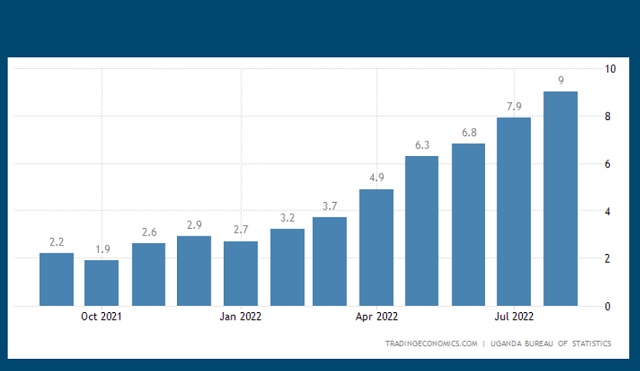

This is the 6th straight month it is rising causing anxiety in the interest rate market

Kampala, Uganda | JULIUS BUSINGE | Inflation, as measured by the Consumer Price Index for Uganda for the 12 months to August 2022, increased to 9.0%, up from 7.9% registered in July 2022, according to figures released by the Uganda Bureau of Statistics on Aug.31.

The statistics body said the increase was mainly driven by an upward trend in prices of commodities under core inflation that increased to 7.2% in the year ending August 2022, up from 6.3% registered in the year ending July 2022.

UBOS said this increase in annual core inflation was attributed to annual services inflation that increased to 3.7% in the year ending August 2022, up from 2.0% registered in the year ending July 2022.

This was due to transport inflation which increased to 8.7% in August 2022 from 4.6% in July 2022.

Specifically, long-distance bus fares increased to 9.5% from minus 27.8%. In addition, restaurant and accommodation services inflation increased to 6.8% in August 2022, up from 5.9% in July 2022.

The annual food crops and related items inflation increased to 18.8% in the year ending August 2022, up from 16.4% registered in the year ended July 2022.

This was due to annual ‘vegetables, tubers, plantains, cooking bananas and pulses’ inflation that increased to 25.3% in August 2022, up from 23.7% registered in July 2022, according to UBOS.

It said, matooke, which is a regular food item on the restaurant and home menus, inflation increased to 62.4% in August 2022, up from 50.7% in July 2022 and beans inflation increased to 27.0% in August 2022 from 18.2% in July 2022.

The annual energy fuel and utilities (EFU) inflation increased to 19.6% in the year ending August 2022, up from 17.2% registered in the year ended July 2022.

This was mainly due to annual solid fuels inflation that increased to 4.7% in August 2022, up from minus 0.8% in July 2022. Specifically, charcoal inflation increased to 4.8% in August 2022, up from minus 0.7% registered in July 2022.

In addition, the annual petrol inflation increased to 59.4% in August 2022, up from 56.1% in July 2022.

Tough times ahead

The continued rise in inflation is fueling the central bank’s urge to signal the commercial banks to increase interest rates in the market – which means reducing money in circulation – and hitting the poor hardest.

Bank of Uganda has since June been increasing the CBR to battle inflation. Mid-last month, it raised it to 9% from 8.5%.

In a bid to manage risk, the increase in the CBR has forced commercial banks to increase interest rates to slightly above 20% for prime borrowers and to higher levels for risky groups.

Senior economists like Fred Muhumuza, have supported the central bank’s move to tightly control money in circulation.

He told the Independent in a recent interview that the tightening of monetary policy is a signal to the financial institutions to be cautious to whom they lend money so as not to make losses given that demand is subdued.

“The central bank is trying to also tell people that think twice before you borrow,” “BoU is emphasizing the message of risk aversiveness but to even tell them that this is not a risk, it is a reality.”

Speaking at an economic forum held in Kampala on Sept.02, Ramathan Ggoobi, the permanent secretary and secretary to the treasury at the ministry of finance said, the government’s fiscal spending is aligned with Bank of Uganda’s monetary policy decisions to fight spiraling inflationary pressures.

The Bank of Uganda Deputy Governor, Michael Atingi-Ego says they expect inflation to stay at 7-7.4% as the current factors are expected to persist, or even get worse if the geo-political conflicts, especially in Europe, worsen.

But he says, there could be factors like better crop harvests, a global recession affecting global demand, as well an improved global transportation environment, which could help bring down inflation.

The bigger worry however is the effect of these negative factors on economic growth. According to UBOS, the economy contracted by 1.6% in the first quarter of the year 2022, when compared to the last quarter of 2021, as economic activity declined.

“All sectors of the economy contracted with the services sector taking the biggest hit,” the Deputy Governor says in the latest monetary policy statement, “in addition, the composite index of economic activity has continued to signal a slowdown in economic activity.” He said the country’s economic growth for the year 2022 will be lower than earlier projected at between 2.3 – 3%.

He said that if inflation reduces, global tensions revert, investor confidence improves, and growth might pick up to above 5% and even higher in 2023.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price