The quarterly payments will encourage savings among users, executives say

| THE INDEPENDENT | Uganda’s biggest telecoms – MTN and Airtel – have paid a combined interest to customers with outstanding balances of Shs1 and above for the second quarter of this year Shs 9.1bn.

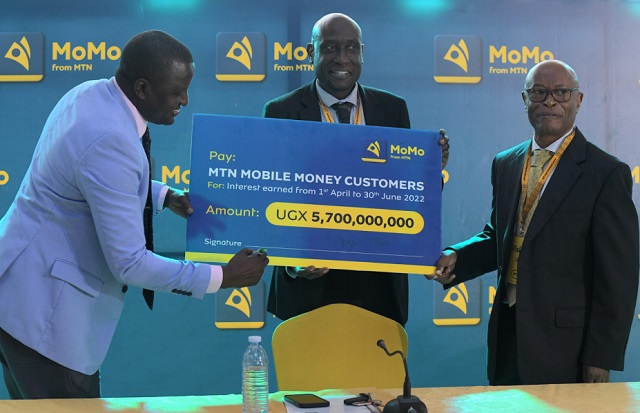

MTN Uganda paid Shs5.7billion to 19.8million MoMo users while Airtel Money paid Shs 3.4bn to an estimated 20 million accounts as interest earned on their mobile money accounts.

The maiden payment is in fulfillment of Section 49(6) of the National Payments Systems Act (NPS) of 2020 and Regulation 14 of the National Payment System regulations of 2021 which stipulates that MTN Mobile Money Uganda and Airtel Mobile Commerce Uganda Ltd pay its customers, interest earned on a Trust Account.

MTN MoMo Limited and Airtel Mobile Commerce Uganda Ltd were separated from their parent companies last year pursuant to the National Payment Systems Act.

“As MTN Mobile Money Uganda, we strongly believe that this quarterly interest paid to customers will encourage a culture of savings and create wealth and opportunities for investment, especially in medium and small businesses which use the mobile money platform intensively,” said Richard Yego, the managing director at MTN MoMo Uganda Ltd.

“We also hope that the pay-out will enhance financial resilience by bringing more people into the formal sector through Mobile Money and thus leading to substantial development and social well-being of the citizens as the country strives to achieve Vision 2040.”

Yego said customers could now also save and invest with Xeno Investments via the mobile money platform and encouraged customers to utilize the various advance products including Momo advance, Mokash, and Mosente to better their lives and those of their loved ones.

James Mugabi, the Chairman Board of Trustees for MTN Mobile Money Uganda Limited said this development will contribute immensely to financial inclusion and deepening among the unbanked population.

“A World Bank report published in 2017 showed that only 16 % of the adult population kept their savings at formal deposit-taking institutions, including banks, microfinance institutions, and savings and credit institutions,” he said.

“The report added that up to 60% of adult Ugandans still kept their savings at home and in the form of assets such as animals and that a larger share of the population, reaching more than 65%, were unable to access formal financial institutions for credit. This meant that a large proportion of the population relied on informal options for accessing finance and savings. However, I am certain that this situation is changing so fast.”

Mugabi said he is glad that the MTN MoMo has stirred the demand for various financial services and products by people who are in the lower pyramid, thus improving their livelihoods.

He said the pay-out will also build consumer confidence in the payment ecosystem and expand a set of mobile e-commerce capabilities to businesses and consumers as the economy becomes cashless.

AMCUL Managing Director, Japhet Aritho said the telecom company is committed to delivering on its promise to share the economic value generated by the Airtel Money business.

“We will continue to share this value with our partners, customers, and communities for the transformation of our country,” he said.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price