Panama Papers expose efforts plot to dodge taxes in oil deals

When 370 journalists from 76 countries collaborate on an investigation, the resulting story is bound to be explosive.

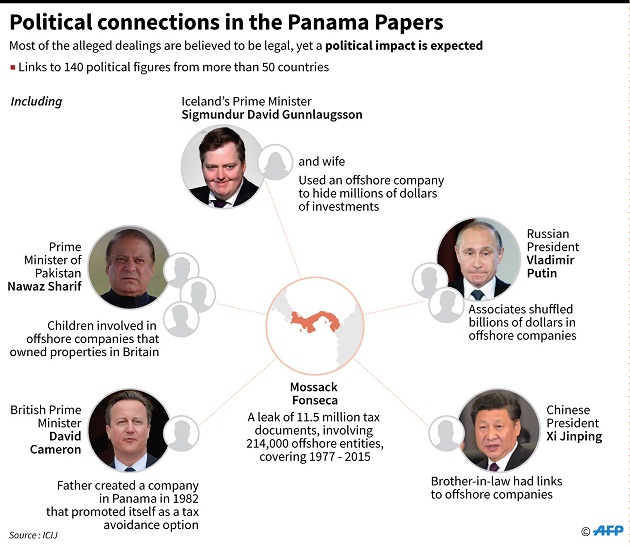

That is exactly what happened with what has come to be known as “The Panama Papers”; which is a huge leak of records of a Panamanian law firm, Mossack Fonseca that sets up offshore tax havens for the rich and the dubious. The cache of 11.5 million records shows how a global industry of law firms and big banks sells financial secrecy to politicians, fraudsters and drug traffickers as well as billionaires, celebrities and sports stars.

From Uganda, Tabu Butagira from the Daily Monitor was one of 27 journalists from eight African countries on the team that reviewed the Mossack Fonseca records. The Panama Papers reveal the offshore holdings of 140 politicians and public officials from around the world The leaked papers come from a little-known but powerful law firm based in Panama, Mossack Fonseca, that has branches in Hong Kong, Miami, Zurich and more than 35 other places around the globe.

The firm is one of the world’s top creators of shell companies, corporate structures that can be used to hide ownership of assets. The law firm’s leaked internal files contain information on 214,488 offshore entities connected to people in more than 200 countries and territories. The data includes emails, financial spreadsheets, passports and corporate records revealing the secret owners of bank accounts and companies in 21 offshore jurisdictions, from Nevada to Singapore to the British Virgin Islands.

More than 214,000 offshore entities appear in the leak, connected to people in more than 200 countries and territories The documents expose the offshore holdings of 12 current and former world leaders and reveals how associates of Russian President Vladimir Putin secretly shuffled as much as $2 billion through banks and shadow companies.

One of the exposés from Uganda reveals how Heritage Oil and Gas Ltd (HOGL) in 2010 attempted to evade paying a Capital Gains Tax (CGT) of US$404 (Approx. Shs1.4 trillion). It all started as Heritage was planning to sell its 50% stake in Uganda’s oil fields at US$1.5 billion (Shs5 trillion) to Tullow Uganda Ltd. Heritage knew that it might have to pay a Capital Gains Tax (CGT) of US$404 million (Shs1.4 trillion) on the transaction and decided to evade it, according to revelations in the Panama papers.

It engineered to shift its business address from the Bahamas to a tax haven in Mauritius in the hope of benefitting from taxation agreement Uganda has with Mauritius which offers a tax reprieve to Mauritian companies investing in Uganda.

The Panama Papers reveal communication before the sale from HOGL to one Bruce McNaught, a chartered accountant, to engage Mossack Fonseca & Co Bahamas as Heritage’s registered agent. Mossack Fonseca is a Panamanian law firm that helps investors to set up tax structures in Panama and other Caribbean tax havens.

“HOGL… is due to complete the sale of an asset in Uganda within the next 11 days,” McNaught wrote to Mossack Fonseca, “Due to tax reasons emanating from Uganda, the directors have been advised by tax accountants to re-domicile HOGL to Mauritius from the Bahamas before completion (of the sale).”

He added: “The group’s tax accountants are working hard to eliminate the potential tax charge imposed by the Ugandan authorities without HOGL having to be redomiciled, but as a second line of defence, the directors have been advised to put in place all that is necessary to effect re-domiciliation to Mauritius so that the process can be completed if it becomes necessary (which we believe to be the case).”

Another Heritage associate, shortly afterwards wrote to the Mossack Fonseca & Co Bahamas office to emphasise how “extremely urgent” it was to stop the capital gains tax. Despite Heritage efforts and a series of dispute resolution meetings, the Uganda government insisted Heritage had to pay.

In a meeting onAugust 3, 2010 with Tullow’s head of tax Richard Inch, Allen Kagina, who was then head of URA, reportedly lost her temper and “there was shouting and she was angry”.

When they met two months later, on October 23 2010, Kagina told Inch: “Tax is imposed and collected by law, not compromise”.

The government then took the tough move of withdrawing some of Tullow’s exploration rights and insisting that Tullow places US$283 million into an escrow account in the UK pending the outcome of arbitration hearings in London. The dispute continued from 2011 until it was resolved in Uganda’s favour in 2015.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price