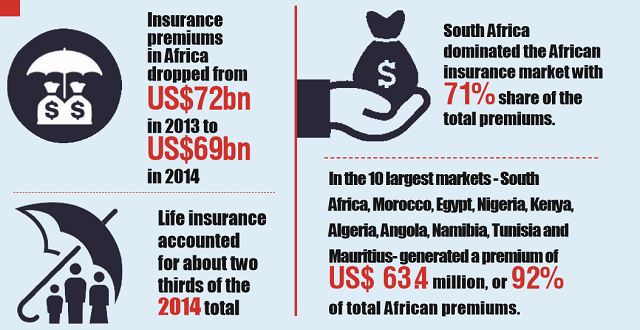

In the 10 largest markets – South Africa, Morocco, Egypt, Nigeria, Kenya, Algeria, Angola, Namibia, Tunisia and Mauritius- generated a premium of US$ 63.4 million, or 92% of total African premiums.

However, insurance penetration accounted for only 2.8% of African Gross Domestic Product. And with the exception of South Africa and Namibia – where insurance penetration levels reached 14% and 7.3% respectively – the contribution of insurance to Gross Domestic Product was significantly lower than the global average of 6.2% in all other African countries.

Kaddunabbi Lubega, the chief executive officer of the Insurance Regulatory Authority of Uganda said the authority is encouraging local insurance companies to have strong financial standings to be able to underwrite bigger risks.

“As a regulator, we have adopted a risk-based supervision to ensure that insurance firms have enough capital to undertake risks,” he said, adding that it is better for a country to have fewer insurance companies but with stronger financial muscles to handle bigger risk than with many smaller insurance firms with limited capital.

He also suggests that merging small insurance companies to handle bigger risks not only strengthens their financial capability but also brings onboard new skills to enhance corporate governance.

Kaddunabbi also revealed that they have advised local insurance companies to come up with products that can be underwritten online as long as they

meet the requirements in bid to increase insurance access and deepen penetration.

Going forward

Kumar Utpal, the deputy vice president in-charge of sales in South Africa and Mauritius at the Mumbaibased 3i Infotech Limited said it is time for African insurance firms to widen their distribution channels to include selling their insurance products through stores and contract centres, banc assurance, kiosks, hospitals, shopping malls, and online to grow their business as it is being done in some countries including Australia and India.

For instance, MetLife Australia is selling Life Insurance Policies via SunCorp Banking channels leveraging on banca assurance while Insurance Australia Group Limited / Wesfarmers Australia is selling insurance policies via full service retail chain supermarkets.

On the other hand, Virgin Money is selling AIG South Africa Insurance plans through their stores and contact centers while Indian insurance companies are setting up offsite center in hospitals, shopping malls, and schools to sell Insurance via tablets. The emergences of insurance aggregators such as InsuranceBazaar.com are now tying up with multiple insurers to give best quotation to customer online.

Utpal said insurance companies on the continent also need to integrate their underwriting and claims processes with Location Intelligence System via Google Maps to understand their exposure in a particular area, making it easy to

ascertain the risks associated with the product.

“The insurance companies need to integrate with Social Media sites such as Facebook, Instagram, and Twitter among others to understand the customer behavior to access the risk and identify fraud in claims processes,” he said.

“Companies like Discovery (based in South Africa) has integrated vitality based loyalty card system which tracks customer’s buying behavior, fitness related information to understand the risk associated with that customer.”

Utpal said insurance companies also need to unveil Usage Based Insurance (UBI) to help them identify customer driving behavior and risk associated with that and determine the premium to be paid for motor vehicle insurance products as well as provide mobile based applications to policy holders which helps them in “Self Service” including claims intimation, policy issuance and renewal.

These initiatives, he said, will keep the African insurance firms at par with those in developed countries and fast grow their business.

Aziz Yerima, the CEO of PayDunya, an online payment solution based in Sénégal said time has come for business entreprises including insurance companies that do not digitalise their services to run out of business.

He said digitalizing services increases product access to customers and noncustomers, eliminate cash management costs and reduce workloads related to accounting and reconciliation.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Big Data will provide operational leverage and reduce premium leakage. But who is listening?

If you would like to obtain a good deal

from this paragraph then you have to apply these techniques to your won webpage.