COMMENT | Joseph Mukasa Ngubwagye | The COVID-19 pandemic has presented unique challenges across all aspects of society. Healthcare systems have been strained, schools closed, and economies constrained. The energy sector has not been spared.

Many oil producing countries have suffered big losses, and their economies have been threatened due to a record global drop in the oil demand since 1995. They have had to employ several interventions to save their economies from collapsing while keeping their competitive advantage on the world market. These developed oil-producing countries are much more integrated into global markets and their economies are facing huge shocks. It is even worse for countries which have no well-established wealth funds, mainly those in Africa.

Uganda’s oil resources are still beneath the surface. The resource rents have not been integrated into the wider economy, and therefore the impact of the pandemic is quite different.

While the plummeted oil prices have greatly affected the already oil-producing countries, Uganda’s oil sector is still at the development stage. The country is thus more concerned about the future than current oil prices. It is even possible to leave the resources under the ground and concentrate on alternatives to sustain the economy. Nonetheless, the journey to production continues, and a number of processes have been affected, delaying further the possibility of getting the first oil out of the ground as soon as had been anticipated.

The pandemic affected the development operations and processes. Several local companies had positioned themselves to partake of the projected fifty billion shillings worth of investment during the development phase. Hotel businesses in the oil districts were booming due to heightened activity, and a number of local technical firms which were undertaking field operations were equally flourishing.

Contracts of some of these companies had been suspended due to the process of transfer of interests between the international oil companies grounding to a halt. This was exacerbated by the suspension of all field operations due to the COVID-19 pandemic indefinitely.

The Final Investment Decision (FID) is now edging closer but many Ugandan firms who would benefit from the sector are struggling after COVID-19 pandemic

The business entities had borrowed highly to invest in the oil and gas sector which was showing potential for high returns. With reduced activity and the pandemic disruptions, these local investors have been left to choke on debts from lending institutions, unsure of when business would resume normally.

The Final Investment Decision (FID) is now edging closer, following the completion of the Purchase and Sale Agreements (PSA) between Tullow and Total E&P Uganda. Tullow, in effect, transferred all its interest in the Joint Venture Partner projects in Uganda to Total E&P Uganda, paving a way for the FID.

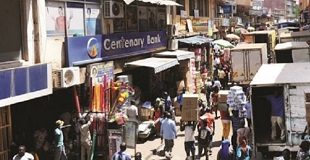

The FID is one most critical factor to have flood gates of investment in the oil and gas sector open. This comes at a time when potential Ugandan firms who would benefit from the sector are financially unstable, especially because of higher levels of vulnerability and lower resilience related to their sizes.

Lack of financial support has been reported as a common barrier to the involvement of indigenous companies in the oil and gas sector. Worse is the high cost of borrowing in Uganda. Intense competition from international players with cheaper access to finance from international financial markets is likely to edge out the local companies in the oil and gas supply chain.

The Local Content bill 2019 was passed in May, 2020. It creates room for Ugandan companies to get involved in government projects. While this is a move in the right direction, the economic vulnerability caused by the pandemic is likely to deter local companies from competing favourably in the oil and gas sector, which is capital intensive.

A deliberate effort by government is needed to boost these companies so that their financial capacity is lifted so that they can compete in the industry.

Financial instruments such as Loan guarantees, direct lending, and grants and subsidies should be thought about going forward to boost the capacity of local firms. Countries such as South Africa, Equatorial Guinea, and Angola are already applying some of these measures to save their local firms from collapsing.

It is important to ensure that the bigger proportion of the huge investment in the development phase of the oil and gas sector is retained in the country to spur economic growth. Otherwise, the country stands a risk of massive economic drain, with much of our money going to the foreign countries, where the financially capable firms are based.

*****

Joseph Mukasa Ngubwagye is a Senior Research Fellow, Advocates Coalition for Development an Environment (ACODE) – jngubwagye@acode-u.org

Joseph Mukasa Ngubwagye is a Senior Research Fellow, Advocates Coalition for Development an Environment (ACODE) – jngubwagye@acode-u.org

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price