Civil Society Organisations (CSO) have petitioned the World Bank over its poor portfolio performance in Uganda. CSOs Uganda Debt Network, Anti-Corruption Coalition, Action Aid Uganda and Civil Society Budget Advocacy Group said, the information and data available indicates that as of April 2016, both the World Bank and Uganda are not as …

Read More »DFCU nets Shs 9.6bn profit

DFCU Bank shareholders are hopeful that 2016 will be good following the release of their company’s half year 2016 un-audited financial statements, which have indicated a Shs 9.6 billion increase in profit compared to the same period last year. According to the financial performance for the first half of the …

Read More »Umeme profits slide

UMEME: NSSF to reap Shs 2.5 billion in dividend payment for first half of 2016 Utility company Umeme has released their 2016 half year results, which indicate that there was a significant revenue growth but an attendant rise in cost of sales means that there will be less profits for …

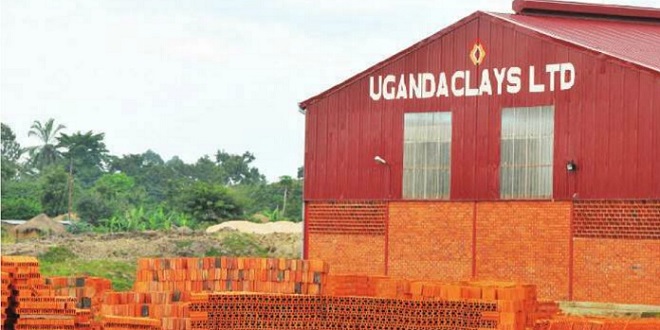

Read More »Uganda Clays eyes Rwanda

Ugandan clay products manufacturer to partner Rwandan market leader in bid to be real regional player Kajjansi-based Uganda Clays Limited is in plans to enter the Rwanda clay products markets in a bid to position itself as a leading regional clay products manufacturer. The company, which from July 27-August …

Read More »Experts still wary of Uganda’s high interest rates

When the Central bank reduced its key bank rate to 14% from 15% early this month, it was expected that commercial banks would respond by cutting their lending rates. This was the third time in a row the Central bank was reducing the CBR by 100 basis points the others …

Read More »NWSC revenue tops Shs 284 bn

NWSC: Corporation hits 105% collection efficiency as five year strategy gets into top gear Silver Mugisha (PhD), the managing director of the National Water and Sewerage Corporation (NWSC), is a soft-spoken and urbane man who doesn’t like to talk too much about himself. He would however spend a day talking …

Read More »MTN adds one million subscribers in six months

In six months since December 2015, MTN Uganda added one million subscribers, growing from 8.9 million to 9.9 million by June 30. Also, the half year financial results show that in the same period, revenue at Group level increased by 14% to R78, 878 million. But capital investment in Uganda …

Read More »BATU profits down 50%

Sale of leaf business takes toll as Tobacco Control Act also gets set to bite By Patrick Kagenda In December last year, British America Tobacco Uganda (BATU) issued a public statement warning shareholders and potential investors that their profits would be significantly lower (by about 20%) than the previous year’s …

Read More »NSSF’s stock market woes

2015/2016 has not been a good year for investors in listed companies on the Uganda Securities Exchange (USE). Given that the National Social Security Fund (NSSF) is the biggest holder of shares in locally-listed companies, there is anxiety. Some 21% of NSSF’s total value is in equities, with 73% …

Read More »World Bank hails Northern Corridor logistics environment

Northern Corridor success: New World Bank report highlights logistics on EAC’s Northern Corridor as an inspiring African success story Finally, the massive investments in projects to remove logistical bottlenecks in the East African Community are starting to pay off great dividends. A new World Bank report dubbed, ‘Trade Logistics in …

Read More » The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price