Stanbic records sharp drop in profits as DFCU’s NPL nearly doubles

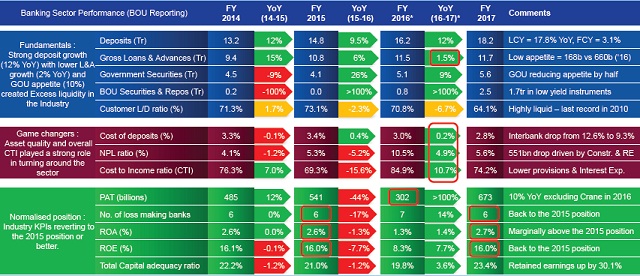

Kampala, Uganda | ISAAC KHISA | Uganda’s banking industry appears to be heading towards tougher times again, according to the industry executives.This is owed slow private sector credit growth, volatile trading security market and the declining interest rates amidst the talk of recovery of the economy.

“2018 is going to be a tough year, there’s no doubt. If you look at the yield curve …it is in the unchartered territory,” Stanbic Bank’s Chief Executive, Patrick Mweheire, told journalists as he announced his bank’s financial performance at the Sheraton Kampala Hotel on March 28.

“Banks in this country have never had a Central Bank Rate of 9% (as it is at the moment). It is a good thing for the economy (as interest rates will drop) but it is very hard for banks to make money.”

Mweheire said 2018 is also likely to be a challenging one and that banks will have to do something else to make money and grow their profits.

Bank of Uganda had already warned that commercial banks are likely to tighten requirements for securing loans as they move towards implementing stricter provisioning standards required under the International Financial Reporting Standard 9 (IFRS9) that came into force in January, this year.

Stanbic Bank which recorded a third of the industry’s profitability saw its net profit grow by merely 5% to Shs200bn last year, up from Shs191bn in 2016 and Shs 170bn in 2015.

Executives Stanbic said profits declined mainly because of slow private sector credit uptake, decline in yield returns on government securities as well as the continuous decline in interest rates.

Similarly, the bank’s net interest income fell by 6% to Shs353bn, down from Shs 376bn in 2016 and Shs 311bn in 2015 due to a reduction in interest rates.

However, the bank’s non-interest income grew with the same margin to Shs 283bn, up from Shs 267bn and 221bn during the same period under review.

Interestingly, the bankannounced an increase in dividend payout to shareholders to Shs90bn compared with Shs 60bn in 2016 and Shs 40bn in 2015, a move seen to impress its shareholders.

Meanwhile, DFCU Bank saw its net profit nearly triple to Shs127bn as at the end of last year, up from Shs46.27bn in 2016 and Shs 37bn in 2015 amidst increase in Non-Performing Loans.

The superb performance was mainly driven by acquisition of Crane Bank last year, growth in interest on loans and advances, fees and commissions and loan recoveries.The bank’s NPL’s, however, nearly doubled from Shs58.38bn in 2016 to Shs96.68bn last year.

Data from the central bank shows that the CBR fell to 9.5% as at the end of last year and to 9% in February this year – the lowest since 2011 when Inflation Targeting Lite (ITL) was introduced to tame inflation that had jumped to 30%, the highest since 1993 – down from 12%in December 2016. Yields on government securities – treasury bills and bonds – also fell from an average of 15% to 9% during the same period under review.

As a consequence, interest rates declined from an average of 22.7% in December 2016 to 20.3% in December last year, with Stanbic Bank charging the lowest interest rate in the market at 17% per annum.

But even as the interest rates reduced, the private sector credit uptake grew by merely two percentage points to 5.9% as individuals and companies involved in the production of goods and services as well as individuals shied away from taking up loans.

The private sector executives The Independent has talked to attribute this to low demand for products and services following the political turmoil in South Sudan and the eastern Democratic Republic of Congo—two of Uganda’s major export destinations.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price