Kampala, Uganda | THE INDEPENDENT | The insurance industry is adjusting its operational and business modules to cater for the new challenges facing the industry, the economy and social life, after unprecedented developments like COVID-19 over the last one year.

The industry says this is a response to concerns that losses arising from the effects of the pandemic could be exempted from compensation, as they were not part of the insurable risks before. There was a related debate more than a decade ago when terrorist activities rocked East Africa, Uganda inclusive, yet insurance could not cover risks arising from such incidents.

Since then, insurers have developed related insurance products to cover such risks. The Insurance Brokers Association of Uganda, IBAU, is now seeking ways of responding to these new challenges without hurting the business while also ensuring the confidence of the customers.

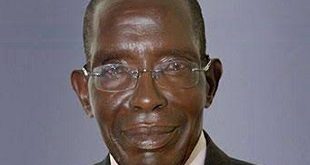

IBAU chairman Solomon Rubondo admits that when COVID-19 broke out, the country was not prepared and the industry did not know how to handle the ensuing risks. These include the closure of businesses and losses of employment. Rubondo says that a pandemic like COVID-19 becomes hard for them because it is difficult to evaluate, tell the trends and even determine when it will come to an end.

Rubondo said this ahead of the 3rd IBAU Conference due on April 8, under the theme; Navigating Risk in Today’s Changing World. The theme also covers the changing preferences of consumers, the employment dynamics like where more people are now working from home, curfew and other regulations that may impact risk.

There have been incidences where clients have complained of not being compensated for accidents met during curfew hours. In such cases, the insurance company cites regulations where an accident or other incidents arising out of committing an illegality, cannot attract compensation.

The Uganda Insurers Association Chief Executive Officer, Paul Kavuma says that while the insurance principles state that a claimant must be free of any offence to be compensated, they always give chance to the client to explain themselves about the circumstances.

Paul Muhame, the Chief Executive Officer of insurance brokerage, Ballpack Inc. appealed to the public to appreciate the changing face of risks as the industry works out the right approaches. He cited the increase in the health risk that has been caused by COVID-19.

Rubondo says that many of the current risks are actually provided for in the laws governing the industry, but because the laws are not being implemented, many properties are lost without compensation. He cites the properties in Kampala which are not insured.

Rubondo says that this is a violation of the laws because no property is supposed to be on a piece of land that is leased from the KCCA unless such property is insured. He says that they are in consultations with KCCA to ensure that this is enforced.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price