Kampala, Uganda | JULIUS BUSINGE | The Insurance Regulatory Authority of Uganda Chief Executive Officer Kaddunabbi Ibrahim Lubega anticipates a good year for the insurance sector supported by improved economic performance in all sectors.

Speaking at the CEO breakfast meeting held in Kampala at the end of last year, Kaddunabbi said, his focus areas for 2023 will be on implementing current sector regulations and finalizing the ones (regulations) pending. He also plans to finalise, the Motor Vehicle Insurance Bill, implementation of International Financial Reporting Standard 17, automating the authority’s supervisory operations through acquisition and deployment of the supervisory and reporting software, implementation of the compulsory marine cargo insurance and continuation with the implementation of Risk Based supervision and Monitoring Capital Adequacy Ratio (CAR) of insurance companies. He also said, sector awareness activities will continue so as to drive the uptake of the sector upwards.

Insurance penetration in Uganda has remained at below 1% for years partly because of the perception within the public domain that insurance players do not easily pay or compensate policy holders when losses occur. In addition, the pressing daily spending on key necessities for households have forced them not to buy insurance given that their disposable income rarely adjusts with the economic times. Other sector pundits have attributed the low penetration levels to the limited awareness campaigns which has kept a significant number of the population ignorant about sector opportunities. IRA’s focus areas for this year are expected to boost the sector penetration levels.

According to the IRA website, Uganda has 31 insurance companies, two re-insurers, 28 loss assessors, three HMOs, 20 bancassurance agents, three re-insurance brokers and 48 insurance brokers.

Current statistics from IRA indicates that the industry remained on a positive growth trajectory in the third quarter of 2022, with the total gross written premium growing from Shs912billion in quarter three of 2021 to Shs1.08 trillion in quarter three of 2022, posting 18.57% growth over the same reporting period.

Meanwhile, gross claims paid amounted to Shs476.52billion during the period, accounting for 44.1% of the industry’s total premium compared to Shs363.15billion which was paid in quarter three of 2021.

“Our core mandate remains policy holder protection and ensuring that legitimate claims are paid in time,” Kaddunabbi said.

Non-life accounted for 58.5% of the aggregate industry written premiums while life business accounted for 32.5% of the aggregate industry written premiums in the report period.

The rest of the classes combined (HMOs, Dedicated Health Insurer and Micro insurers) accounted for 9% of the aggregate premiums underwritten.

Brokers and bancassurance performance

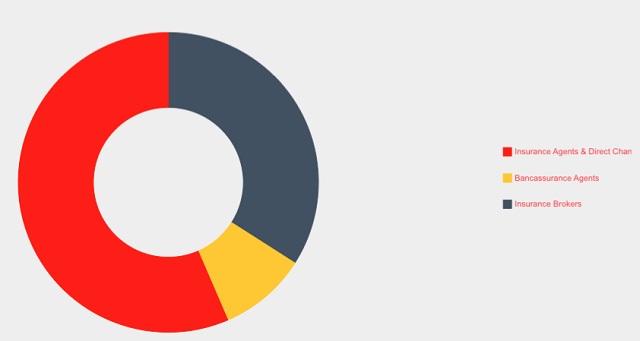

As at the end of September 2022, Kaddunabbi said, gross written premiums collected through the brokerage distribution channel was Shs367.6billion accounting for 27.5% of the total insurance premium during the third quarter of 2022.

Brokers are critical players in the market as they play a pivotal role in providing expert advice to clients on risk management, according to industry experts.

On the other hand, during quarter three of 2022, gross written premium collected through the bancassurance distribution channel was Shs102.44billion compared to Shs74.73billion in September, 2021 representing a 37.0% growth.

There is a marked increase in adoption of the bancassurance channel as a one-stop centre for financial services – which is expected to continue growing in the foreseeable future, according to sector analysts.

Kaddunabbi said, 2022 was characterized by challenging macroeconomic fundamentals, characterised by double digit inflation which continued to affect people’s purchasing power and inevitably impact on the demand for insurance.

The other challenges included, high taxes especially on small-value policies (Stamp duty and VAT) imposed on insurance premiums which increases the cost of insurance policies, high cost of credit hence slowing down private sector investment, reduced financial inflows to the non-governmental organisations hence affecting demand for, among other things, insurance and slow legislative processes.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price