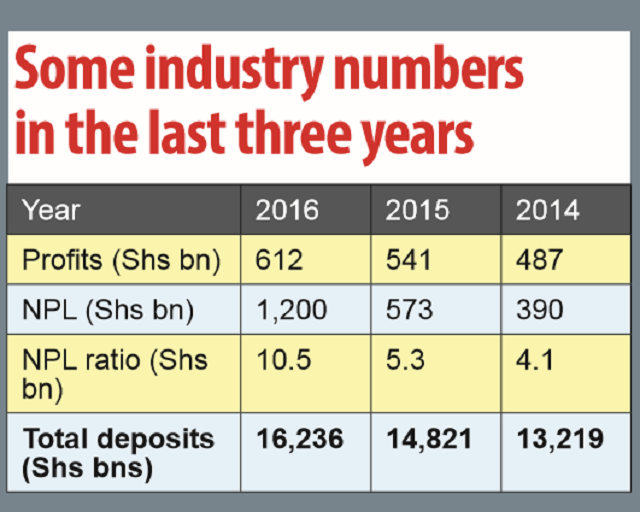

On the other hand, the industry deposits grew by 9.5% to Shs16.24 trillion last year, up from Shs14.82 trillion in 2015 and Shs9.20 trillion in the previous year.

And with regard to NPL’s, Dfcu saw its NPL’s reduce to Shs58.5 billion, down from Shs71.2billion in the previous year.

In 2014, Dfcu recorded Shs47.67 billion in NPL. Similarly, DTB saw its NPLs drop from Shs69.28 billion in 2015 to Shs28.33 billion last year. In 2014, DTB registered merely Shs5 billion as NPLs.

Stanbic, however, witnessed a surge in NPL’s by 10% to Shs14 billion in 2016 which it blames on hard economic environment experienced during the year.

NPLs in the entire banking industry more than doubled to Shs1.2 trillion; up from Shs573 billion in 2015 and Shs390 billion in 2014. The defunct Crane Bank alone held more than Shs142 billion.

This put the industry’s NPLs ratio at 10.5% last year, up from 5.3% in 2015 and 4.1% in 2014. The defunct Crane Bank contributed 4.3%.

Better 2017

Mweheire says the banking industry is expected to register further growth in profits in 2017 as banks lower their lending rates in response to the reduction in the Central Bank Rate by Bank of Uganda from 12% to 11.5% last month.

So far, a number of banks have announced a bigger interest rates cuts for both new and existing facilities offered in local currency.

United Bank of Africa announced a reduction in lending rate from 24% to 20% per annum while Housing Finance Bank has reduced its lending rates from 23% to 21% per annum effective March.

Similarly, Diamond Trust Bank reduced lending rates from 24% to 22.5% per annum while Standard Charted Bank has lowered its lending rates to 21% per annum.

The reduction in lending rates aims at boosting uptake of private sector credit and ultimately contributing to economic growth.

Uganda’s GDP has stagnated at below 5% for the past five years largely because of limited access to cheap credit amidst low demand for goods and services.

In fact, the country’s economic growth for this FY (2016/2017) has been revised downwards to 4.5% from 5%, according to BoU.

BoU Governor Emmanuel Tumusiime-Mutebile said on Feb. 15 that he was easing monetary policy to largely support economic activity.

He said, however, that the “easing will also be consistent with achieving the annual core inflation target of 5% over the medium term”.

Analysts say the current average interest rates that stand at 21% are still high for the business. The recent 8th World Bank’s Economic Update for Uganda focusing on financial inclusion says high cost of credit is a major constraint for Uganda’s economic growth and is making many people shy away from loan products.

It says the overall domestic credit to Gross Domestic Product ratio in Uganda has stood at the average level of 13% of GDP over the past decade, far lower than the figures recorded by regional neighbors.

It further says Uganda ranks in 120th place out of 138 countries in affordability of financial services.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price