A huge chunk of 2022/23 Shs48.1tn budget will go to the usual sectors of works and transport, security, health and education

NEWS ANALYSIS | ISAAC KHISA | Uganda’s national budget, read on June.14, has drawn mixed reactions from various players, with manufacturers partly welcoming it but the civil society organisation and the citizens dissatisfied.

The private sector and manufacturers said the government’s decision to freeze introduction of new taxes was a good move for business but added that the high penalties for non-tax compliance could ‘kill’ businesses.

“You cannot enhance collection through penalties. (Instead) those penalties can kill businesses as a matter of fact,” said Richard Mubiru, a member of the economic sub-committee at Uganda Manufacturers Association during the post budget dialogue in Kampala.

Prosper Ahabwe, Tax Manager at Ernest and Young said it is time for the government to start looking inward revenue mobilization to finance the budget while at the same time manage the growth of the budget.

“There’s fast growth in the budget and it shows perhaps that there’s optimism that the economy is really going to grow but let’s see how this goes,” he said.

Finance Minister Matia Kasaija, who first served as an MP in 1979 under a short-lived, interim government after the violent overthrow of autocrat Idi Amin, presented to Parliament Shs48.1 trillion budget for 2022/23 compared to Shs44.7trillion for the FY 2021/22.

The government planned to spend Shs 45.5trillion n the FY 2020/2021; Shs 40.5trillion in the FY 2019/20; and Shs32.7trillion for the FY 2018/19.

It hopes to spend a huge chunk of the budget to enhance transport and power infrastructure with allocation of Shs4.3trillion. This is followed up with the education and skills development that was allocated Shs4.14 trillion. Improvement of security and security infrastructure, heath were allocated Shs3.98trillion and Shs3.7trillion, respectively.

The private sector development has been allocated Shs1.65trillion, sustainable energy development Shs1.57trillion, promoting agro-industrialisation, enforcing product standards and enabling market access Shs 1.44 trillion as implementation of the parish development model has been allocated Shs 1.059 trillion.

The implementation of the development plan has been allocated Shs 1.19 trillion, legislation, oversight and representation Shs915 billion while climate change, natural resource, environment and water have been allocated Shs 628 billion.

With the exception of budget allocation to the implementation of the Parish Development Model, agribusiness, climate change and private sector development, the biggest sectors that have consistently received a huge chunk of the funding are works and transport, security, health and education for the past 10 years.

This is despite the increase in the price of commodities such as soap, fuel, maize flour and wheat and the slowdown in the growth of the economy.

Opposition politician Dr. Kizza Besigye has since been arrested several times in the past few months for staging protests in downtown Kampala in response to the high cost of living.

President Yoweri Museveni, however, has said the government is unable to respond to high commodity prices because the situation has been caused by external factors.

He added that the attempt by the government to provide subsidies or reduce taxes on some essential items to arrest the situation is ‘suicidal’ as the country still needs more revenue to finance various projects including roads and schools.

How budget will be financed

Kasaija said, the government plans to finance the Shs48.1trillion budget through domestic revenue mobilisation, loans and grants. However, in this, the government hopes to collect only Shs30.79trillion through tax and non-tax revenue. This comes as the country’s public debt stands at Shs73trillion, representing 49% of the Gross Domestic Product (GDP).

