Uganda’s electricity tariffs are structured in such a way that even if electricity is not purchased, the money for the Bujagali Power Dam must be paid.

The government says the relatively high tariffs in Uganda are a result of the high cost of electricity generation due to involvement of private-sector players seeking a return on investment.

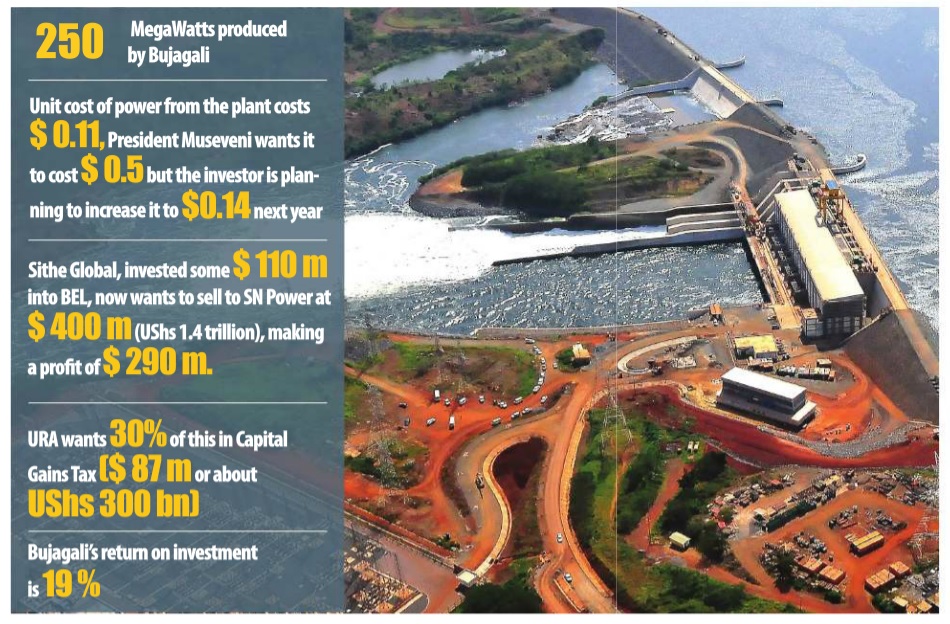

These include Aga Khan Development Network, developers of the US$900million Bujagali Hydropower Dam. The investors in the 250MW dam, which is currently the biggest in Uganda, have up to 15 year to recoup their invested capital and profits.

High electricity tariffs are said to be causing havoc in neighbouring Kenya.

With domestic consumers in Kenya paying an average of Ksh 19 per Kwh (Approx. Ug.Shs657.5) compared with industrial consumers paying between Ksh12.85 (Ug.Shs444.7) and Ksh.20.4 (Ug.Shs705.9) per KWh, Kenya has recently witnessed a wave of firms exiting its market citing high electricity tariffs.

For instance, in September 2016, a leading tyre maker; Sameer Africa joined Cadbury and Eveready in closing its factory in Kenya.

The firm said in a statement that the move was a result of high energy costs, cheap imports from India and China and a reduction in Customs duties under the five-nation East African Community’s Common External Tariff.

“The board of directors resolved to stop the manufacturing of tyres and allied products at the Sameer Africa plant in Nairobi and to commence offshore production by tyre manufacturers domiciled in China and India,” the company said in the letter to the Capital Markets Authority.

Three years ago, Eveready chose to import dry cells into Kenya from Egypt instead of manufacturing them locally in a bid to compete with cheap imports from China while Cadbury decamped to South Africa in October 2014.

Mondelçz International, the US-based parent company of Cadbury Kenya, said shifting operations would allow it to focus its resources on scale manufacturing facilities where it can generate greater efficiencies, to reinvest in growth.

Other manufacturers that have closed down production lines in the country are Procter & Gamble, Reckitt Benckiser, Johnson & Johnson, Bridgestone, Unilever and Colgate Palmolive — with most of them either leaving for Egypt or South Africa.

However, the Ugandan government has always argued that a fall in electricity tariffs in the country will be realised once Karuma Hydropower Dam and Isimba Hydropower Dam now under construction are completed in 2018.

On the other hand, Rwanda’s electricity tariffs have fallen since 2014 with small industries now paying Rwf126 ($0.15), down from Rwf134 (US$ 0.15) per Kwh. Medium scale industries are now paying Rwf90 ($0.11), down from Rwf126 ($0.15) while large industries are paying Rwf83 ($0.10), down from Rwf126 ($0.15) per kWh.

Electricity tariff for households that consume not more than 15 kilowatts per month, now pays Rwf89 (US$ 0.10), down from Rwf182 (US$ 0.21), translating to 515 drop while consumers whose power consumption is between 15-50 kilowatts per month has remained constant at Rwf182 (US$ 0.22) per unit. Customers whose consumption is beyond 50 Kwh, the deduction will be from Rwf119 to Rwf112 (US$ 0.13).

The Rwanda Utilities Regulatory Authority (Rura) official says their objective is to help grow the economy to attract foreign and domestic investment by having competitive tariffs.

Tanzania, which has five electricity consumer groups namely; D1, which involves the lowest consumers using up to 75 units; T1, above 75 units; T2, medium industries using more than 7,500 units and T3, those connected to medium and high voltage, has the lowest electricity tariffs in the region.

Small consumers in the D1 category now pays TZS100 per unit (US$ 0.04), the same amount they have been paying over the last three years while T1 consumers pays TZS292 per unit (US$ 0.13), down from TZS306 per unit (US$0.13) in 2014.

Medium industrial consumers in category T2 currently pays TZS195 (US$0.08), down from TZS205 per unit (US$ 0.09) with category T3-MV consuming paying TZS157 per unit (US$ 0.06), down from TZS163 (US$0.07). T3-HV consumers now purchase each unit at TZS152 ($0.06), down from TZS159 (US$0.06) in 2014.

This tariffs are in addition to a fixed monthly fee ranging from TZS 5,520 (US$2.42) to TZS 16,550 (US$7.25) and the value added tax depending on the category.

Tanzanian President John Magufuli on the first day of the year 2017 sacked the head of the state-run electricity company after the firm approved a power tariff hike of 8.53% by the Tanzania Electric Supply Company (TANESCO), less than half of what the utility said it needed to stem losses.

According to President Magufuli, the move by TANESCO boss, Felchesmi Mramba, would stymie his plans to industrialize the East African nation.

“It’s unacceptable that while we are making plans to build manufacturing industries and ensure more citizens have access to electricity…someone else uses his position to increase power tariffs,” Magufuli said in a statement.

Going forward, Badagawa says the government needs to enforce local content policy to stimulate production and ultimately leading to a fall in electricity tariffs.

Government last years ordered all its accounting officers to buy local products to promote the growth of local industries.

RELATED STORY: African Dev Bank promises to bring down electricity prices

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price