Shs44.7 trillion budget

The government plans to spend Shs44.7 trillion in the next FY 2021/2022. This is almost at par with that of current year ending on June 30. Initially the next budget had been cut to Shs41.2 trillion.

And as usual, Governance and Security will take the lion’s share of Shs 7.7 trillion, followed up with human capital development, which covers education and high level training, at Shs 6.8 trillion.

Integrated transport infrastructure and services will take Shs 3.9 trillion, Agro industrialization will take 1.4 trillion, and regional development 1.2 trillion shillings.

The budget also shows that domestic refinancing will take Shs 8.5 trillion, domestic arrears Shs400 billion while interest and amortization will take Shs 6.7 trillion.

Nalunga said the new proposed budget “is very disappointing”.

“Agro-industrialisation is getting just Shs1.4trillion when security is getting Shs7.7trillion and debt financing is Shs8.5trillion but you are expecting to get resources from agro-industrialisation to finance security and service the debt,” she said.

“But looking at the security budget, you just wonder whether we are not at war. The best way is to make people happy and the issue of insecurity will not be there.”

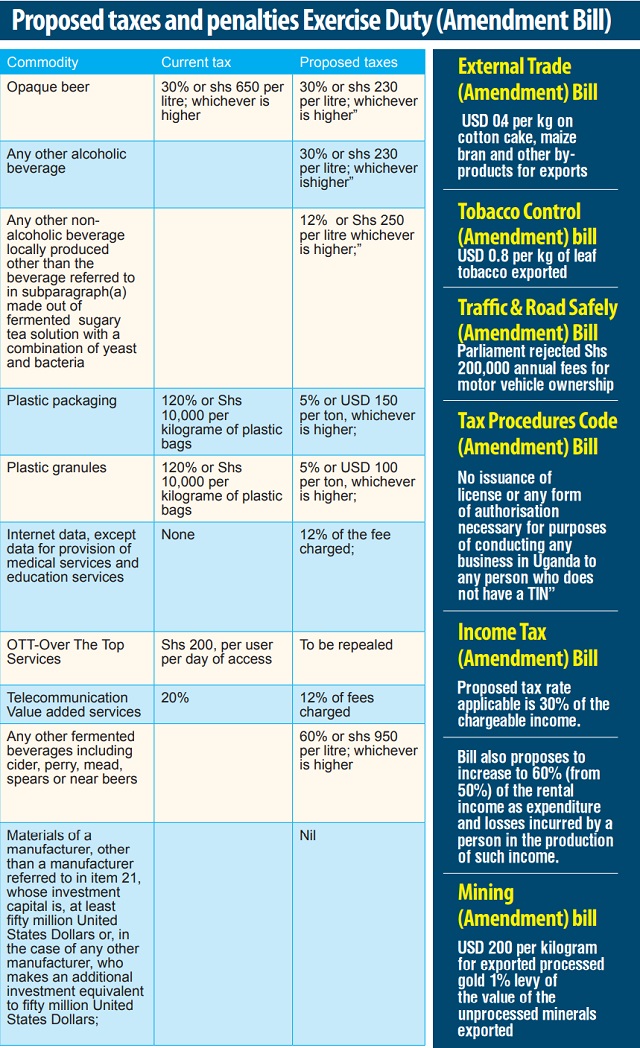

She said the government is right to focus on taxing plastics to save the environment. She said taxes on sugar- related drinks should be targeted for health reasons together with sports betting and minerals exports.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price