Up to 80 per cent of fertiliser consumed across sub-Saharan Africa is imported, with West Africa accounting for 40% while East and Southern Africa consume remaining 60%

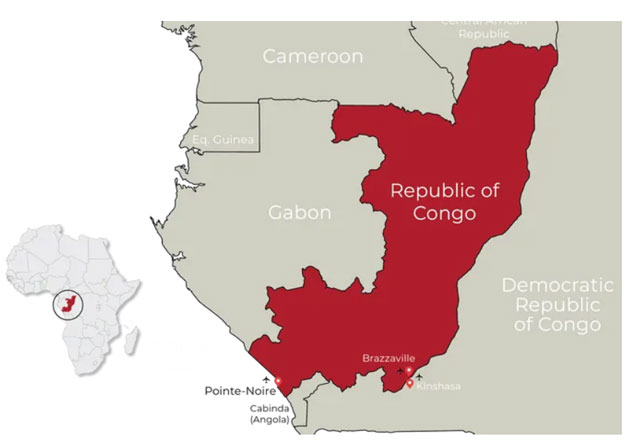

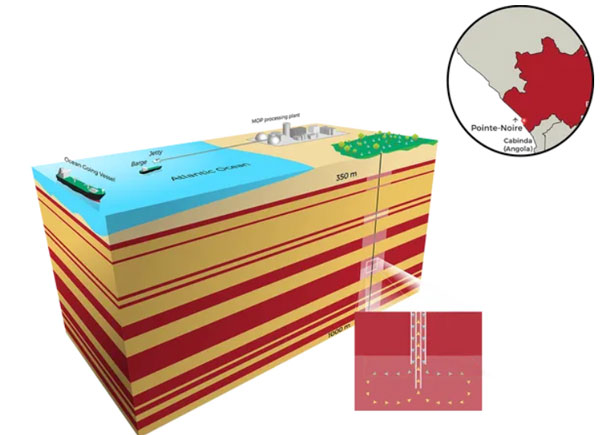

Pointe Noire, Congo | BIRD AGENCY | Located in Kouilou Province, 32km north of the central economic hub of Pointe Noire in the Republic of Congo, the Kanga Potash project seeks to manufacture 2.4 million tonnes of Muriate of Potash (MOP) per annum with an estimated mine life of 30 years.

Barbados-based private equity Investment Company, Sarmin Mineral Exploration and the African Mineral Exploration and Development were in June 2022 licensed to mine and produce potash under the Kanga Potash project.

With pre-construction developments ongoing, the project will be advanced in three phases. In the first phase, 400,000 tonnes per annum of MOP will be generated. This will be extended to 800,000tpa in the second phase, further ramping up to 2.4Mtpa in the final phase.

In a recent exclusive interview with Mining Weekly, Stephane Rigny, the executive chairperson of the Kanga Potash project, noted that the deposits in Congo are “the thickest carnallite seams ever drilled anywhere in the world. The seams of recoverable carnallite are in the order of 210 metres thick.”

Carnallite consists of hydrous potassium-magnesium chloride, an essential source of potassium for crops. It contains 60% potash which produces sugars and proteins, making it a vital enrichment for crops.

Africa Fertilizer Organization, AfricaFertilizer.Org, estimates that “80 per cent of the total fertiliser consumed across sub-Saharan Africa is imported,” with West Africa accounting for 40% of all fertiliser consumed in sub-Saharan Africa while East and Southern Africa consume the remaining 60%.

From the second quarter of 2021, the continent has been immensely affected by a shortage of fertiliser supply due to the Russia-Ukraine war

From the second quarter of 2021, the continent has been immensely affected by a shortage of fertiliser supply due to the Russia-Ukraine war. Over time, the scarcity has been waded further down by soaring fertiliser prices threatening food security in the continent.

The International Fertilizer Development Center, IFDC, estimates that 30% of fertiliser demand will have been reduced by the end of the year, translating to an approximate shortfall of 2 million metric tonnes (mt) of fertiliser.

The reduction in fertiliser demand due to high costs and reduced supply from external markets directly translates to 30 million metric tonnes less food produced in the continent, which can feed 100 million people, according to data from the IFDC.

Therefore, Kanga Potash will offer a lucrative opportunity for continental fertiliser manufacturing by availing the primary raw material needed to prepare potash fertiliser.

In Africa, fertiliser production is progressive, with much of the production activity concentrated in the northern parts of the continent.

Morocco, the world’s fourth largest exporter of fertiliser, has been at the centre of fertiliser production, boasting phosphorus reserves of close to 50 million tonnes. Neighbouring Algeria is also a critical player in fertiliser production in the continent, exporting about 7 million tons of fertilisers annually.

In August, Egypt, another heavy producer of fertiliser in the continent, announced it had exported $ 2 billion in the first eight months of 2022, translating to a 53% increase compared to fertiliser export returns in 2021. With the ongoing global climate conference, COP 27, Egypt is already looking to scale up its fertiliser production base by lobbying for investments in the sector.

Nigeria, South Africa and Tunisia have also made critical developments in boosting the production of fertilisers, especially for their local and regional markets.

According to Roger Nishimwe, a Rwanda-based market analyst at OCP Africa, huge capital investment in fertiliser production has been the obstacle blocking African countries from leveraging their vast reserves.

“But with the supply from Europe closed, more projects will come up because the demand has to be gratified,” he explained.

Nishimwe believes that if Africa can leverage its vast renewable energy potential, it will significantly cut investment costs in fertiliser production since a significant portion of the investment costs can be attributed to power and infrastructural expenses.

“Many countries do not think that production is more cost-effective than importing but as an analyst, I can tell you the two are incomparable and internal production is way more economical,” he said.

*****

SOURCE: bird story agency.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price