The bank is also expanding its footprint across the country with establishment of regional offices, with the initial one set up last in Gulu City last year, besides online channels

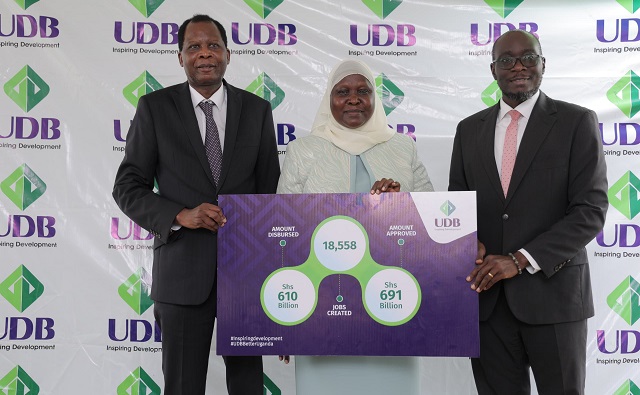

Kampala, Uganda | THE INDEPENDENT | In a significant move to bolster the Ugandan economy, the Uganda Development Bank (UDB) disbursed Shs UGX610 billion in 2023, targeting critical sectors to spur growth and development across the country.

The bulk of the disbursements, amounting to Shs 391 billion or 65% of the total, was injected into the industry sector, emphasizing agro-industrialization and manufacturing. This strategic focus is designed to enhance the sector’s capacity, boost productivity, and foster sustainable economic growth.

Additionally, primary agriculture received Shs 38.5 billion, accounting for 6% of the total disbursements, further supporting Uganda’s backbone and ensuring food security while increasing the sector’s commercial viability.

Infrastructure and services, including health, education, and tourism, also benefited from UDB’s financial support, though specific figures for these sectors were not disclosed.

The deployment of these funds is expected to create 18,558 jobs, generate UGX 11.39 trillion in additional output value, contribute UGX 615.96 billion in tax revenue to the government, and earn UGX 3.3 trillion in foreign revenue.

The banks’ assets recorded an 8% growth from Shs 1.52 trillion in 2022 to Shs1.64 trillion last year.

The Bank’s Managing Director, Patricia Ojangole, said the bank remains focused on delivering tangible development outcomes and maintaining financial sustainability.

She emphasized the strategic implementation of the bank’s mandate to support socio-economic progress through careful balance and strategic funding initiatives.

Moreover, UDB’s initiatives extended beyond financial disbursements. The bank was instrumental in supporting the underserved segments such as SMEs, youth, and women, with Shs 22 billion approved to support 118 enterprises in these categories.

Furthermore, the Bank’s venture into Private Equity and Venture Capital, with Shs 9.9 billion invested in innovative startups, signified a strategic pivot towards nurturing high-impact projects in sectors critical for Uganda’s future.

The bank is also expanding its footprint across the country with establishment of regional offices, with the initial one set up last in Gulu City last year, besides introducing online channels.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price