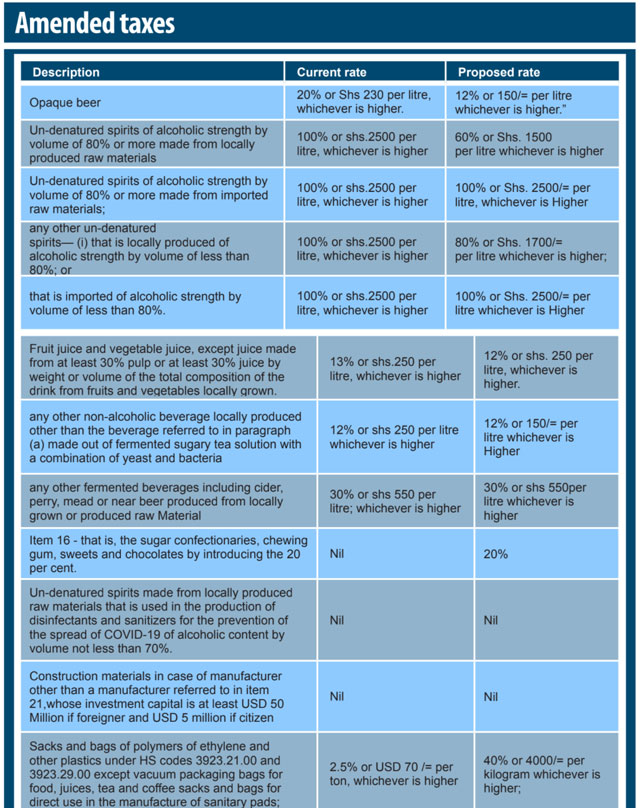

The government has proposed an increase in excise duty on undenatured spirits of alcoholic strength by volume of 80% or more made from imported raw materials or ready-made spirits has remained at 100% or Shs 2500per litre whichever is higher.

They increased excise duty on fruit juice and vegetable juice, except juice made from at least 30% pulp or at least 30% juice by weight or volume of the total composition of the drink from fruits and vegetables locally grown have seen their excise duty reduced from 13% or Shs 250 per litre to 12% or Shs 250 per litre, whichever is higher.

Sacks and bags of polymers of ethylene and other plastics under HS codes 3923.21.00 and 3923.29.00 except vacuum packaging bags for food, juices, tea and coffee sacks and bags for direct use in the manufacture of sanitary pads have had excise duty increased from 2.5% or US$70 per ton to 40% or 4000 per kilogram whichever is higher.

However, un-denatured spirits made from locally produced raw materials which is used in the production of disinfectants and sanitizers for the prevention of the spread of COVID-19 of alcoholic content by volume not less than 70% have been tax exempted.

The supply of educational materials including educational materials manufactured in a partner state of the East African Community, supply of sanitary towels, menstrual cups, tampons, and inputs for their manufacture, oxygen cylinders or oxygen for medical use, assistive devices for persons with disabilities and airport user services charge by Civil Aviation Authority will be tax exempted effective next month.

Similarly, the government has reduced excise duty on opaque beer from 20% or Shs230 per litre to 12% or Shs 150 per litre whichever is higher, a move intended to promote value addition and the use of locally sourced raw materials.

It has also proposed a reduction in un-denatured spirits of alcoholic strength by volume of 80% or more made from locally produced raw materials from 100% or Shs 2500 per litre to 60% or Shs 1,500 per litre whichever is higher. Similarly, excise duty on un-denatured spirits locally produced of alcoholic strength by volume of less than 80% have been reduced from 100% or shs.2500 per litre to 80% or Shs. 1700 per litre whichever is higher.

It has also reduced excise duty on any other non-alcoholic beverage locally produced other than the beverage, made out of fermented sugary tea solution with a combination of yeast and bacteria, from 12% or Shs 250 to 12% or Shs 150 per litre whichever is higher. The government has also slapped a 20% tax on sugar confectionaries, chewing gum, sweets and chocolates.

Tax penalties

As a measure to ensure compliant in tax obligations, the government through the Tax Procedures Code Amendments, had extended the Uganda Revenue Authority’s right of temporary closure to businesses that don’t comply with the requirements of electronic receipting and invoicing or tax stamps.

The act has also introduced a requirement on a person engaged in the construction or extractive industry to disclose to the URA the names of persons contracted during the performance of their duties or business within seven days or fined Shs 20 million and increased penalty for making false and misleading declarations while complying with one’s tax obligations from Shs4million to Shs 110million.

Further, the government has imposed criminal sanctions for a taxpayer who fails to affix or activate a tax stamp thus creating an offense punishable by a fine of Shs 30 million or a prison sentence not exceeding 10 years or both; a fine of Shs 30 million or a prison sentence not exceeding 10 years or both for a person who prints over or defaces a tax stamp; and a Shs 30 million or a prison sentence not exceeding 10 years or both for a person who forges or if found in possession of forged tax stamp.

Similar fines and penalties have been imposed on a taxpayer who fails to deploy and use the Electronic Fiscal Receipting and Invoicing System (EFRIS) system, a person who is found in possession of forged EFRIS documents as well as a person who conducts unauthorized interference with EFRIS hardware and software.

