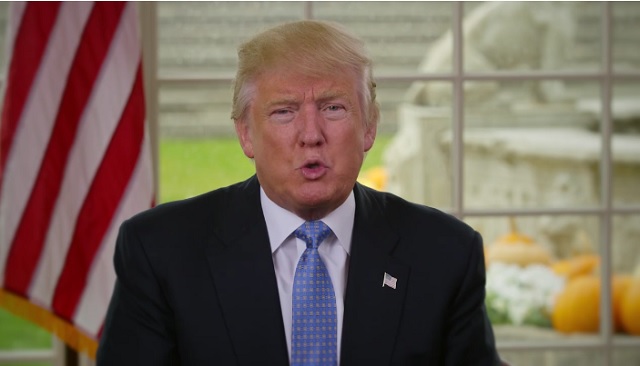

Washington, United States | AFP | The Republican-controlled US Congress was on the cusp Tuesday of passing a landmark tax overhaul, securing a legislative triumph for Donald Trump as the first year of his presidency draws to a close.

The House was set to debate and vote on the contentious $1.5-trillion package of tax cuts for businesses and individuals — billed by the president as a “Christmas gift” for the country — early Tuesday afternoon, with the measure widely expected to pass.

The Senate, where the vote appears to be tighter, will vote on the measure later Tuesday night after a period of floor debate, the chamber’s Majority Leader Mitch McConnell said.

“Congress is standing at the doorstep of an historic opportunity,” the veteran Senate Republican told colleagues, calling the legislation “the most significant overhaul of our nation’s tax code in more than 30 years.”

Should the Tax Cuts and Jobs Act make it into law it would be the first major legislative victory in the 11 months since Trump’s inauguration.

The Republican plan is projected to add nearly $1.5 trillion to the national debt over the coming decade, according to the Joint Committee on Taxation, but that figure drops to about $1 trillion when economic growth is taken into consideration.

House Speaker Paul Ryan predicted the bill will give a needed jolt to the US economy, and put more take-home pay into the pockets of American families.

– ‘America’s comeback’ –

“With this tax reform, families at every income level get a tax cut, but especially middle-income families,” he said, noting that the typical, median-income family of four earning $73,000 annually would save $2,059 in taxes next year.

“This is America’s comeback,” added number two House Republican Kevin McCarthy. “This is the beginning. This is the opportunity.”

The Democratic opposition has denounced the measure as most benefiting companies and the wealthiest Americans — including Trump himself.

They also warn the reform risks blowing a hole in the national debt, which has surged past $20 trillion.

Republican leaders unveiled their final version of the bill only late last week, after a period of negotiations between the House and Senate to iron out differences.

Trump has demanded the bill be on his desk by Christmas.

His party holds a 52-48 majority in the Senate, and can afford only two defectors.

With Senator John McCain, who has brain cancer, announcing he is undergoing treatment and will not return to Washington until January, that number shrinks to just one, although no Republicans are publicly opposed to the measure.

Vice President Mike Pence, who is president of the Senate, would be called on to cast the deciding vote in case of a deadlock.

Assuring he would be on hand in the event he is needed to break a tie, Pence delayed a visit to the Middle East, the White House said Monday, ahead of the looming tax vote and amid anger in the region over Washington’s policy shift on Jerusalem.

Under the legislation, the federal corporate tax rate would fall from 35 percent to 21 percent — a notch up from the 20 percent in previous versions — and the maximum individual income tax rate would drop from 39.6 percent to 37 percent.

The bill also doubles the standard deduction for families, doubles the child tax credit, and doubles to $10 million the amount of money that can be exempted from inheritance tax on the wealthy.

While Republicans failed earlier this year to repeal and replace the health care law of Trump’s predecessor Barack Obama, the tax plan takes a key step in that regard, by scrapping the individual mandate that requires nearly all Americans to have health insurance or pay a fine.

Because the government subsidizes some health plans under Obamacare, repealing the mandate is projected to free up $338 billion over 10 years to help pay for the overhaul, but Democrats and several experts warn the repeal would lead to 13 million fewer people with health insurance over the next decade.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price