Move to expose ‘who owns what’

COVER STORY | RONALD MUSOKE | Who is the real owner of the multi-billion dollar telecoms giant, MTN Uganda? How about the fast-rising oil and gas marketing company, STABEX? Depending on who you talk to, several names will be whispered. Yet, quite often, the whispered so-called owners have no connection to those companies. But the push to know the exact owners of companies operating in Uganda has recently gained traction with the government registering their details, reports Ronald Musoke.

“We all know that companies are hypothetical people, so when you are dealing with a company, you do so as if you are dealing with a person. But the law is now saying, let’s find out who is the real person behind this company,” says Jolly Mutesi, the Supervisor International Tax and Transfer Pricing in the Department of Domestic Tax at the Uganda Revenue Authority (URA). She says it is beneficial to know who owns the company and earns money its activities generate.

“Let’s say if you have MTN Uganda, and I am using it for hypothetical purposes, it is owned by another MTN which is also owned by another MTN so that when you look at the company’s memorandum, all you are going to see is one company after another and if someone asked you who owns MTN Uganda, you actually don’t know. What beneficial ownership wants us to do now is find the real individual that owns MTN.”

That is why the Uganda Registration Services Bureau (URSB) on Jan. 11 issued a public notice to all companies and partnerships to submit details of their beneficial owners “no later than 30 days from the date of the notice.”

Twelve months later, as the year closes, Steven Baryevuga, the senior publicist at URSB told The Independent on Dec.03 that “companies are responding as required.”

“The numbers are good,” he told The Independent without providing details of what percentage of the known 334,799 companies operating in Uganda (as of June 30, 2021), have so far complied with the directive.“This information is not readily available to the public,” he says.

Baryevuga’s positive note and caution belie widespread doubt about whether URSB can compel owners of companies who include powerful political figures to give details of the companies they own.

Fred Muhumumuza (PhD), a Senior Lecturer of Economics at Makerere University in Kampala, says for various reasons many Ugandans, especially in the political establishment, want to hide their wealth.

“Some people want to hide their wealth from their spouses, some people want to hide their wealth from tax authorities, others want to do so for many other reasons and they have created pseudo companies,” he told The Independent on Nov.30, “So, you want to first understand why we are where we are and then gauge whether the government agencies can do it.”

Muhumuza says it is important to appreciate what exact problem the Beneficial Ownership (BO) register is attempting to solve.

“Is it that we have never bothered to know who owns what or is it because the nightmare of trying to know who owns what can be too dangerous in itself? Who are the powers behind the status quo and are those powers ready to let the status quo go?”

“These are the issues that we have to interrogate before we get excited about the beneficial ownership register,” he says.

Experts who The Independent has talked to for this story say having a BO register has become important for the government to tackle challenges associated with allowing use of shell, anonymous and front companies to undertake business transactions.

“The creation of shell companies with fictitious shareholders and directors that are then used to launder money, evade taxes and engage in organised crime and corruption are common practice in Uganda and these weaken a country’s credit rating and its ability to attract investment capital,” says Bwesigye Don Binyina, the executive director of the Africa Centre for Energy and Mineral Policy (ACEMP).

He told The Independent on Nov.30 that updating the BO register is timely for resource mobilisation and the government’s fight against illicit financial flows.

“Anonymous shell companies are the core vehicles for illicit financial flows and money laundering. This necessitates a clean-up of a country’s company and business registry to detect and weed out such shell companies.”

Indeed, Uganda has since February, 2020, been battling to get off the so-called “grey list” of the Financial Action Task Force (FATF), a global anti-money laundering and terrorism financing watchdog.

Countries placed on the “grey list” by FATF usually have challenges of detecting and curtailing money laundering and terrorism financing and FATF says this often poses a threat to the entire global financial system.

Citizens and business entities of a grey-listed country often find difficulty in carrying out financial transactions in and out of the country since the parties fear that they could be exposed to money laundering or similar financial crimes.

The implication for a country that is grey-listed is its reputation damage as its internal systems for combating financial crimes such as corruption and money laundering and terrorism financing are deemed to be below international standards.

FATF Pressure

Among its 24 recommendations the FATF gave the Uganda government if it wishes to get off the grey list was to take measures aimed at preventing the misuse of legal persons for money laundering and terrorism financing.

