Lagarde (right) praised Museveni’s (left) scaled-up infrastructure investments.When President Yoweri Museveni, Minister of Finance, Economic Planning and Development Matia Kasaija, Governor of Bank of Uganda Tumusiime-Mutebile and other senior officials stepped into the meeting with visiting IMF Managing Director Christine Lagarde this last week, they had under their belt a tough budget proposal for the 2017/2018 Financial Year.

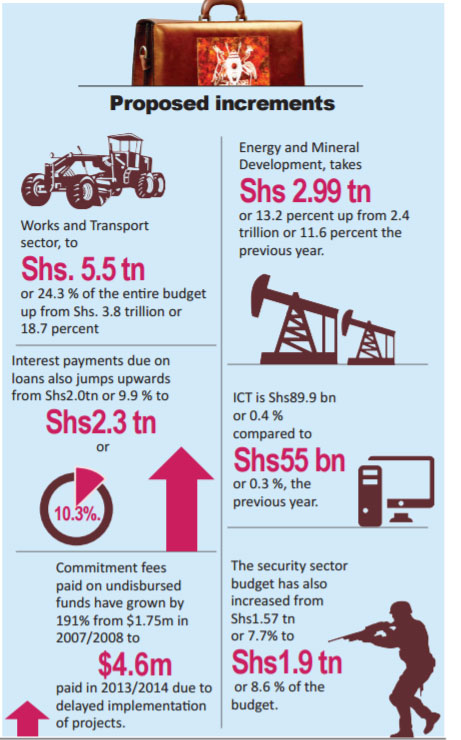

They propose to reduce government spending on health, education, and social development, raise taxes to fund ambitious oil refinery and pipeline, roads, railway, and hydropower projects, and borrow more locally to starve the economy of liquid cash.

By the time Lagarde, as the head of the most listened to advisory financial organisation on earth, left Uganda, Museveni and his team had secured her support.

In a statement on Jan.28, Lagarde praised Museveni’s scaled-up infrastructure investment in the energy and transport sectors, progress on domestic revenue mobilization (taxation), and inflation targeting which uses high commercial bank interest rates to enforce a contractionary monetary policy.

Lagarde showed that she was aware of constraints hurting the Ugandan economy by listing them; secrecy surrounding oil deals, absence of policies that promote inclusive economic growth, high rates of unemployment in a fast-growing population, weak institutions, weak public investment management, failure to allocate adequate resources to the social sectors, and a bad business environment for the private sector.

But Lagarde did not point them out as a problem; she offered their inverse as solutions. Museveni’s team giggled at the kid-gloves treatment from the IMF and appears set to maintain the status quo. Some economic watchers are not impressed.

President Yoweri Museveni and his Finance Ministers and technocrats propose to reduce government spending on health, education, and social development, raise taxes and borrow more locally to fund ambitious energy and oil infrastructure projects

Lawrence Bategeka, the Vice Chairman of the Parliamentary Committee on the National Economy told The Independent that he understands that the government has “limited revenue because economic growth has been very slow” and donors have slashed their support to the budget from Shs937 billion last FY to just Shs34 billion in the 2017/18 FY.

“That leaves you with no options,” he said.

But he said even under such circumstances, the government should not be making the mistakes it is making; including borrowing heavily locally, and cutting spending on education. He says the government should instead make developing the population a priority by investing in social services.

“Cutting on areas like these shows that we are postponing our chances of development,” he told The Independent.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price