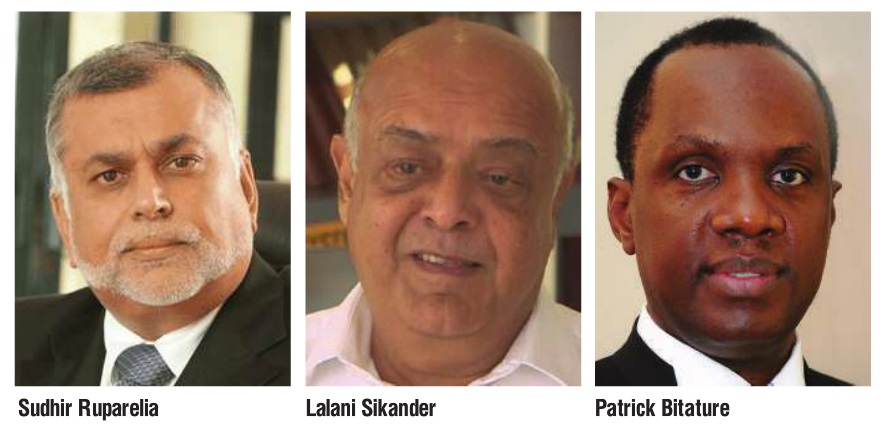

Several sources have told The Independent that former Uganda Investment Authority (UIA) chairman, Patrick Bitature and current Private Sector Foundation Uganda (PSFU) Chairman, Gideon Badagawa are among officials that have been working on the bailout list with Prime Minister RuhakanaRugunda.

When contacted, Badagawa who is very familiar with the issues having previously been executive director of the Uganda Manufacturers Association confirmed that “almost all the firms in Uganda are distressed because of trouble with the current business environment”.

“Ever increasing interest rates and the depreciating shilling are some of the many problems,” Badagawa said, “You have companies that borrowed at an interest rate of 18 percent and now have to pay back at a rate of 25 percent.

“Other firms borrowed in dollars when the interest rate was Shs.2700, it increased to Shs3800 and has just dropped to Shs3300. This makes it hard for companies to pay back.”

To make matters worse, Uganda’s major export market, South Sudan, has become inaccessible ever since fighting broke out there between forces loyal to President SalvaKiir and his Deputy Riek Machar.

Estimates indicate that Ugandan businesses made about a million dollars a day in South Sudan during peacetime. But the latest fighting which broke this July is likely to make a bad situation worse.

“Remember,” Badagawa said, “there are Ugandan business people who have never been paid the over US$54 million (some put the figure at $100 million) owed by their counterparts in South Sudan.

“This has constrained their cash flow and affected Uganda businesses ability to do business and pay their loans.

Proponents appear to be mainly the Who-is-Who in Uganda’s business community and politicians, while opponents appear to be technocrats in Ministry of Finance, policy makers, and regulators.

“Apart from this, there are companies, which also demand government a lot of money because government has delayed to pay and this has affected their cash flow too.”

As a result, Badagawa confirmed that negotiations have been on-going to assist distressed firms pay their loans. He said, however, this will be done by improving the business environment and denied reports that government would fork out cash to pay the loans of private companies.

“Government doesn’t have that kind of money,” Badagawa said, “Even if it did, it is not sustainable for government to pick money from the public coffers and pay for private companies.”

Instead, Badagawa said PSFU and government are working on a set of measures intended to fix the economy by boosting production, reduce cost of doing business, reduce the import bill and also reduce commercial bank interest rates.

Who is on list?

But basing on some of the potential beneficiaries, proponents are hailing the bail out as a pragmatic move to save the economy. Critics meanwhile see it as a form of money laundering – with government cronies helping themselves to public resources.

Proponents appear to be mainly the Who-is-Who in Uganda’s business community and politicians, while opponents appear to be technocrats in Ministry of Finance, policy makers, and regulators.

Those for the bailout, argue that the problems afflicting the companies are not as a result of their internal management problems but as a result of external problems. Amongst these, they cite interest rate escalation, for which they say they say the central bank is partly to blame.

Since 2012, the central bank has been buying Treasury Bills at an interest rate as high as 18 percent, at some point 23 percent. The central bank also increased the CBR to as high as 20 percent in a bid to control inflation.

As a result, interest rates for commercial banks increased to 32 percent and have since kept above 25 percent. Apart from this, there has been a problem of exchange rate depreciation of about 30 percent.

Also political uncertainty over elections and anger over the now repealed Anti-homosexuality Act is said to have contributed to poor revenue from tourists and reduced Foreign Direct Investment (FDI).

But opponents of this proposal, argue that public money should not be used to compensate commercial banks, which failed to do due diligence on their borrowers. They also argue that such a measure might erode payment discipline and create a culture, where private business borrow hoping to use political influence to side step their obligations. The technocrats say the banks and companies must pay for their wrong decisions.

The question proponents pose is; what happens if the businesses are not saved. The answer, they claim, is that local companies will collapse, lay off over 100,000 workers and also lead to the collapse of local banks, and ultimately the economy.

Banks are tight-lipped about those who owe them money but when The Independent approached some bankers with a list, some bankers confirmed that indeed some of them were highly indebted.

Some of the most affected are giant transport and logistics companies, giant steel manufacturers, construction companies and hoteliers, among others.

A source at one of the commercial banks who declined to be named because of the sensitivity of the matter intimated to The Independent that one of their biggest debtors owed them over Shs150 billion.

“This investor cannot pay and has even failed to sell his properties because no one can or wants to pay what they want,” the banker intimated.

