Dr. Mary Goretti Kitutu, the Minister of Energy and Mineral Development noted in a short statement released yesterday that: “The agreement is a significant milestone in Uganda’s oil and gas sector and is a critical development that takes the sector towards the final investment decision (FID) that the country is eagerly waiting for.”

French super major, Total, announced on April 23 that it had reached an agreement to take over Tullow’s assets in Uganda’s Lake Albert Development project including the stake in the East Africa Crude Oil Pipeline.

Total said it would pay Tullow US $575 million, with an initial payment of US $500 million at closing (of the deal) while US $75 million would be paid when the partners finally take the final investment decision to launch the project.

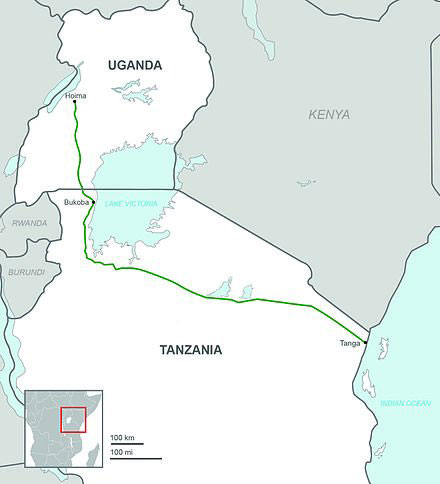

Under the terms of the deal, Total will acquire all of Tullow’s existing 33.3334% stake in each of the Lake Albert project licenses EA1, EA1A, EA2 and EA3A and the proposed East African Crude Oil Pipeline (EACOP) System.

The transaction is, however, subject to the approval of Tullow’s shareholders, to routine regulatory and government approvals and to CNOOC’s right to exercise pre-emption on 50% of the transaction.

“We are pleased to announce that a new agreement has been reached with Tullow to acquire their entire interests in the Lake Albert development project for less than US$2/bbl in line with our strategy of acquiring long-term resources at low cost, and that we have an agreement with the Uganda government on the fiscal framework,” Patrick Pouyanné, Total Chairman and CEO said in a statement seen by The Independent.

“This acquisition will enable us, together with our partner CNOOC, to now move the project forward toward FID, driving costs down to deliver a robust long-term project.”

In a related statement posted on Tullow’s website on April 23, the British wildcatter which still retains exploration interests across Africa said it was pleased to announce that it has agreed the sale of its assets in Uganda an effective date of 1 January 2020.

“Tullow and Total E&P Uganda B.V. (Total Uganda) have signed a Sale and Purchase Agreement (SPA), with an effective date of 1 January 2020 (the Effective Date), in which Tullow has agreed to transfer its entire interests in Blocks 1, 1A, 2 and 3A in Uganda and the proposed East African Crude Oil Pipeline (EACOP) System (the Uganda Interests) to Total Uganda for cash consideration of US$575 million (the Cash Consideration) plus potential contingent payments after first oil (the Transaction).”

“Tullow and Total have had supportive discussions with the Government of Uganda and the URA in recent weeks, including to agree the principles of the tax treatment of the Transaction. This includes the position on Ugandan tax on capital gains, which is to be remitted by Total Uganda on behalf of Tullow Uganda, and which is expected to be US$14.6 million in respect of the Cash Consideration.”

Binding tax agreement next

Tullow Uganda and Total Uganda now intend to sign a binding tax agreement with the Ugandan government and the Uganda Revenue Authority that reflects these principles which will enable the transaction to be finally completed.

Robert Kasande the Permanent Secretary of the Ministry of Energy and Mineral Development said the government and the oil companies have in principle agreed on the tax treatment of the transaction.

In August last year, Tullow Oil Plc announced the collapse of a US $ 900 million farm down to its local partners Total E&P Uganda and China National Offshore Oil Corporation (CNOOC) following a two year deadlock.

In January, 2017, Tullow had signed a sale and purchase agreement with Total, agreeing to transfer 21.57% of its 33.33% interests in Exploration Areas 1, 1A and 2 in the Lake Albert Development Project worth US$ 900 million.

Tullow was expected to receive US$ 200 million in cash consisting of US$ 100 million on completion of the transaction and US$ 50 million at both Final Investment Decision and First Oil. The balance of US$ 700 million in deferred consideration was meant to fund Tullow’s share of the development and pipeline costs.

However, a month later, CNOOC Uganda exercised its pre-emption rights to acquire 50% of the interests being transferred to Total. In September, 2017 Tullow then notified government about the farm down to Total and CNOOC. But then the government slapped Tullow with us$ 167 million in Capital Gains Tax.

Tullow disagreed with the assessment arguing that it was not liable to pay this tax because it was transferring shares to another investor for re-investment in the project. The Uganda Revenue Authority and the government technocrats insisted on Tullow paying Capital Gains Tax. A stalemate over the transaction then ensued stalling Uganda’s oil development project.

Going forward, Tullow said in a statement that the firm hopes the transaction will remove all future capital expenditure associated with the Lake Albert Development Project whilst retaining exposure via contingent consideration linked to production and the oil price through the contingent cash payments described above.

Dorothy Thompson, Tullow’s chief executive officer said: “Tullow has been a pioneering explorer in Uganda over many years and we are very proud of the role we have played in the founding and development of Uganda’s oil industry. We wish all Ugandans and our joint venture partners well as they take this important project forward.

“This deal is important for Tullow and forms the first step of our programme of portfolio management. It represents an excellent start towards our previously announced target of raising in excess of US$1 billion to strengthen the balance sheet and secure a more conservative capital structure.”

Africa Energy Chamber welcomes deal

Meanwhile, the Africa Energy Chamber has also welcomed the deal noting that the Ugandan government, Tullow Oil and Total could not have chosen a better time to announce the resolution of a long standing capital gains tax dispute that had earlier prevented Tullow Oil from farming out its Lake Albert licences to Total.

“This deal shows a lot of foresight to make an acquisition of this nature for such an amazing but reasonable price. The resolution of disputes that paved an opening for this deal should be commended,” said NJ Ayuk, the executive chairman of the African Energy Chamber.

Ayuk said the deal would send the right signals to the market and investors— that despite the current challenges, Uganda is open and ready to do business.

“This is good for Uganda and an example for other African countries facing the oil crisis to follow. It is likely to have positive effects far beyond the current crisis, with ever more explorers and oil companies likely to take another look at Ugandan acreage in an attempt to replicate Tullow Oil’s discovery successes.”

Elizabeth Rogo, the president of the Africa Energy Chamber (East Africa) referred to the deal as a big win for the local and regional oil and gas industry that would propel the East Africa region to play a role in helping the energy sector rebound.

“The proposed Uganda/Tanzania pipeline (East Africa Crude Oil Pipeline) in itself will not only lead to additional jobs being created, it will also render the entire country viable as a major oil frontier,” Rogo said.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price