Government, analysts search for elusive answers over declining exports, rising imports

About 700 trucks enter Uganda daily from Mombasa Port in Kenya, loaded with all types of goods. However, most of them go back empty for lack of exports, a situation that makes transport costs rather prohibitive for Ugandan importers.

The latest trading data explains the reason behind the tendency: Steel, petroleum products and other manufactured products normally weigh down the trucks coming to Uganda but later loaded with bags of tobacco, coffee, and cocoa or even move with empty containers on their return to the port.Analysts say to change this situation, the government has to wake up.

This financial year ending June 30, the country’s economy grew 4.6%, sailing past the projected 3% in the Sub Saharan Africa during the same period. Yet, the trade deficit is expected to widen to $2.34 billion this year, nearly the same similar amount recorded two years ago, and the highest in nearly 15 years amidst a fall in oil prices.

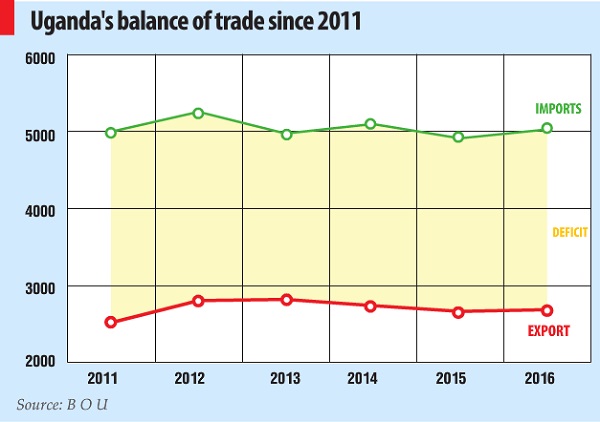

Latest data from the Bank of Uganda (BoU) shows that whereas Uganda’s export earnings are projected to grow by merely $22million to 2.7billion this year, imports are expected to grow much faster, cruising at $115million to $5 billion, a trend that the East African nation has been experiencing for many years now.

Exports account for roughly 10 % of the Uganda’s Gross Domestic Product- with more than half of the exports destined to the CommonMarket for Eastern and Southern Africa (COMESA) markets and the rest shared between Europe, Middle East, and Asia, and the rest of the world.

It is against this backdrop that the government has been struggling in the past months to save the value of the shilling that lost approximately 39% of its value vis-à-vis the US dollar between September 2014 and September 2015.

Luckily, the cautious fiscal and monetary policy and successful February general election has restored confidence in the economy, with the shilling recovering its strength to Shs 3, 326 per US dollar byApril, representing a 10% improvement compared with the position in the last September. But the market watchers say favourable balance of trade in Uganda is still a blink in the near future, signifying future instability in the value of the local currency against the international currencies especially the US dollar. Local traders prefer transacting their international business in dollars as it is recognised world over.

Adam Mugume, the director for research at the Bank of Uganda (BoU), says the prices of the country’s major exports (coffee, tea, cotton, tobacco, flowers, fish etc) are projected to remain subdued in the near future due to high supply on the international market. “The trend for agricultural commodity prices has been either stagnation or decline,” Mugume told The Independent.

“Therefore, even with the increased volumes of exports, the values will remain low.” For instance, in spite of the fact that the volume of coffee exports increased from 3.14 million bags in 2011 to 3.6 million bags in 2015, their export value declined from $466.7 million to $402.6 million during the same period, Mugume says.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price