And as The Independent went to press, Standard Chartered put giant steel maker, Steel Rollings Mills under receivership over a debt of Shs. 50 billion. The same bank was expected to also put another of its debtors, a logistics company, under receivership.

While some officials have denied reports that government will be releasing hard cash to meet some of these loan obligations, others say close to a trillion shillings is being considered.

Multiple sources interviewed by The Independent, some in private banks and others in government estimate that over a hundred private firms need over Shs.1 trillion to dig themselves out of indebtedness. This is over 5 percent of the 18 trillion available for government expenditure in this financial year.

President Yoweri Museveni forking out Shs1 trillion of public money to private businesses might sound unbelievable but a banking executive with one of the top banks says it is very close to the total sum of non-performing loans on commercial bank loans. Non-performing Assets (NPAs) were the biggest contributor to the poor performance of banks in 2015.

By December, they stood at 2.6 percent of total banks’ assets. By June this year, the figure had jumped to 8.2 percent or about Shs. 1.8 trillion the total assets, which is about Shs.21.7 trillion.

Two major banks are most affected.Standard Chartered and Uganda’s fourth largest bank by assets, Crane Bank, whose profits slumped from a Shs50 billion profit the previous year to a loss of Shs3 billion in 2015.

Many will remember that in the past, President Museveni has bailed out cronies and politicians. At the height of the contest with his then Prime Minister, Amama Mbabazi, with in the ruling party in 2014, Museveni, for instance, offered to clear the loans of members of parliament after he learnt that Mbabazi was considering the same.

President Museveni first hinted on saving local firms as he gave his state of the nation address. He said the solution to cheap credit, which was critical for boasting agriculture and manufacturing, was in recapitalising Uganda Development Bank (UDB).

The deal, if it goes through, will be the biggest deployment of taxpayers’ money to prop up ailing private companies in the history of Uganda. It will be bigger than even the Public Enterprises Reform and Divestiture of the 1990s and the earlier distribution of the properties of expelled Asian in the 1970s

He said the delay to recapitalise UDB was because he “wanted to see whether the involvement of the private sector in Banks, would lower the interest rates because of “competition” and the “efficiency” of private actors”.

“Well, the facts show that it has not,” he said. He said that even when the inflation rate is 5%, commercial banks lend at 23.5% as of now. He said UDB will come to the rescue but there are, however, short-term issues that must also be addressed in addition to recapitalising UDB.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Just another way of transferring public wealth to private pockets – in most cases, pockets that have contributed to the President’s campaign. All these private businesses operate in a free market, with rewards for taking sensible risk. When they make mega profits, they don’t donate a portion to the public, do they? Why then, should the public support them when they make losses? In most cases, these are bad investments, for which the entrepreneur (not the taxpayer) should pay the price! If a business has expanded so much that it has 70% idle capacity, that was bad planning by the owners. It’s laughable to suggest that a few firms going down will “collapse the economy”. If Uganda’s economy is such a flimsy house of cards, maybe it should be allowed to collapse. A bailout as proposed will create moral hazard, making it even more likely that future wealthy “businessmen” beneficiaries will take even more outrageous risks, and plunder their companies, in the knowledge that “Government” (i.e. the taxpayer) will come to their rescue anyway. A perfect example of private profit and socialised losses!

Well said

Govt wants to take one trillion out of the tax payers’ purse to bail out ailing companies. The same govt owes suppliers one trillion!?! It is most likely that the beneficiaries of the bail out are also the suppliers who haven’t been paid. So after bailing them out, does govt also intend to clear the arrears? Meanwhile, there are small businesses which are also sinking in “small debts” taken from micro-finance institutions, SACCOs and Village Loan Schemes, who is going to bail them out?

Proponents appear to be mainly the Who-is-Who in Uganda’s business

community and politicians, while opponents appear to be technocrats in

Ministry of Finance, policy makers, and regulators.

Mistakes by investors that are pushed by lack of strategic planning but by free wheeling opportunism should never be a burden on Ugandans. They invest without thought, no focus and majority of them have never had of business analysis in its raw form. They expand without planning and now that they are collapsing Ugandan should shoulder them!!!

Such intervention should be into the economy as a whole not to inefficient organizations that employ their cronies without regard to skill. We all borrow from the same institutions and have the same burdens. If a bank did not appraise her client well, should we prop it. The same bank will announce profits, shouldn’t it be left to leak their wounds like all of us.

For once the technocrats are spot on.

Yet to confirm but the same so called investors could be benefiting from other incentives that are denied us.

So where is our economy heading with this?. the worst in history than AMIN

If our government is serious, it should only think of

helping the affectecd companies by renegotiating the loans with commercial

banks or ask Uganda development Bank to buy out the

loans. Sincerely we are all sweating to meet our loan obligations and its quite

difficult for me to understand how they compiled that least of affected

companies. I have seen Ham also listed as a beneficiary and yet this is same

person who borrowed to build a 5 star residential home in Bunga, estimated to

be USD 5millions in addition to buying several flashy vehicles. Pls advise me

how the economy is going to benefit from that? Am not against ham but this is

just an example.

Secondly, there is nothing wrong with banks selling off

businesses because that’s what happens in the free world. This will not put our

economy at risk since other capitalized investors will be taking over and still

continue doing business in Uganda.

Some of these guys borrow money and start showing off, buy

their concubines new vehicles, fly their families abroad for holiday,s etc and

now they want to shift their problems to the ordinary tax payer. That’s what

makes me hate this government with passion. Is there any due diligence that was

done to confirm that borrowed money was used to stimulate the economy? AND its high time that the small individuals also

start subsidizing themselves by not paying URA Taxes since nobody thinks us.