Under Uganda’s Anti-Money Laundering Act, 2013 and 2017 as amended, and regulation 11 of the Anti-Money Laundering regulations, 2015; the Registrar of Companies is one of the accountable persons and is charged with the responsibility of identifying, obtaining and keeping a record of beneficial owners of the different legal persons. This is the main reason why the URSB is working to have the companies provide their beneficial owners’ details.

Other experts told The Independent that the push for a BO register is part of worldwide “wave of transparency.” “I think it is quite strong and people and governments need to prepare for this,” one expert said adding that, “the message is that the era of tax dodging has come to an end.”

Anneke Wolmarans, a specialist commercial advisor currently working with Open Ownership in southern Africa, told The Independent, the BO register will “level the playing field in business.”

“Citizens deserve to have the money made in their country remain in their country,” she said, “When the city prospers, the citizens should also prosper.”

“Beneficial ownership transparency will bring to light any drainage of resources which is building riches elsewhere,” she said, “If you make money from our people and participate in our economy, we deserve to know who you are and if you build our country,” she said.

Defining a beneficial owner

The push for a BO register in Uganda followed the enactment of the Companies (Amendment) Act 2022 and the Partnership (Amendment) Act 2022, which require every company and limited liability partnership registered in Uganda to keep a register of its beneficial owners.

The Ugandan laws define a beneficial owner as “a natural person who has final ownership or control of a company/partnership or a natural person on whose behalf a transaction is conducted in a company/partnership and includes a natural person who exercises ultimate control over a company/partnership.”

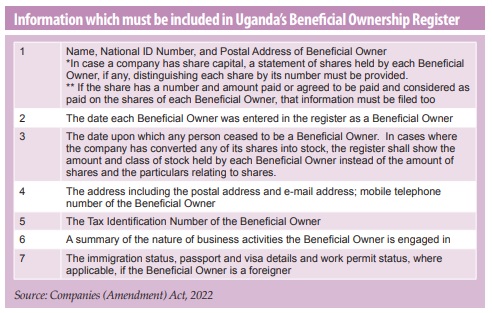

According to the Companies (Beneficial Owner) Regulations, 2023, and the Partnership (Beneficial Owner) Regulations, 2023, the beneficial owner register must disclose the personal information of the beneficial owners of a company or partnership, the nature of the ownership or control they have in the company or partnership, and the date they ceased to be beneficial owners.

The use of offshore companies to hide the identity of owners intensified after the so-called ‘Panama Papers’ leaks were published in 2016 revealing how such high profile individuals and companies, including from Uganda, hid their ill-gotten wealth.

“The prime objective of having a (beneficial ownership register) is to combat financial crimes which is eroding the global economy,” Anneke Wolmarans, a specialist commercial advisor currently working with Open Ownership in southern Africa, told The Independent.

Phoebe Atukunda, a research fellow at the Advocates Coalition for Development and Environment (ACODE), a Kampala-based public policy thinktank, recently told The Independent that the beneficial ownership register is a global corporate transparency standard.

She says this is one of the mechanisms that countries around the world have put in place to fight illicit financial flows and raise the domestic revenue for better public services. “It is in every Ugandan’s interest to fight illicit financial flows,” she told The Independent.

Identifying the individuals that ultimately own or control a company allows business entities, such as financial institutions, to have a clearer understanding of the risks associated with a potential customer or third party. It also enables authorities to investigate and/or prosecute individuals or entities engaged in financial crimes such as corruption, money laundering, tax evasion, and terrorist financing.

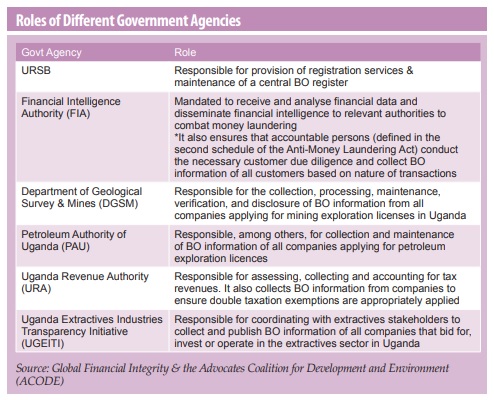

Atukunda says the BO register supports other areas where Uganda has done well to fight illicit financial flows through agencies such as URSB, the Uganda Revenue Authority (URA), the Financial Intelligence Authority (FIA), the Public Procurement and Disposal of Public Assets Authority (PPDA), the Uganda Extractive Industries Transparency Initiative (UGEITI) and the Inspectorate of Government (IG).

