Failure to operationalise the National Health Insurance Scheme and resurgence of COVID-19 may constrain demand for insurance

Kampala, Uganda | ISAAC KHISA | Uganda’s insurance industry is projected to register consistent growth in 2022 riding on technology innovations, government’s investment in infrastructure and increased economic activities as economy opens up.

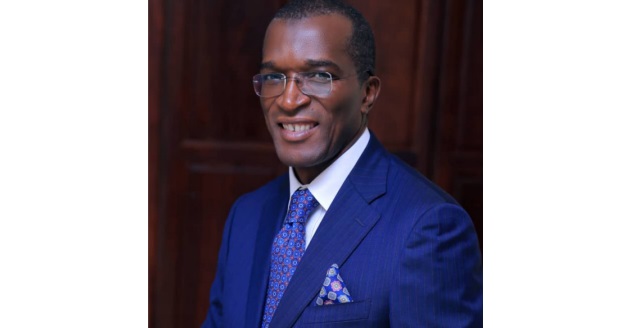

Ibrahim Kaddunabbi Lubega, CEO at the Insurance Regulatory Authority (IRA) told The Independent on Jan.07 that the projection is premised on a fairly impressive performance of 2021 where the industry is estimated to have grown at about 11% amidst several disruptions.

He said the COVID-19 pandemic seems to have improved the risk awareness amongst the public as demonstrated with renewed interest in insurance by small, medium and large scale enterprises.

“The insurance industry players have (also) continued to adopt technology,” he said. “We anticipate that going forward, the entire insurance cycle right from underwriting through policy issue, claims intimation up to claims payment will be largely enabled by technology.”

Kaddunabbi said the regulator has also developed and issued guidelines for sandboxes to enable budding innovators test some of their innovative solutions before they can be rolled into the market.

“Currently, we have two companies in the sandbox, and we are optimistic that more innovators will soon come on board,” he said.

Latest statistics from the IRA shows that that the industry’s gross written premiums as the end of the third quarter of 2021 shrugged off the effects of COVID-19 to record a 16.87% growth in premiums to Shs 911.9bn compared with the same period in 2020.

The non-life insurance business took the lion’s share of gross written premiums of Shs528.7billion, representing a merely 0.7% growth. Life insurance business recorded a sharp growth in the gross written premiums to Shs 291.6bn, representing 46% growth as micro-insurance’s gross written premiums increased from Shs 24million in 2020 to Shs 504million. However, Health Membership Organisations recorded 35% reduction in gross written premiums to Shs35.9bn.

Uganda’s insurance industry has consistently recorded a surge in insurance business with the gross written premiums increasing from Shs 463billion in 2013 to Shs1.06trillion in 2020 on the back of government investment in infrastructure such as Karuma and Isimba Power Dams, Kampala-Entebbe Expressway and Entebbe International Airport expansion.

However, insurance penetration remains at less than 1% compared with South Africa, Namibia, Lesotho and Kenya, whose insurance penetration stands at 16%, 6.6%, 4.7% and 3.4%, respectively.

Focus areas in 2022

Kaddunabbi said insurers expect to start seeing dividends from the various interventions that have been implemented over time such as the integrated Marine Insurance platform where importers will demand insurance from local players and the integrated Motor Third Party payment platform with the Express Penalty Scheme System (MTP-EPS) to enhance compliance.

He said insurance players will this year focus on providing insurance risk solutions as opposed to providing insurance services as it has been. Intermediaries too will need to evolve with how advice and customer engagement is delivered and how customers are on-boarded.

“This means that investment in Artificial Intelligence and Machine learning, which have a great potential to make virtually every process in the insurance value chain more efficient and streamlined, will be a must,” he said. “The success of this will be dependent on the quality of data generated and kept over time.”

Kaddunabbi said the industry will also focus on enhancing customers’ trust and retain their buy-in as a strategic step in the wake of increased competition for consumers’ shrinking income.

He said the industry will thus need to develop products that speak to the consumers’ unique needs and deliver the same in a way that suits the client’s circumstances.

Nevertheless, the industry stares at some challenges in 2022. These includes failure to operationalise the National Health Insurance Scheme (NHIS) and resurgence of COVID-19 that may constrain demand for insurance services.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price