Why Sudhir will not be jailed…..And three things everyone must know about how the powerful and wealthy look at financial crimes

COMMENT | JOSEPH WERE | Bank of Uganda Governor Tumusiime Mutebile’s defense about the central bank’s perceived poor handling of the Crane Bank take-over and sale has been simple: We did not know at first and when we later did know, we acted quickly, brilliantly.

On at least two points, Mutebile is being very economical with the truth. But since one of the most common lies that people tell is to lie that they do not lie, he might comfortably deny that Sudhir’s 100% ownership of Crane Bank was an open secret and the transfer of 48 branches could not have happened without BOU’s approval. Sudhir who is Uganda’s richest man but is accused of siphoning billions from his bank via insider lending and false-door accounting, uses the same defense in the on-going court cases.

What is important is that the moment the name of the head of one of the top four commercial banks in a country is being pronounced in the same line with words like stole, cheated, embezzled, and forged, the inner sanctum of profession propriety in the whole financial sector cannot remain inviolable.

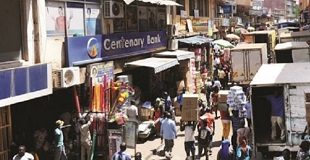

So Sudhir’s case against BoU raises broader implications that might require reform of the nation’s financial sector and policies, and reassignment of roles, responsibilities, and recrimination. This is important if we are to foster responsible corporate leadership among the elite and ensure that we get successful local banks owned and run by Ugandans.

Mutebile’s defenses and passing of the buck of culpability to BoU’s regulatory department imply he is aware of the wider implications even as allegations of collusion, back scratching, and turning a blind to financial malfeasance persist.

Sudhir is, of course, innocent unless proven guilty. But the tragedy of the Crane Bank saga is that when it finally dies down, he will not be in jail, Mutebile will still be boss of BOU, and the commercial bank supervision teams will still be intact – waiting for the next bank failure – which is inevitable. To understand why, one needs to look at why wealthy, powerful, successful people steal.

That white-collar crime is not seen as theft is a factor. Social norms, culture, attitude, and lifestyle appear to condone it. Many ordinary Ugandans, for example, will lynch a person who steals a chicken but admire another who steals billions of shillings from a government department. The two crimes are actually similar. The only difference is that one is white-collar crime while the other is street crime. White-collar crime does more harm but nobody seems to see that and there are no severe penalties for those caught.

White-collar crimes allegedly brought down Dr. Suleiman Kigundu, the CEO and owner of former Greenland Bank. It was the same with Patrick Kato of former International Credit Bank, and the Amos Nzeyi group at former National Bank of Commerce.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price