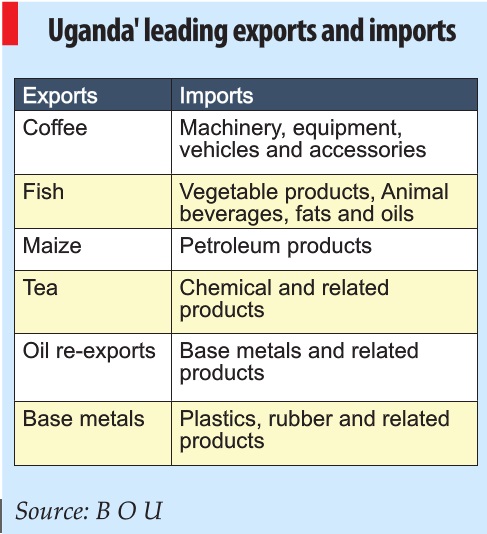

In addition, tea prices have dropped from $403.03 cents per Kilogramme in July 2015 to $ 237.99 cents per Kilogramme in April 2016, and that of copper falling from $ 5,456.75 per tonne to $4,872.74 per tonne during the same period, with the decline in China’s economy contributing to the fall in the global demand for mineral and other commodities.

Last year, China’s economy slumped to a 25-year low, growing at just 6.9 %with further declines expected as global tumult continues. This mixed with the country’s imports that are predominantly raw materials, capital goods, and services constituting 70% of the imports, further complicates efforts to a favourable balance of trade.

“Although the prices for these products declined in 2015, the decline is always temporary, and the trend is for the prices to recover, hence the increase in value of imports,” says Mugume. “In addition, as the economic activity strengthens, including the increase in government imports to implement public investments, these will add to the increase in imports.”

Presently, the government is implementing various public projects including construction of Karuma and Isimba hydro power dams, rehabilitation and expansion of EntebbeAirport, construction of Jinja Bridge and the Kampala-Entebbe Express Highway, and soon the Standard Gauge Railway and the oil refinery and pipeline, with majority of raw materials being imported. Uganda hopes to start oil production in 2020.

Stephen Kaboyo, the managing director of Alpha Capital an investment advisory firm, says Uganda’s trade deficit can be corrected over time through exchange rate adjustments and competitiveness, but regrettably, this has not happened. “Going forward, there is need to change export focus, explore newmarkets, enhance production with value addition in order to achieve a new balance of economic growth,” Kaboyo says.

However, trade captains say the hard economic environment in the country is to blame for the consistent unfavourable terms of trade. “The high interest rates coupled with high costs of electricity have been our biggest challenge; they have made our products expensive compared with similar goods produced by our trading partners in other parts of the world, “says Everest Kayondo, the chairman of Kampala City Traders Association (KACITA).

For that, Kayondo, says traders prefer importing goods similar to those produced locally because they are cheaper compared with those produced locally. He says the government needs to ensure that there’s a reduction in the price of electricity as well as creating an enabling environment for lenders to lower their interest rates so as to boost production mainly for exports.

Currently, companies operating in Uganda pay $11-$12 cents per kilowatt hour (Kwh) of electricity and more than 20% in interest rates on loans yet their counterparts in SouthAfrica pay $6-$10 US cents for the same unit of electricity and 10.5% interest rates on loans.

In addition, while the average price of electricity in the US and UK stands at $9.43 cents and $14.16 cents per Kwh- nearly a similar billing that the local users are charged- for the same units of electricity, according to the latest data from the German based statistics’ firm- Statista, they charge an average of 6.72% and 7.56% interest rates on loans per annum, respectively.

This has ultimately led to low production costs compared to their rivals in developing countries such as Uganda. But the government has argued that the cost of interest rates is determined by the forces of demand and supply; adding that there’s need to increase on the country’s exports to earn more foreign exchange.

Further, the government has also believed that a fall in electricity tariffs in the country will be realised once Karuma and Isimba dams go live in 2018.

However, the private sector is also laying down strategies to boost production amidst the hard economic environment. Ezra Rubanda, the head trade policy & advocacy at the Uganda National Chamber of Commerce and Industry, an umbrella body for the private sector, says they have embarked on mobilising foreign direct investments to lower the costs of finance in various production sectors having failed to implement import substitution strategy.

He says the private sector is also embracing an export diversification including human resource to reduce over-reliance on the traditional crops. In a similar vein, the government has promised to boost the agriculture sector, exemplified with the allocation of Shs 823.42 billion ($242.68million) this coming financial year, up from 343.46 billion ($101.22million) in 2015/16, to boost agricultural productivity.

Presenting the national budget on June 08, Matia Kasaija, the minister for finance, planning and economic development, said the government’s medium term goals in the agriculture sector aim to increase production and productivity, improve household food security, increase farmers’ income and increase the value of exports.

Kasaija believes the new initiatives would revitalise coffee production from the current 3.6 million bags to 20 million bags by 2020, valued at approximately $2.4 billion; and 135,000 metric tonnes of tea, valued at approximately $190 million; plus milk exports worth $300 million, among others, which he said would go a long way towards improving the country’s balance of trade.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price