“I am optimistic that if these laws are implemented to the dot, then it is one of the ways of fighting illicit financial flows,” she says.

According to Open Ownership, a global corporate transparency non-profit, information on the true owners of companies is an essential part of a well-functioning economy and society. For instance, public registers of beneficial owners give access to high-quality data about who owns, controls, and benefits from companies and their profits. “This information, known as beneficial ownership transparency, helps tackle corruption, reduce investment risk, and improve national and global governance.”

Transparency in Uganda’s extractives sector

Although, the URSB is the leading agency in implementing the process, it is working with other government agencies that are mandated with combating illicit financial flows. The Uganda EITI Secretariat (UGEITI) is one such agency. It is working with URSB to ensure that the beneficial ownership information of the companies that operate in Uganda’s extractive industry, particularly in mining exploration and production, is publicly accessible.

In August, 2020, Uganda became a member of the international extractives standard–EITI. However, its legal framework in regard to beneficial ownership transparency was found lacking. The country’s Mining and Mineral Act, 2022, was then quickly enacted to cater for among other provisions, beneficial ownership transparency.

The extractive industries sector which covers mining, oil and gas, fisheries and forestry is a multi-billion dollar industry and it is one of the economic sectors susceptible to illicit financial flows, organised crime, money laundering, mineral smuggling, illicit trade in minerals and corruption.

Local experts in the sector say identifying beneficial owners, monitoring their operations and exposing them will be critical in the fight against illicit financial flows in Uganda. Edwin Kanakulya Kavuma, the compliance officer at the Uganda EITI Secretariat told The Independent recently that with the good governance of the extractive sector through transparency and accountability, the beneficial ownership register will ensure that government collects more revenue from the sector.

“Within the extractives sector and more specifically the mining sector, beneficial ownership data will ensure that the government is able to know all the people behind the companies that apply and are awarded licenses in the mining sector,” Kanakulya told The Independent.

Kanakulya adds that the public and state authorities will also be able to access beneficial ownership data from one single location. He says the Mining and Minerals Act, 2022 requires companies to provide BO information. This major reform supports the cleanup of the Cadaster thus enhancing overall transparency in beneficial ownership data administration in line with the EITI Standard.

He says this will contribute to ensuring that only the right and eligible companies are awarded licences and not speculators hiding behind shell companies to secure licenses. “This will only be possible when the Mining Cadaster is updated and it will enhance overall transparency in beneficial ownership data administration in line with the EITI Standard,” he says.

Managing expectations

Bwesigye Don Binyina, the executive director of ACEMP agrees. He told The Independent the BO register sets a trap for non-compliant money launderers and raises the cost of organised crime more so in the extractives sector.

“It raises the cost of corruption and tax evasion by those implicated leading to prosecution, penalties, fines, and ultimately increases a country’s tax base as a form of resource mobilisation from the extractive sector,” he says.

But, what will it take government agencies to implement their respective mandates to fight illicit financial flows but also raise domestic revenues?

For starters, Uganda has a sizable percentage of senior government officials involved in business. Can the beneficial ownership register help combat illicit financial flows or even boost domestic revenue mobilization when the country’s ruling class are at the centre of the economic system?

Wolmarans from Open Ownership says beneficial ownership transparency, if implemented correctly, could serve as a great tool in exposing high profile politicians as well as bringing to justice those who cause proliferation of state funds.

“The aim is to ensure adequate, up-to-date and reliable data is collected in order to aid competent authorities in evidence collection. Once the global system becomes more robust and interconnected, it could serve a greater purpose in exposing those who are committing financial crimes and eroding the global economy. As a consequence of heightened oversight and regulation of transparency, it could potentially deter chances taken by the politically exposed persons participating in illicit financial flows.”

However, Jolly Mutesi, the Supervisor International Tax and Transfer Pricing in the Department of Domestic Tax at URA says the challenge lies in the accuracy of the information being entered into the beneficial ownership register.

“We (URA) are not the ones updating it,” she told The Independent at a recent public forum convened in Kampala by the Southern and Eastern Africa Trade Information and Negotiations Institute (SEATINI).