To support identification of offenders, government has introduced two categories of remuneration to informers: 1% of the tax or duty assessed or Shs 15 million, whichever is less for whoever provides information leading to identification of unassessed tax or duty; and: 5% of the tax or duty recovered or Shs 100 million, whichever is less to the informer who provides information leading to the recovery of unassessed tax.

Kasaija said the national budget for 2022/23 aims to revive the national economy after being hit by the corona virus pandemic.

He said: “In order to achieve Uganda’s social and economic transformation, the National Resistance Movement government is committed to implementing the following goals in the coming and medium term: Introduce a process to rehabilitate households that are still participating in subsistence in the financial economy, supporting trade and the economy as a whole to recover from the effects of the COVID-19 disaster and restore lost jobs and subsistence means, and to protect households from rising food prices, fuel and other essential commodities prudent economic policies.”

But Fred Muhumuza, an economist from Makerere University said during the Ernest and Young post budget breakfast meeting in Kampala on June.15 that to transform communities from subsistence into financial economy, there’s need for a deliberate effort to ensure that the population have some more money to spend.

He said the finance minister need to be aware that some of the funds that the government borrows from the public comes from abroad.

“So, we are not just running this as a Ugandan budget but Ugandan budget within a global context and the global context is not giving us good pointers that we should take for comfort,” he said.

Sarah Chelang’at, commissioner Domestic Taxes at Uganda Revenue Authority said the taxman among others, plans to use a lot of ICT in tax mobilisation. She said URA also plans to invest more resources in understanding their tax payers, challenges and possible solutions going forward to grow revenue.

Amended taxes

| Description | Current rate | Proposed rate |

| Opaque beer | 20% or Shs 230 per litre, whichever is higher. | 12% or 150/= per litre whichever is higher.” |

| Un-denatured spirits of alcoholic strength by volume of 80% or more made from

locally produced raw materials |

100% or shs.2500 per litre,

whichever is higher |

60% or Shs. 1500 per litre whichever is higher |

| Un-denatured spirits of alcoholic strength by volume of 80% or more made from

imported raw materials; |

100% or shs.2500 per litre,

whichever is higher |

100% or Shs.

2500/= per litre, whichever is Higher |

| any other un-denatured

spirits— (i) that is locally produced of alcoholic strength by volume of less than 80%; or |

100% or shs.2500 per litre,

whichever is higher |

80% or Shs. 1700/=

per litre whichever is higher; |

| that is imported of alcoholic strength by volume of less than 80%. | 100% or shs.2500 per litre,

whichever is higher |

100% or Shs.

2500/= per litre whichever is Higher |

| Fruit juice and vegetable juice, except juice made from at least 30% pulp or at least 30% juice by weight or volume of the total composition of the drink from fruits and vegetables locally grown. | 13% or shs.250 per litre,

whichever is higher |

12% or shs. 250 per litre, whichever is higher. | |||

| any other non-alcoholic beverage locally produced other than the beverage referred to in paragraph (a) made out of

fermented sugary tea solution with a combination of yeast and bacteria |

12% or shs 250 per litre

whichever is higher |

12% or 150/= per

litre whichever is Higher |

|||

| any other fermented beverages including cider, perry, mead or near beer produced from locally grown or produced raw Material | 30% or shs 550 per litre; whichever is higher | 30% or shs 550per

litre whichever is higher |

|||

| Item 16 – that is, the sugar confectionaries, chewing gum, sweets and chocolates by introducing the 20 per cent.

|

Nil | 20% | |||

| Un-denatured spirits made from locally produced raw materials that is used in the production of disinfectants and sanitizers for the prevention of the spread of COVID-19 of alcoholic content by volume not less than 70%. | Nil | Nil | |||

| Construction materials in case of manufacturer other than a manufacturer referred to in item 21,whose investment capital is at least USD 50 Million if foreigner and USD 5 million if citizen | Nil | Nil | |||

| Sacks and bags of polymers of ethylene and other plastics under HS codes 3923.21.00 and 3923.29.00 except vacuum packaging bags for food, juices, tea and coffee sacks and bags for direct use in the manufacture of sanitary pads; | 2.5% or USD 70 /= per ton,

whichever is higher |

40% or 4000/=

per kilogram whichever is higher; |

|||

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price