Uganda’s retirement benefits sector grows from sh15.4 trillion to Sh17 trillion, 11.1% of Gross Domestic Product

Kampala, Uganda | THE INDEPENDENT | The Minister of Finance, Planning and Economic Development, Matia Kasaija has lauded the Retirement Benefits Sector as key to Uganda’s economy because of the sector’s ability to mobilise national savings and enhance population productivity and wellbeing.

“The retirement benefits sector contributes significantly to the country’s gross domestic savings, which account for a big proportion of the Gross Domestic Product,” Kasaija said. As of July 2021, the sector assets were worth Sh17 trillion.

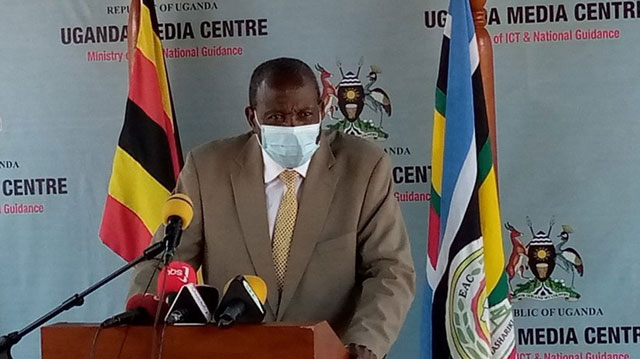

The Minister said this today as he was releasing the 2020 Annual Sector Performance Report of the Retirement Benefits Sector at the Uganda Media Centre.

“The future of the retirement benefits sector is bright. I urge URBRA and all other sector stakeholders to continue sensitizing Ugandans about the need to develop a saving culture – this is good for them as individuals and good for the long-term growth of the economy,” Kasaija said.

Presenting the sector performance highlights, Martin Nsubuga the CEO of Uganda Retirement Benefits Regulatory Authority (URBRA) observed that despite the negative effects of the COVID-19 pandemic, the sector continued to grow because more Ugandans had become aware of the need to save for retirement and avoid old-age poverty.

Currently, 2,821,910 Ugandans are covered by the existing retirement savings arrangements with the majority under the mandatory National Social Security Fund (NSSF). However, that is only 18% of the estimated workforce of 15.9 million countrywide. In effect, 82% of the working population is not saving for retirement.

Nsubuga commended employers and employees who contributed to their retirement savings schemes throughout the year, amidst the economic challenges. He reported that sector inflows on account of contributions increased by 5.3% from 1,498 billion in 2019 to 1,578 billion in 2020.

In terms of investment, government securities dominated with 76.11% of the investment portfolio. The increased allocation to government securities was mainly to hedge against the negative performance of equities. By the end of 2020, sector investments in all asset classes had increased to UGX16.31 trillion from UGX 14.28 trillion in 2019.

In lockstep with increased investment, sector income increased to UGX1,677 billion compared to UGX1,077 in 2019. The major source of income was interest, accounting for 96.3% of the total sector income. Consequently, all savers were able to enjoy an average annual interest of 9%.

Commenting on the performance highlights, Minister Kasaija expressed optimism that the retirement benefits sector can grow further if all Ugandans adopt a saving culture. “This is good for them as individuals and for the long-term growth of the economy,” he said, and appealed to URBRA to ensure that non-salaried and self-employed individuals also get on board.

The URBRA CEO reaffirmed the Authority’s commitment to continue guiding the sector and ensuring prudent management of savers’ funds. He said that the regulator remains keen on identifying and mitigating risks before they impact on funds; improving scheme operational efficiency and extending coverage to the informal sector workers.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price