In the last three years, seven have applied but none has met the criteria

Kampala, Uganda | JULIUS BUSINGE | Listing on a stock market is a big step for any company. From being privately owned, it becomes public. This would imply that the company expands its operations using capital raised from new shareholders.

But that has not happened in Uganda to some companies in the recent years. Currently the Uganda Securities Exchange (USE) has 16 listed companies since its inception in 1997, with limited activity on most counters. And the last time it had a new listing was in 2012, and that was Umeme Limited.

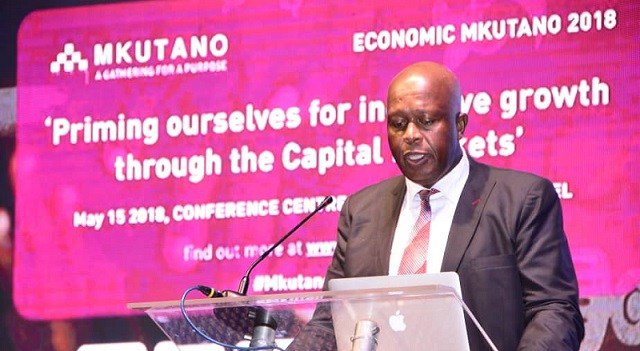

So who is to blame for this stalled listing process that feeds into the country’s overall capital markets performance? On May 15, Uganda hosted its first 2018 Economic Mkutano Conference at the Kampala Serena Conference Centre to among other things find answers to the above question.

The inaugural conference was held under the theme ‘Priming ourselves for inclusive growth through the Capital Markets’ and was attended by over 200 people from the business community, government, academia, investment clubs and tech evangelists.

“The market structure is not favorable for companies listing because the supply and demand side has challenges when it comes to accessing the market,” Paul Bwiso, the chief executive officer for USE said on the sidelines of the conference.

Bwiso, who has been in charge of the USE for slightly over three years said that seven potential companies have in the last three years applied to list on the bourse but failed to meet the criteria.

Part of the problem, Bwiso said, relates to the nature of their books of accounts, corporate governance and failure to adequately avail information about their trade.

“We have the Gross Enterprise Market segment and the regulation is light…but we have not got companies to list because investors have a better yield or return on the government bond market of over 13-14 percent plus per year,” he said. Bwiso, however, shifted the blame to government, arguing that the current legislation is pushing more on the side of increasing bank accounts and giving less attention to the long term avenues of raising capital via capital markets and savings.

According to the Uganda Bureau of Statistics, Ugandans save around 5% of their monthly earnings as compared to an average of 18% for the other three big East African countries – Kenya, Tanzania and Rwanda.

Dickson Sembuya, the director for research and market development at the Capital Markets Authority (CMA) concurred with Bwiso. He said corporate governance has been one of the key weaknesses that the private sector has faced while trying to access capital through the capital markets.

However, he said under the current CMA 10 year Master Plan that was launched recently, they are pushing for the proposal with other partners to develop what he called ‘The advisory Capital Markets Centre’ that will offer training for businesses on key aspects of corporate governance, record keeping, business strategy and plans and more – all geared towards helping beneficiaries to tap into the capital market to raise long term financing for expansion and related opportunities.

Going forward, Bwiso said they are working closely with CMA to enhance awareness and education about the products available on the market and helping businesses understand their funding needs.

“Businesses only look at their families to raise capital without considering the fact that the public can also support through the capital markets,” he said.

This is in line with the fact many of Uganda’s business owners fear losing control for their business once they go public. However, Bwiso said that this fear can be managed in instances where one owns 51% of the business.

This means they would have what he called ‘effective control’ of the business. Already, he said that most companies listed on the USE have all their strategic investors holding over 75% apart from power distributor Umeme that is held 100% by the public.

“When you bring in new investors they will not try to look at controlling the business…all they want is a return on their investment,” Bwiso said.

Sello Moloko, the chairman of Thesele Investments and keynote speaker at the conference said that having a well thought out policy and legal regime for capital markets would attract a diversified shareholder base of large pension funds, life insurance companies and the people on the street – this has happened in markets like South Africa – on the Johannesburg Stock Exchange.

For this to happen, Moloko said it would involve a lot of dialogue between the exchanges, business community, general population and the regulator. “Regulation can be very uncomfortable but it is something that is necessary,” he said, adding that it is important that a culture of proper governance is introduced in the entrepreneur’s minds.

In addition, he said business owners need to uphold principles of integrity and confidence while delivering goods and services on the market.

He said well-managed businesses – both local and international – involved in oil and gas can have high appetite to raise cheap capital through the stock market and thus, create some buzz around it.

Moloko said this was the case with the South Africa’s JSE index that was dominated by the mining companies which also helped it to grow further.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price