Is Museveni serious this time?

The government is planning to increase public spending in the next financial year but some experts say it is punching above its weight. This could be true since the country is getting low returns on its large infrastructure projects.

Since winning his fifth five-year term, President Yoweri Museveni has been promising a more efficient government and tough action on corruption. Despite the tough talk, a cloud hangs over the nation and a close look at the budget as an indicator of the economic environment in the next 12 months offers little cause for optimism. Part of the gloom results from the increasing failure of the economy to pick-up in the last five years.

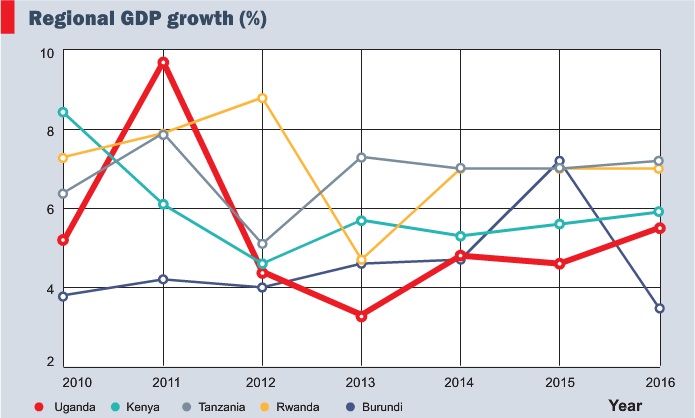

From the all-time high 9.6% GDP growth of 2011, the economy has failed to regain its fast pace and continues to hobble towards becoming the “sick man’ of the East African region.

Among the four regional economies in the block whose budget cycles are aligned, Uganda – at 4.6 GDP growth – had the worst performance in the 2015/16 FY and also has the worst growth forecast for 2016/17 at 5.5%.

Early projections, in the Budget Framework Paper, had put anticipated GDP growth this FY at 5.8%. It is marginally higher than the 5.3% of 2014/15 FY and a sign that the government was determined to pull the economy away from the downward slope. However, growth in private sector consumption and both private and public investment which were projected to be the main drivers of the last financial year performed dismally, according to Ministry of Finance data.

Now the GDP growth projection has once again been set more conservatively at just 5.5% – meaning that Finance ministry officials do not forecast sunny days ahead. The renewed pessimism is another sign of the bad times.

The new budget comes at a critical time, when the country is still smarting from the consumptive expenditure and reduced Foreign Direct Investment around the anxiety-filled February general election, slack private sector financing, a floundering currency, and hiked interest rates hovering between 20-23% as commercial banks hedge their Non-performing portfolios. There is increasing public debt which now stands at Shs29trillion, declining agricultural output, and exogenous factors; including an international fall in commodity prices which have shown no sign of bouncing back.

Behind these factors, the trouble for the Ugandan economy appears to be two pronged. First, in an era where fiscal stimuli appear to be in vogue regionally, Uganda appears unable to raise the extra resources required – the Uganda Revenue Authority (URA) maybe on course to meeting its annual revenue target of Shs11.6 trillion based on good performance in the first two quarters of 2015/16, but it registered a shortfall of Shs242billion between January and March. The tax collector says Pay as You Earn (PAYE) numbers are down as employers; including big ones in the beverages sector, banking, and oil, are feeling the economic squeeze and laying off workers.

The tax authority also appears unable to squeeze any more taxes out of its current payers. Instead, in the new budget, the government is talking of a Domestic Revenue Mobilisation strategy. But it is a pitch with non-SMART items like “gradually formalising the large informal sector, and improving efficiency in tax collection and compliance.” The target is to raise the tax to GDP ratio from the current 13% to 16%. But the Financial Year 2019/20 means it’s a mid-term ambition without tangible short-term imperatives.

The only puny tax increases in the budget is a 10% increase on petrol and diesel, 20% on sweets, and a little more on cigarettes. The only substantial increase was on stamp duty on transfer of property. This went up by 50% from 1% to 1.5% of value. The other big tax increase was on registration fees for personalised motor vehicle number plates from Shs5 million to Shs20 million. But this is a fringe ostentatious product and the focus on it merely highlights URA desperation.

Earlier anticipated forays by URA into more aggressive and lucrative tax areas; such as on used-cars, unused land, commercial farms, and off-shore operators, did not materialise.

Secondly, even with the minimal funds that Uganda sprinkles on mainly infrastructure projects in the transport and energy sectors, the country appears to get the lowest value out of every shilling invested. In a recent report, the World Bank blames the ineptitude in Uganda’s project implementation on corruption, endemic delays, and cost overruns. Some of the projects, the WB noted, are given as political gifts and no thorough assessment is done.

Christina Malmberg Calvo, the World Bank Uganda country manager, said: “Over the past decade, for every shilling invested in the development of Uganda’s infrastructure, less than a shilling (about 70 per cent of a shilling) of economic activity has been generated.”

The report said a road project initially planned to cost about $100m ends up costing $200m.

“Evidence shows that projects that are poorly-designed often fail to produce strong and favourable results, and capacity gaps among others. This is where Uganda needs to put emphasis,” said the report.

Unfortunately, according to most analysts that The Independent spoke to, the prognosis for the 2016/17 FY is that it will follow the same bleak route to economic underperformance – unless President Museveni (this time) acts on the tough measures he has been promising against the vices.

Museveni is talking tough and the Finance minister introduced, in the budget, a result-monitoring tool he called a “Strategic Result Matrix”. Apparently, it will be used to monitor project performance using increased political and technical inspection of key service delivery sectors like education and health and Accounting Officers will be penalised for shoddy works, staff absenteeism, late coming, poor service delivery, and corruption.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price