The dairy sector in transformation in Southwest Uganda

NEWS ANALYSIS | RINUS VAN KLINKEN | Coffee has for a long time dominated the political, economic and social landscape in Uganda. Government policies, programming and budgeting is geared to supporting the coffee sector to propel the economy. However, a quiet revolution has been taking place in the dairy sector in Southwest Uganda offering lessons on sector transformation, and posing a challenge to the dominance of coffee in government strategy.

Dairy exports have climbed from zero less than 10 years ago to the third highest agricultural export earner after coffee and fish. Farmers are making investments at an unprecedented level, with many recording doubling of milk production within the last two years alone. Some of the top farmers in the country have a production system that rivals (and surpasses) top dairy farms in Kenya, for long being seen as the trendsetter for Uganda.

But the sector is not (yet) at its peak, as many farmers are only slowly catching up with these changes. To realise the full potential of the dairy sector, and to get a critical mass of farmers to benefit from these changes, more needs to happen.

The sector is peppered with individual and incidental success stories (from export to farmers), but to sustain and accelerate this change, the sector transformation requires to be supported, particularly from the financial sector and government. If that happens, the potential for further growth is truly revolutionary within the African context.

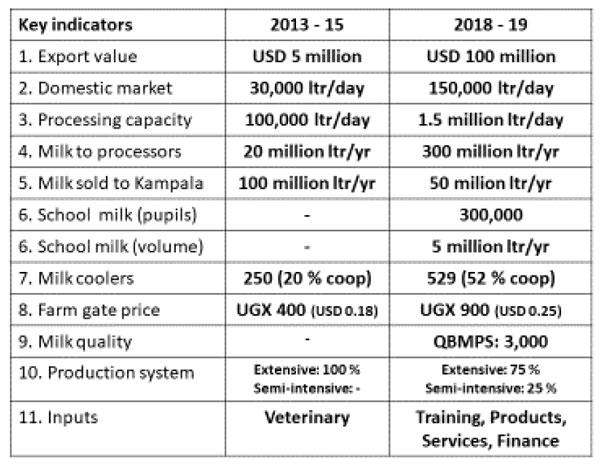

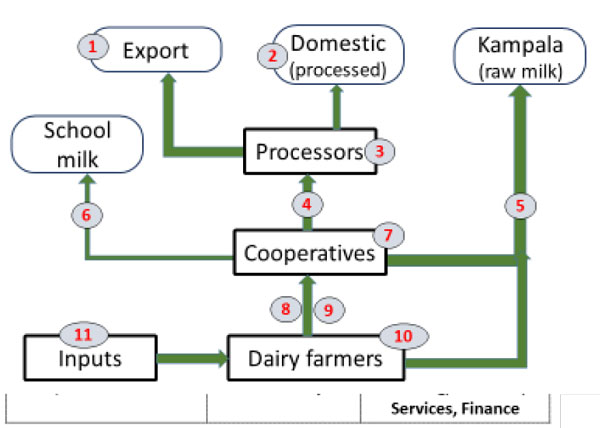

The sector transformation that has emerged over the last few years in Southwest Uganda is affecting all parts of the sector, as is evident when comparing some of the key indicators of the value chain over the past five years.

To the surprise of industry watchers, Uganda has emerged as a dairy exporter. Ever since independence, Uganda has been a net importer of dairy produce. Some 5 years ago, limited export started, and last year the country exported dairy products valued at USD 150 million, of which an estimated USD 100 million came from Southwest Uganda alone.

That is an incredible increase in just a short time (5 years!), and with the export curve still pointing upwards. The dominant export market is still Kenya, but other African countries and also Asia are now using Ugandan dairy produce.

Exports are made possible because of three factors.

Firstly, the domestic market is small. Milk consumption per head of the population is low in Uganda, even compared to other African countries (it is half of the Kenyan consumption). However, the domestic market for processed milk is also growing fast.

One indicator for that is the Kampala market for pasteurised fresh milk, dominated by JESA but with also other small processors moving in. In the last 5 years that market has consistently grown with an incredible 40 % per year, to now 150,000 litres daily, mostly in supermarkets but also increasingly through other outlets.

The second factor contributing to the growth of export is the investment by processing companies. By 2013, most of the milk marketed in southwest Uganda was transported to Kampala, either for sale on the raw milk market or for delivery to the processor (now Brookside), who had taken over the privatised processing factory and with 90 % market share still had a virtual monopoly. Some small and micro-processors that were actually based in the southwest had together not more than 100,000 litre/day capacity.

This has now increased within a short five years to 1.5 million litres per day, which in 2020 will reach 2 million litres per day, of which the leading exporter, Pearl Dairy, owns half.

The final key factor in the growth of exports from southwest Uganda is the role of the dairy cooperative societies. Supported with a grant from the Netherlands government, cooperative societies have acquired milk coolers and strengthened their role in the market.

This intervention not only facilitated access to markets for dairy farmers (by bringing the cold chain closer to production), but also altered the market power for traders.

Their dominance of the market is reduced, and by now more than half of the dairy market is in the hands of dairy cooperatives. While currently not a major factor yet, cooperatives have also opened a new market outlet by supplying local schools with milk. Initiated by the SNV project TIDE (funded by The Netherlands), parents are contributing to the school, for their children to be provided with porridge during break time. In 2019, some 300,000 children in 1,000 schools (half of the total enrolment in Southwest Uganda) are benefitting from this initiative. This constitutes a market of 5 million litre of milk per year (mostly bought from cooperatives), but is also an investment in the future market.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Teso region, eastern Acholi, and Karamoja could also greatly benefit from the attention of SNV/TIDE dairy project for before 1986 these areas especially Teso had great herds of cattle that unfortunately were lost in regrettable ways but the people of Teso, Eastern Acholi are still cattle people at heart even with their greatly reduced herds and are also impoverished and are kindly requesting the assistance of the Dutch government to help in anyway they see fit as they are doing in South West Uganda