Ugandan clay products manufacturer to partner Rwandan market leader in bid to be real regional player

Kajjansi-based Uganda Clays Limited is in plans to enter the Rwanda clay products markets in a bid to position itself as a leading regional clay products manufacturer.

The company, which from July 27-August 10, participated in the 19th Rwanda International Trade Fair in Kigali organised by the Rwanda Private Sector Federation in conjunction with the Rwanda ministry of trade and industry, says it is in plans of identifying a “strategic partner” in the Rwanda market.

Nazarius Rukanyangira, the UCL head of marketing and sales, told the Independent that the discussions are in advanced stages. “We recently participated in the Rwanda International Trade Fair in Kigali and we identified potential in the Rwandan construction sector. We have ongoing discussions and also doing due diligence and once we are done and have identified a strategic partner we will be good to go.”

Besides the Rwanda market, the clays manufacturer is also looking at Northern Tanzania and Eastern DR Congo as the other markets it wants to delve into.

An industry observer told The Independent that UCL is keen to re-position its self following the stifling competition it is facing locally especially from a host of cheap substitutes and imitation products, especially roofing materials, facing bricks and max pans that have greatly nibbled on its profitability. The other reason the clays manufacturer is eyeing Rwanda is because of the collapse of the South Sudan market where it was a big player supplying tiles, maxi pans and facing bricks but because of the war in that country the construction sector has almost collapsed. Rwandan business people have been procuring UCL products from Kampala and so opening a franchise in Rwanda would be a great advantage to Uganda clays.

Rogers Mawanda, the company’s commercial manager and head of communications, said that South Sudan was the company`s second largest market – contributing 35% of the company’s revenue, but when civil war broke out in the country in 2013 the firm closed operations the following year.

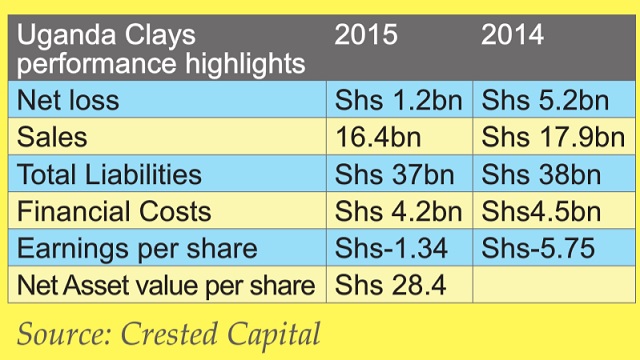

According to Crested Capital, a brokerage firm, UCL’s financial position is slowly picking up going by its 2015 financial year results which showed that it posted a $2.3 million profit when compared to 2014. According to the company financial statement published on May 16, 2016, the company revealed a marginal upside in its core business owing to higher revenues and reduced operating expenses compared to 2014. There was a slight growth in revenue from Shs 22.1 billion to Shs 24.1 billion whereas loss after tax reduced from Shs 5.1 billion to Shs 1.2 billion.

The improved performance was also supported by a one off income of Shs 3.1bn arising from land acquired by the Uganda National Roads Authority (UNRA) for the construction of the Entebbe Express Highway.

Industry analysts say it is this one off from UNRA that Uganda Clays could be targeting to open the Rwanda frontier.

During the release of the financial statement for 2015, the company also reported how net loss had reduced to Shs1.2bn from Shs 5.2bn in 2014 on the back of incomes from land compensation and higher revenues.

The financial results revealed how the company costs of sales had fallen by 8.5% year on year to Shs 16.4bn compared to Shs 17.9bn due to a change to a more affordable firing fuel at the Kamonkoli factory.

As and when Uganda clays enters the Rwanda construction sector, it will have to prepared for competition from a domestic Rwanda clay products manufacturer the Ruliba Clays, a subsidiary of Crystal Holdings, the business arm of Rwanda’s ruling party RPF. The Ruliba plant has been building capacity over time and is a dominant player in fired clay construction materials producing some 140,000 tons of clay products daily.

While Rukanyangira remained cagey on how Uganda clays plans to enter the Rwanda market, instinct points to buying a stake within Ruliba since Kajjansi is over 500km by road to Kigali meaning exporting finished Uganda Clays products would have to factor in transport costs if it is to go by its plan to use outlets and agents to distribute its products.

A clearing agent told The Independent that it costs about $2,000 (Shs 6.7mn) to transport a 40-ft container from Kampala to Kigali.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price