By Joseph Were and agencies

On which side will BoU intervene, if at all?

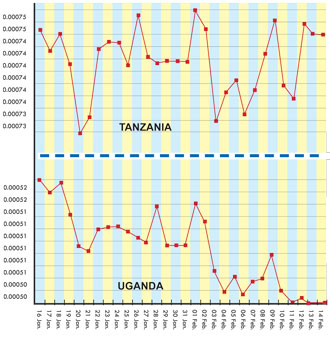

The weakening of currencies in the East African region against the U.S. dollar experienced in the last two weeks is likely to persist, according to analysts.

Dollar demand by offshore investors and the corporate sector to meet end month obligations is cited as the main influence.

Demand by the telecommunications sector is said to be driving the currency movements in Uganda and Tanzania while the energy sector is the dominant influence in Kenya.

The dipping in local currency has been cushioned by hard currency inflows from foreign trade and remittances by East Africans in the Diaspora.

Across the region, there is anticipation of intervention by the central banks to stabilize the currency incase the decline slides into volatility.

On the other hand, the value of the regional currencies could sink deeper if the central banks intervene to buy dollars instead.

“We anticipate central bank will come in and pump more dollars into the foreign exchange market,” Theopistar Mnale, a trader at Tanzania Investment Bank told Reuters.

Ugandan dealers said they did not expect any central bank intervention in support of the shilling following governor, Emmanuel Tumusiime-Mutebile’s comments that the bank would allow the shilling to depreciate if it did not affect macroeconomic stability.

Most traders predict that the shilling will remain weaker. By Monday Feb. 15, the shilling was trading at between Shs 1990 and Shs 2000 to the dollar.

“If central bank intervenes, it may recoup some of its losses. But I still see a weaker shilling because we expect to see more dollar buyers than sellers going forward,” said another trader with a commercial bank, according to a Reuters report.

The shilling has been gradually deprecating against the dollars, according to the latest figures from the Bank of Uganda, the nation’s central bank.

In December 2009, the shilling depreciated by 1.2 percent to an average

mid-rate of Shs 1,896.6 per U.S. dollar. At the time, the depreciation was attributed to increased demand for foreign exchange from off-shore

investors, energy and manufacturing sectors. In addition, the BoU said in a report, commercial banks heightened their demand for dollars in order to cover their short dollar positions, especially during the first weeks of the month. Towards mid December however, there were appreciation pressures which prompted BOU’s intervention on the purchase side. BoU sold US$ 1.9 million in the Interbank Foreign Exchange Market (IFEM)for purposes of liquidity sterilisation. The sterilized liquidity through daily sales of foreign exchange was Shs. 5.8 billion in November 2009. BoU’s intervention amounted to a purchase of US$ 30 million in December 2009.

Generally, BoU often intervenes when the shilling appreciates. This favours exporters as the value of their goods and services in local currency appreciates. However, import traders get jitterier when it depreciates. Many worry that they will need more shillings to buy dollars in order to import the same quantity of goods. This in turn sends the price of imported goods up.

In November 2009, the balance sheet of imports and exports registered a trade surplus of US $ 4.2 million, relative to deficits of US$ 0.9 million and US$ 105.7 million recorded in the preceding month and the corresponding month of November 2008, respectively. The monthly improvement was largely on account of a decrease in imports.

Uganda’s total import bill for the month of November 2009 amounted to US$ 298.1 million mainly comprised of private sector imports which accounted for 95.1 percent. In particular, machinery, vehicles and accessories, chemicals and related products, vegetable products, animal fats and oils and base metals and their products amounted to US$ 248.6 million while the oil imports totalled US$ 34.8 million. These oil imports were 6.0 percent and 19.1 percent less than the values recorded in October 2009 and November 2008, respectively, partly reflecting decreased import volumes.

However, overall earnings from exports have been declining. In November 2009, the latest month for which figures are available, the total export earning decreased by 1.7 percent relative to October 2009. They were, however, 45 percent higher than earnings recorded the in November 2008. Total exports amounted to US$ 302.3 million in November 2009; US$ 5.1 million lower than the outturn of the preceding month.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price