Over the past two decades, Uganda’s economy has developed in important ways – dependence on agricultural exports has eased, the services sector has grown, and regional trade and integration has strengthened. But there are still major weak spots, including a weak manufacturing sector and constraints on small and medium sized enterprises.

Breaking away from agriculture

Some progress has been made in diversifying Uganda’s agricultural exports and, although still dominated by food exports, the share of non-food merchandise exports has been increasing in recent years (see Figure 1 ). Exports of agricultural raw materials and ores and metals exports have declined, indicating that greater domestic value addition is taking place.

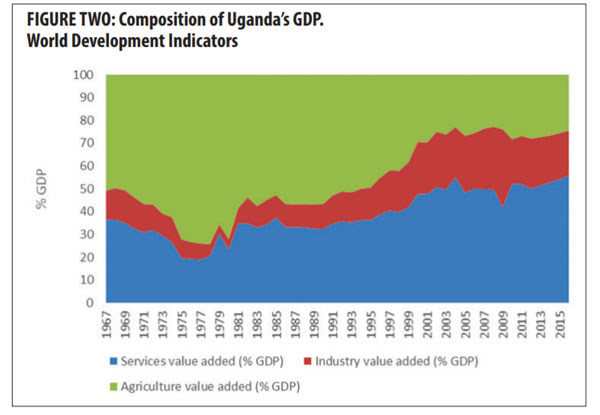

The composition of Uganda’s economy has changed quite significantly over the past few decades (see Figure 2 ). Agriculture’s contribution to GDP has shrunk, although it continues to employ some 70% of Uganda’s labour, and the share from services has increased from 19% in 1977 up to over 55% today. Industry’s share has also grown since the sector’s collapse in the early 1970s, but its growth has been more muted.

Within industry, manufacturing’s contribution to GDP has remained stagnant at around 8% for the last 15 years. Uganda’s manufacturing sector is small and dominated by micro, small and medium enterprises, which make up some 93.5% of the sector, with agro-processing being a particularly important activity in the sector. These small firms are limited by a number of constraints including lack of access to high quality inputs, reliable and cost effective electricity, and affordable credit. As a result, they struggle to achieve the economies of scale needed to grow and increase their productivity.

Remaining challenges

Under the NRM, Uganda has experienced positive, albeit fluctuating, economic growth (see Figures). Growth of the services and industry sectors shows important progress towards structural transformation, shifting labour out of less productive agriculture and into more productive sectors.

Population growth, however, has remained high, averaging 3.4% since 2010. This has lowered net growth rates (economic growth less population growth) and eroded potential improvements in living standards.

Indeed, Uganda’s population growth has meant that GDP per capita growth has been on the decline in recent years. In contrast, Kenya and Tanzania have had lower population growth averages since 2010. In Kenya it’s been 2.7% and in Tanzania 3.1%. Both countries remain on positive and higher GDP per capita growth trajectories.

Looking forward

The East African Community was revived in 2000 and regional integration has made significant strides since then. A customs union and common market have been introduced. Among other benefits, regional trade has been shown to promote regional peace and bring economic development to border areas. Further integration, such as greater transport connectivity, could offer important advantages.

Continued growth of the services sector should be promoted. Attention should also be given to supporting manufacturing sector growth as it has the potential to create many low-skilled jobs. Easing the constraints faced by small and medium sized enterprises would facilitate firm growth, increase productivity, and raise manufacturing’s contribution to GDP and exports.

To increase Ugandan firms’ competitiveness it’s critical that production capacity is raised through training programmes and by matchmaking domestic suppliers with foreign firms. And firms need unrestricted access to high quality inputs if they’re going to be able to move into the export market.

The Ugandan government has an important role to play in supporting these efforts and, with government commitment, considerable economic gains could be achieved.

Sarah Logan is an economist, International Growth Centre

Source: The conversation

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

I like the article but I think it falls short of the specifics which is what is required now since we all know that we need to make great strides in industrializing if we are to achieve significant growth. Given the set up of global manufacturing it’s going to be difficult to do so since it means competing against manufacturers who have better technology skilled man power and infrastructure. So even though we are improving our infrastructure it will take a deliberate effort to court large international manufacturers to come and set up some of their manufacturing processes in Uganda under the arrangements of global value chains for us to get a piece of the cake. So to summarize as government puts in place infrastructure it will also need to engage with large global manufacturers to set up some part of their manufacturing in Uganda which might require incentives. If well targeted such that there are forward and backward linkages then issues of training and financing sme’s involved in the linkages would also be resolved by such manufacturers.