“But we shall be accessing it for purposes of sharing information with jurisdictions where we have the obligation to share such information,” she told The Independent, “We need to know who the beneficial owners of the companies in Uganda are because we are also asking other jurisdictions to share information of the beneficial owners of the companies that are not registered in Uganda.”

“Given the challenge that we have around systemic corruption and people hiding money offshore, the Beneficial Ownership register will make this challenge a thing of the past because with all the information available now, we know who owns what and countries have put in place frameworks to exchange this information automatically,” another senior official who also works with URA told The Independent.

“For instance, if you have US$ 1 million in a Swiss account and it is earning interest; with the frameworks in place, the Swiss government can share that information with the Ugandan government and we tax the interest.”

Jury still out on BO register

For Binyina, the beneficial ownership register might be a step in the right direction, but certainly it is and will not be a silver bullet in the fight against illicit financial flows in Uganda’s extractive industries sector.

He says the challenge about fighting corruption with a top-bottom approach model as advanced by the Beneficial Ownership Register tool is in finding willing allies against this struggle in Government agencies and institutions.

“Most wars and initiatives against corruption in Uganda have been lost at government level because corruption is a livelihood that sustains the expensive lifestyle of the majority of Uganda’s civil servants,” Binyina of ACEMP told The Independent.

“But, for now, we can have faith that the beneficial ownership register as a tool will keep away dirty laundered monies from distorting our economy through this multi-national and dimensional due diligence tool most especially for stock exchange listed extractive companies seeking to invest in Uganda’s rich natural resource sector.”

“But, for now, we can have faith that the beneficial ownership register as a tool will keep away dirty laundered monies from distorting our economy through this multi-national and dimensional due diligence tool most especially for stock exchange listed extractive companies seeking to invest in Uganda’s rich natural resource sector.”

Samuel Okulony, the Chief Executive Officer of the Environment Governance Institute also told The Independent that fighting illicit financial flows calls for effective collaboration between various government agencies, such as the Uganda Revenue Authority, the Financial Intelligence Authority, and law enforcement agencies such as the Police and the Office of the Director of Public Prosecutions (ODPP), where they will have to secure the sharing of information and coordinate efforts in combating illicit financial flows.

“There is need for international cooperation among organizations, such as financial institutions, to share information and raise red flags of transactions that seem suspicious to be coming into their countries, and this will have to ensure that the BO register is already aligned with international standards to facilitate cross-border cooperation.”

For Regina Navuga, the Coordinator of the Financing for Development Programme at SEATINI- Uganda, although civil society commend the government for the steps taken so far on beneficial ownership in Uganda, there is still need to ensure that it is implemented well.

“At the moment, we have not included a minimum threshold-even in the regulations-which will make it hard to effectively achieve the intended objective. Will the government ascertain the accuracy of data in time on all submissions? A 5% minimum threshold would be a good starting point,”she says.

She told The Independent that commitment will be key-to implementing the beneficial ownership register very well. “This will require; targeting all individuals particularly those who are not paying their fair share of taxes, enhancing capacity of government officials to analyse the information provided by companies and use the findings to inform decisions, inter agency collaboration, and raising awareness among citizens on the importance of BO and the role they can play.”

But Dr. Muhumuza remains doubtful.

“There was a time when the Uganda Revenue Authority (URA) wanted to get into our bank accounts to try to find out what we are doing with those bank accounts. You saw what happened,” he says, “Then the Inspector General of Government came in and said she wanted to do lifestyle audits and the President was quick to say, ‘please don’t go there.’”

“With those two clear examples, will the beneficial ownership register pick-up? What are you trying to solve and will you get the space to sort those challenges? With those realities, I don’t think that the beneficial ownership register will be allowed to go to certain levels where it will actually get the intention of the people who are driving it.”

“They will get to the third door and realize they can’t go beyond that door and yet there are still ten more doors to open. If they don’t understand the political economy and the context within which we operate as a country, we wish them luck.”

“This is something that will either not see the light of day or if it dares, it will not be implemented. But it is something that is ideologically and theoretically the right thing to do. The international system might be well-intentioned in fighting illicit financial flows and terrorism financing but locally, the context is different.”

Muhumuza told The Independent that sorting out that will require cultivating a coalition of the willing. “As we try to implement the global expectations, let’s also appreciate the local context and take the right decisions,” he says.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

FinCEN Guidance helps small and international businesses comply with their new Beneficial Owner reporting obligations – starting January 1, 2024

https://fincenguidance.com/