BY ISAAC KHISA

With barely two months to the next budget, Ugandans have to brace themselves for higher taxes come June. The country is only emerging from a tough general election. The economy is improving and there’s hope that the Bank of Uganda’s tighter monetary policy implemented in the past year would prove effective in mitigating a repeat of the 2011 post-election crisis where inflation soared to 30%.

Now, with the onset of the budgeting season, the government must find money to finance its expenditure. The target is to raise Shs 21.2 trillion in the 2016/17 financial year.

Of this planned expenditure, the government is looking at raising 68% of it from taxes and the rest from grants and loans.

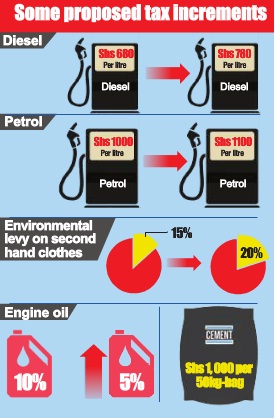

The government is now set to amend the Excise Duty Act 2014 to increase taxes on all types of cigarettes, ready-to-drink spirits, petrol (gasoline), gas oil, cane or beet sugar and chemically pure sucrose in solid form, motor vehicle lubricants, and confectioneries (chewing gum, sweets and chocolates).

It is also intending to impose taxes on the importation of un-denatured alcohol, lubricants, steel and steel products, electronics, including fridges, washing machines, radios, DVD Players and television sets, paper and paper products, and diapers, which were initially enjoying the tax waiver from the Common Market for Eastern and Southern Africa (COMESA).

It is also intending to impose taxes on the importation of un-denatured alcohol, lubricants, steel and steel products, electronics, including fridges, washing machines, radios, DVD Players and television sets, paper and paper products, and diapers, which were initially enjoying the tax waiver from the Common Market for Eastern and Southern Africa (COMESA).

Secretary to the Treasury Keith Muhakanizi told The Independent that the government’s move to hike taxes is aimed at raising more funds for various development projects including roads infrastructure.

Though economic experts agree with Muhakanizi, they say the bloated Parliament and the anticipated aid cuts as a result of the disputed general election could have triggered the government’s move to raise taxes.

“When you look at these taxes, they are not new. The government is simply looking for additional revenue to finance various activities including a bigger Parliament. Another scenario is that the government could be projecting aid cuts,” Fred Muhumuza, a research and advocacy specialist at the Financial Sector Deepening Uganda, said.

The total number of legislators in the 10th Parliament stands at more than 410 compared with the 375 in the previous Parliament as a result of creation of new districts and municipalities.

The raise in tax measures comes at the time business activities are showing signs of recovery with increased inflows for government securities in past Bank of Uganda securities auctions, suggesting a return of investor confidence following the general election.

According to Crested Capital, a Kampala-based advisory firm, the demand for short and medium term notes advanced in January and February this year increased, leading to a significant reduction in rates on those tenors. As a result, the 1-year yield declined from 24.15% in the first auctions held in January to 17.98% in the most recent auction held on March 03.

Ezra Munyambonera, a senior research fellow at the Economic Policy Research Centre at Makerere University, said although the government is looking at raising more revenue for development projects, the structure does not show any meaningful tax expansion. “This creates a more tax burden to the traditional tax payer,” Munyambonera said. “Over the years, Uganda tax effort has stagnated around 12.5% – 13% of Gross Domestic Product for years, largely due to the narrow tax base and large informal sector.”

Munyambonera says unless the government re-thinks strategic measures to unlock the informal sector to widen the tax base and expand revenue collection, the country is likely to continue plunging into higher budget deficits as it borrows to finance its public expenditure.

He says the ever-increasing taxation is likely to be counterproductive to tax collection efforts as it could lead to tax evasion and avoidance as tax payers attempt to maintain their profits and survive in an uncompetitive market characterized with the high informality. The government is also proposing to remove excise duty on specialised hospital furniture and international incoming calls and waived Value Added Tax (VAT) on agricultural processing machinery.

There is also a plan under the Finance Amendments Bill to waive arrears of tax accruing from savings and credit cooperative societies (SACCOs) and also exempt clinics from income tax.

In addition, the government is proposing to exempt tax on the supply of any goods and services to contractors and sub-contractors of hydroelectric power dams, solar power, and geothermal power projects.

However, civil society organisations that monitor the budgeting process fault the government for failing to look for new revenue streams especially in the agriculture sector and rental properties to widen the tax base.

“These (tax measures) are soft targets. There is no deliberate attempt to look at sensitive revenue collection areas where we can get serious money,” said Julius Mukunda, the coordinator of the Civil Society Budget Advocacy Group. The activists say the government is targeting only areas whose revenues can easily be collected and thus leaving investors in some sectors out of the tax net.

According to the budget frame work paper 2016/17, the government plans to spend Shs 3.78 trillion through the ministry of works and transport, up from Shs 3.32 trillion last year.

The education ministry is set to receive Shs 2.2 trillion, up from Shs 2.02 trillion whereas the health ministry and that of agriculture would receive Shs 1.38 trillion and Shs 627.7 billion up from Shs1.27trillion and Shs 480 billion, respectively.

However, security, trade and ICT ministries are expected to get cuts from Shs 1.64 trillion, Shs 81 billion, and Shs 66.7 billion to Shs 1.50 trillion, Shs 76.6 billion, and Shs 22.1 billion, respectively.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price