Surprises in 2018 budget:mFinance Ministry makes right moves, but timing could be wrong

Kampala, Uganda | JULIUS BUSINGE | For years now, Uganda’s budget making process has been dominated by debates about four contentious issues; the government’s huge investment in infrastructure, domestic resource mobilisation, the size and rate of external borrowing, and the squeeze on some expenditure; especially on agriculture, education, and health.

As the 2018/19 budget making process reaches its mid-point this January, the Ministry of Finance has released the Budget Framework Paper (BFP) indicating that this budget could have the most dramatic changes in a long time; especially regarding the areas of contention.

For the first time in over five years, the government is proposing pulling the breaks on general budget expansion – the resource envelop will increase just slightly by Shs 200bn in 2018/19 from this year’s Shs 29 trillion. Unfortunately, it could be a case of right move, done wrongly, at the wrong time.

The proposed literally flat budget for 2018/19, if maintained, will be riding against the current mood of optimism locally, and globally.

Locally, optimism is reflected in the rise of the Business Tendency Index above the 50% threshold, the latest World Bank/IMF reviews that forecast growth above 5% in 2017/18 and 6% in 2018/19, and up to 7% according to the government’s own projection as presented by the Minister of State for Finance at the National Budget Conference.

Global forecast for growth is equally robust on the back of high growth in the USA, China and Europe. This means more kyeyo remittances. Inflation has been held in check, ending 2017 at 3.3%, which is far below the Central Bank target of 5%.

But Uganda’s flat budget is also structured oddly because the government proposes to continue pumping big sums into infrastructure and energy. It proposes to cover the increased financing to these sectors by slashing funding to social sectors like health and education that are already starved. On the revenue side, it proposes to tax the same payers more, instead of innovatively expanding the tax base.

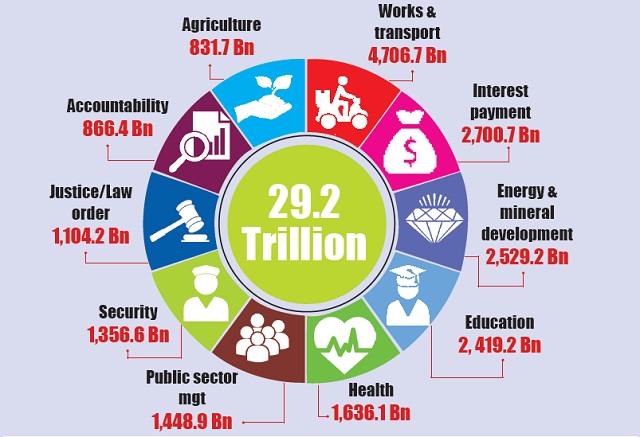

As a result, and as in the recent past years, up to 45.2% of budget spending is proposed to go to Works and Transport, Energy and Mineral development, and interest payments.

On the other hand, Education and Health is proposed to consume 11.0% and 7.4% (FY2018/19) compared to 11.4% and 8.3% in FY2017/18 respectively.

Other areas proposed to be cut are Security; from 6.7% this year to 6.2% in 2018/19, Justice, law and order sector will get 5% down from 5.1%, and the remaining 10 sectors will take the balance with each getting less than 4% of the resource envelop. Only the public sector management retains its 6.6%.

Top planners disappointed

Civil society organisations (CSOs) under their umbrella body – Civil Society Budget Advocacy Group (CSBAG) criticise the budget allocations because the beneficiaries have, in the past, failed to utilise the money. In the last 10 years, the CSOs say, the Works and Transport sector has reportedly failed to absorb 60% of borrowed money the government pumps into it.

Some top planners, including Gideon Badagawa; the executive director of Private Sector Foundation Uganda (PSFU) want more aggressive pronouncements on cutting government expenditure, providing cheaper credit through the Uganda Development Bank (UDB), timely payment of domestic arrears owed to the private sector, and increasing support to the private sector’s capacity in Research & Development.

Badagawa told The Independent in an interview that money saved from cuts in the cost of running government, can be deployed to support needy sectors.

The proposed budget allocations also appear to obliterate any good news in the budget. Experts, including Prof. Augustus Nuwagaba, an economist and managing consultant at REEV Consult International, who have been clamouring for these moves, should be happy that the government proposes to reduce development related spending from 9.6% of GDP in FY2018/19 to 8.6% of GDP over the medium term as large infrastructure projects – Karuma and Isimba Hydro Power Projects (projected to cost approx. US$2 billion) –are expected to be finalised by December 2018.

Critics should also be happy that the government is proposing to reduce domestic borrowing from Shs954.2 billion in the current FY to Shs940 billion in FY2018/19 and reliance on project support (external financing) from the current budget Shs7.0 trillion to Shs6.7 trillion in the coming FY. An additional sweetener is that domestic borrowing is projected to decline further to Shs 611bn in FY 2019/20 and reach Shs 409 bn by FY 2022/23.

But the experts say the government’s moves are inadequate and wrongly matched. Nuwagaba told The Independent that instead of reducing, the government should stop domestic borrowing as it crowds out private sector borrowers and raises the cost of money.

“Interest rates cannot go down unless government stops domestic borrowing,” he told The Independent.

Nuwagaba says borrowing to fund development projects like roads, railway and power dams and short term projects like irrigation and storage facilities for agriculture is okay because, at 36% of GDP, national debt remain sustainable. Nuwagaba says, however, the funds should not be abused and projects should be delivered on time and with best quality standards. But he opposes prioritising development projects that do not deliver short term growth.

“In an economy like ours where production is still low, spending on long term projects would yield zero returns in the short term, and it would constrain demand because people’s disposable income will not be growing,” he says.

Nuwagaba says the 2018/19 but needs to be restructured to focus on accelerating production for Uganda’s largest sector, agriculture.

“Our budget should be production driven but not consumptive; agriculture should be taking 50 percent of the budget instead of 3 percent,” he said.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

50% should go to agriculture