Ugandans’ hopes of a resurgence of trade links rise as civil war comes to an end

There is one very busy triangular area in down town Kampala along Ben Kiwanuka Street that got to be known as Arua Park. The triangle is where three streets namely Johnson, William and Ben Kiwanuka intersect.

Despite being looked at as a low end area, Arua Park is a big business hub that brings into the Uganda economy millions of US dollars from traders originating from South Sudan.

Before the war broke out in South Sudan in Dec 2013, over $500 million was being transacted every year through Arua Park. Though that may not be the case today, trade activity is slowly picking up and there is optimism that the situation could get much better when the warring factions of South Sudan tow the UN line of creating stability in Africa’s youngest country.

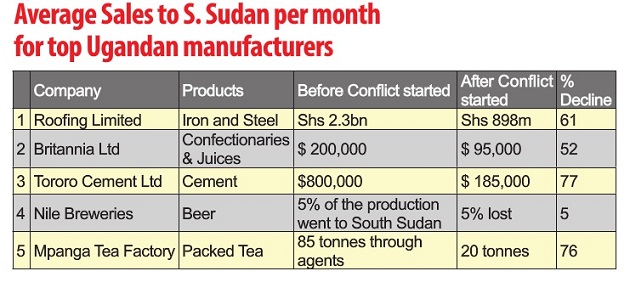

Despite the South Sudan civil war taking a significant toll on the Ugandan economy, things are slowly beginning to work out for the Ugandan manufacturers, agribusiness, traders, and the construction industry which all had been greatly affected.

According to bank of Uganda statistics, formal and informal exports from Uganda to South Sudan have been ongoing despite the volatile political situation.

Formal exports to S. Sudan are reported to have earned the country $80.83 million in financial year 2012/13, $236.28 million in 2013/14 and $308.54million in 2014/15.

On the other hand, informal exports stood at $127.6 million in financial year 2012/13, $125.3 million in 2013/14 and $113.67million in 2014/15. This underlines the importance of South Sudan to the Ugandan economy.

According to data collected in Juba by International Alert in early 2013 before the war broke out in December, it was found out that there were almost one million Ugandans engaged in provision of professional services, technical services, traders, and other services.

Many of them quit

All those, numbering about one million, were remitting thousands of dollars back home but the majority quit. Gideon Badagawa, the chief executive at Private Sector Foundation Uganda, is optimistic. He said while trade between Uganda and South Sudan has slowly picked, it is not yet to the level it was before the war broke out.

“The business people I have talked to are all waiting to see whether the peace agreement between the government of South Sudan and the rebel forces of Reik Machar will hold. If it holds then Uganda as a country will reap big,” he said.

“However, Ugandan manufacturers and other business people have concentrated their efforts on the DR Cong market, which is also doing very well. Many of the locally-manufactured goods are now finding their way to the DR Congo.”

According to statistics from the Uganda Revenue Authority (URA), the value of formal exports to South Sudan in 2013 was Shs 895.7bn ($269 million).

At the Ministry of Trade and Industry, officials at the research department said the conflict in South Sudan had negatively affected trade and industry in Uganda. They said few traders are willing to take goods to South Sudan due to insecurity, which has affected Uganda’s exports.

Additionally, manufacturers are foregoing revenue and also meeting extra costs in form of storage and spoilage of some goods that were meant for the South Sudan market. If this goes on manufacturers will decrease production which is likely to result into laying off of some workers and also dampen demand for both local and imported raw materials.”

Transporters are also losing revenue as they cannot transport goods to South Sudan.

Abamwe Transporters, which plies the Juba route, indicated that business was completely closed fromDec.15, 2013 until mid-January 2014. Transporting goods to South Sudan resumed in mid January 2014 but at a very low level of one truck per week compared to ten trucks before the break out of the conflict.

Those who dare to transport the goods do it at a very high cost and at their own risk as the insurance policies do not cover the damages/losses caused by acts of war. Transporters were charging Shs 11m per truck before the conflict.

After the conflict, the demand for transport to South Sudan was very low and the prices fell to Shs 7.5 million per route. Truckers say they do not break even on this price but have to continue transporting so as to maintain cash flows to meet their short term obligations such as paying fuel supplies and repairs.

As a result of this conflict, Abamwe Transporters, which had a turnover of Shs 110 million per week from the ten trucks going to Sudan, is now making Shs 7.5 million from one truck per week.

The situation is not limited to Abamwe alone but also to other transports such as Aponye Transporters and Onacotram. The transporters also reported increased harassment and multiple roadblocks mounted by the army, police and even some armed militia inside South Sudan.

They demand for bribes to pass the road blocks, which has worsened the already bad situation of high costs. There are areas such as Bor in Jonglei State, Bentiu in Unity State and Malakal in Upper Nile State, which are now no-go areas because of the high insecurity risk caused by the conflict.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price