Kisa said MPs cannot deliberate well when they are hungry and they need new allowances to cater for that.

There is a new mantra for MPs in Uganda’s parliament. The MPs say: “We cannot deliberate when we are hungry”.

The phrase was coined by newly elected Luuka South MP Stephen Kisa. Speaking at the end of a two-day orientation workshop in Kampala on May 25, Kisa said MPs cannot deliberate well when they are hungry and they need new allowances to cater for that. “We need break tea and lunch,” he said as some colleagues who appeared embarrassed attempted to play down his demand. But he was backed by Kasese Municipality MP, Franco Robert Centenary.

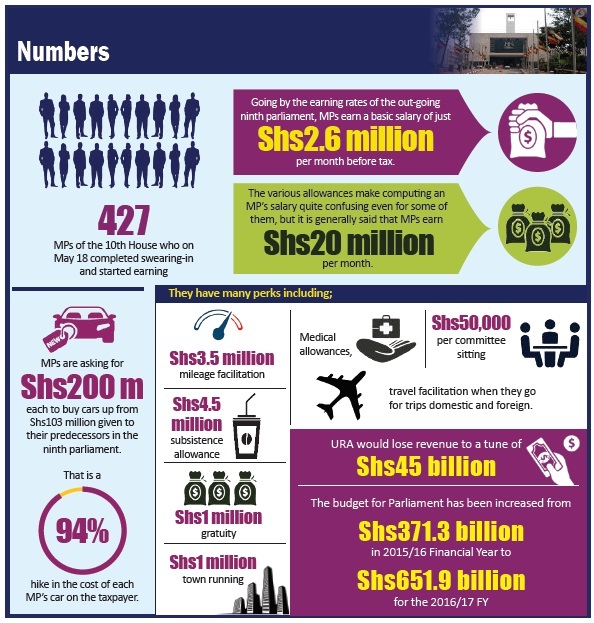

The focus on money and the allowances they stand to earn is attracting criticism of the new MPs who on May 18 completed swearing-in and the 427 MPs of the 10th House started earning. Majority of members from the ruling NRM seem to be already succumbing to the money bug after bagging Shs5 million each from President Yoweri Museveni in the first week in parliament to throw parties for their voters.

Not surprisingly, according to many of the MPs, the first order of business should be about their car allowance, tax exemption, and whether or not to increase their salaries and allowances.

From such small demands as tea and lunch, the MPs progress to big items. They are asking for Shs200 million each to buy cars up from Shs103 million given to their predecessors in the ninth parliament. That is a 94% hike in the cost of each MP’s car on the taxpayer. The 9th parliament had 388 MPs and about Shs40 billion was spent on buying them cars. Based on the demands of the new MPs, their cars will now cost taxpayers Shs86 billion.

Cutting tax deals

The bigger issue of the moment is that the MPs have also gone to court to insist on an amendment of the Income Tax Act to exempt them from being taxed on some allowances.

It was passed inApril by the out-going parliament. Even though the tax exemption move has been widely criticised by Civil Society Organisations (CSOs) and was initially rejected by President Yoweri Museveni, the MPs are insisting on it.

The President wrote to Speaker Rebecca Kadaga warning that MPs are sending wrong signals to the general public in trying to dodge their taxes. But Rubanda East MP Henry Musasizi who introduced the tax exempting clause in the Income Tax Amendment Bill 2016 says they will pursue the exemption. He says the MPs agreed on the tax exemption with the President during the inaugural 10th parliament NRM retreat in March as a condition for not increasing their basic salary from Shs2.6 million. On May 20, the Parliamentary Commission won an injunction in the commercial court blocking the Uganda Revenue Authority from implementing the tax.

The injunction, it was argued, is to give the Parliamentary Commission a chance to exercise its right of appeal against an April judgment by Justice Henry Peter Adonyo of the Commercial Court that ordered MPs to fulfill their civic duty of paying taxes just like all other citizens.

Going by the earning rates of the out-going ninth parliament, MPs earn a basic salary of just Shs2.6 million per month before tax. But they have many perks including; around Shs3.5 million mileage facilitation, Shs3.2 million constituency facilitation, Shs4.5 million subsistence allowance, Shs1 million gratuity, Shs1 million town running, medical allowances, Shs50,000 per committee sitting, and travel facilitation when they go for trips domestic and foreign.

The various allowances make computing an MP’s salary quite confusing even for some of them, but it is generally said that MPs earn between Shs15 million and Shs20 million per month.

‘Greedy MPs’

Godfrey Akena, the Executive Director East African School of Taxation says the row over the perceived MPs refusal to pay tax on their income is a creation of the MPs themselves.

“When determining their emoluments they became greedy and added things to their salary that are not supposed to be there,”Akena says, “They grossed up their payment which meant that their tax base for income tax would also increase.” MPs currently pay tax on their basic salary, gratuity, honoraria, and sitting allowances.

They do not pay tax on their mileage allowance. But early in March this year, the Parliamentary Commission decided to consolidate MPs pay in order for them to get a huge pension and gratuity when they retire. Now the Uganda Revenue Authority (URA) wants to tax the MPs income as a lump sum. Akena says the consolidation of all an MP’s earning created a problem as the “MPs mixed the law relating to pension with that of income tax”.

How backdoor deals, greed, fuel MPs ploy to dodge income tax

“The money given to MPs is not an allowance per se. They are given the money to enable them go to their duty stations. Under the Income Tax Act, this is not supposed to be taxed,” he says. Akena says, under normal circumstances, MPs would be signing for the money every time they travel to their constituencies but parliament found it economical to give it to them in form of allowance. This money according to him falls under sections of the Income Tax Act which set out that employment income does not include the cost actually or likely to be incurred on accommodation or travel expenses in the course of performing duties of employment.

Akena says because MPs get allowances that are far higher than their monthly salaries, they decided to consolidate this money such that at retirement or when leaving parliament, they go with a bigger gratuity package.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price