Days after the interview with Rubondo, President Museveni also appeared to resolve a fight amongst the oil companies that threatened to delay oil production.

The fight stemmed from the $ 900 million deal in which Tullow Oil is selling part 21.57 percent of its 33.3 percent stake to CNOOC and Total E&P.

CNOOC has been demanding operatorship of one of the Exploration Area2 (EA2) which was initially being operated by Tullow and which stood to go to Total following the farm down.

Previously, CNOOC operated Kingfisher, Tullow EA2 and Total EA1 and EA1A.

With the farm down, CNOOC was set to remain operating the Kingfisher field, while Total would also start operating EA2 previously operated by Tullow Oil; in a project it had already code-named Tilenga. Total was excited about the deal because it stood to give them the leading role in the entire project. But CNOOC was opposed to this arrangement.

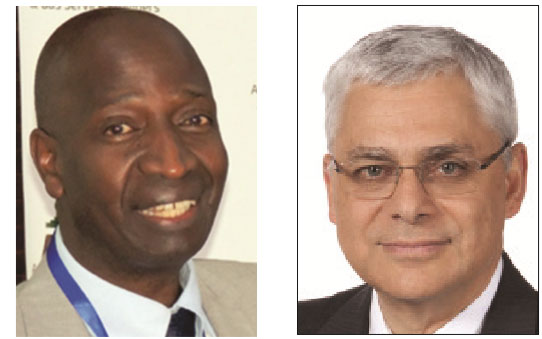

To resolve the impasse, Total S.A’s Vice President for Africa, Guy Maurice and another top official flew to Kampala mid-November to meet President Museveni.

Sources say Maurice’s delegation camped in Kampala for about half a week and met the president. It was the second time Maurice was coming into town in a few months. And his meeting followed another by CNOOC’s Vice-President Xu Keqiang from China, who together with the Chinese ambassador, met Museveni and raised concerns over Total. Initially, Museveni appeared to side with the Chinese.

But intense lobbying on the part of the French saw the president pledge to give CNOOC another block and ask them to let Total go ahead and operate EA2.

By unlocking that impasse, insiders say, President Museveni has helped speed up the process and dispelled fears the fights would put oil production well beyond the 2020 deadline that government set last year.

Despite this, the deadline is still seen as unrealistic because the companies need at least three years after making the Final Investment Decision (FID)—which is now expected between June and December this year. This would mean that at the very least, Uganda can only be able to pump oil after well after 2021.

But all this will partly depend on the outcomes of the FEEDs, which are in the final stages of completion.

The completion of the $ 900 million farm down now awaits government tax treatment and finally, approval. Many hope that the deal will not attract tax disputes as the ones before it; especially because it is seen as a critical stage before the FID, which is expected to unlock billions and kick-start production.

The major oil deals of the year will be guided by the FEED. In February, Total picked three companies to carry out FEED studies for its Tilenga project. These included; Technip (French), Fluor (U.S. and partnering with China Petroleum Engineering and Construction Corporation-CPECC) and the Chicago Bridge & Iron Company (CB&I). China also picked a contractor for Kingfisher, who has been at work in Beijing.

Once the FEEDs are concluded, the companies are expected to announce the Engineering, Procurement and Construction (EPC) contractors on the two projects. The EPC contracts, insiders say, will swallow the biggest chunk of $ 10 billion for the development phase.

Apart from development of the oil fields, actual construction of the $3.55 billion oil pipeline is expected to commence this year. However, it remains to be seen whether a deal on the $ 4.5 billion oil refinery will be reached this year. A group led by General Electric and another led by China’s Dongsong Guangzhou Energy Group are still up against each in the race for the deal after negotiations with Russian firm Global Resources collapsed in 2015.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price