With climate models predicting a dramatic drop in the availability of coffee as temperatures rise, farmers are preparing themselves for an uncertain future

| JACK DUTTON | On Mount Elgon, an extinct volcano on the Ugandan-Kenyan border, Kenneth Barigye grows Arabica beans on his coffee farms. He also grows them on his estates in the Rwenzori Mountains and in Kisoro in Uganda, a country that registered its highest coffee exports in three decades last year. Business is steady right now, but like many coffee producers in Africa, Barigye believes his days of producing the world’s most popular bean are numbered.

“We are experiencing yield shocks resulting from adverse weather and the burdens of pests and disease which have a substantial impact on the incomes of smallholder farmers,” Barigye, managing director of Mountain Harvest, says. “Further compounding these challenges is the lack of access to finance to purchase critical inputs (improved and drought-resistant varieties, irrigation systems, fertiliser, and tools) leading to poor soil nutrition and low quality and productivity of coffee.”

Arabica is sold in most coffee shops, including large global chains like Starbucks, Costa, and Seattle Coffee Company. The bean needs high altitudes and cold temperatures to grow, unlike its less popular cousin Robusta, a hardier plant with higher caffeine levels. Robusta, which tastes bitterer than Arabica, can grow in lower elevations in much higher temperatures.

In recent years, global coffee consumption has been soaring, as incomes rise around the world. Yet despite the high demand, climate models predict there will be a dramatic drop in the availability of the crop as temperatures rise in the years to come. Africa, the continent where coffee was born, will be no exception, placing its $2.5bn market under threat.

Africa has the most coffee-producing countries of any continent. Ethiopia is Africa’s leading exporter, bagging around $1.2bn worth of coffee exports per year, while Uganda is the second largest with around $594.2m, according to data from Statista. With Cop27, the UN climate change conference, being held in Egypt in November, African leaders will need to work to secure financial and political commitments if they wish to safeguard the continent’s coffee trade.

Not smelling the coffee

One study from January forecasts that climate change will dramatically decrease the suitability of coffee in most regions by 2050, including in Africa. Compared with cashew and avocado, coffee was found to be the most vulnerable crop to climate change. West African coffee is expected to be particularly hard-hit.

Another study from 2019 found that 60% of wild coffee species are at risk of extinction due to global warming and deforestation, as well as diseases and pests.

“Coffee is very sensitive to even small increases in temperatures and the impact can vary depending on the stage the crop is in,” says Michael Hoffman, executive director emeritus at the Cornell Institute for Climate Smart Solutions. “A little warming at the wrong time can affect yield, aroma, and flavour.”

Temperature and precipitation impact yield, as well as soil acidity. In some regions, steep slopes and unfavourable soil texture can be limiting factors. On top of this, pests and diseases – such as stem rust – can thrive in warmer temperatures too.

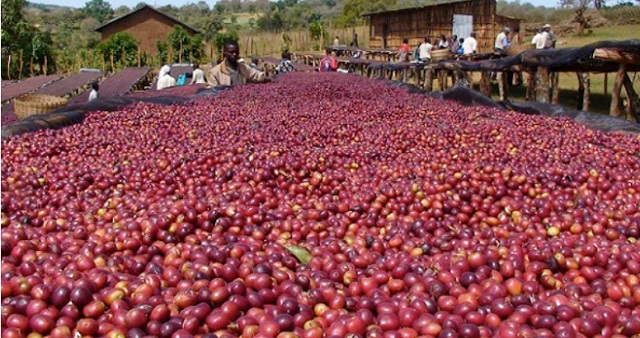

Flooding and droughts – events predicted to become more frequent under climate models – can also stunt growth. Too much rain can cause mould and interfere with harvesting and too little means that the drupes – the coffee fruit – do not grow as much.

Fears for the future

Coffee growing was introduced to Asia and the Americas by European colonialism.

“The lion’s share of coffee traded today is produced in these regions. However, the wealth of genetic diversity is still concentrated in coffee’s ancestral home in modern-day Ethiopia and South Sudan,” Cooperative Coffees’ impact manager Melissa Wilson Becerril tells African Business. Preserving the crop’s genetic diversity will be key to maintaining a vibrant coffee market.

Hoffman believes that increasing global temperatures will spell trouble for African coffee farmers. “The challenges faced by coffee farmers in Africa will only get worse as climate change impacts intensify,” he says. “Some scientists predict that the suitable area for growing coffee in Africa could be reduced by 50% by mid-century.”

Indeed, many scientists are factoring a 4°C rise in temperatures above pre-industrial levels into their climate models, 2.5°C above the 2015 Paris agreement target. Under a +4°C scenario, Bariyige says, it will be too hot for many Arabica-growing areas.

Coffee quantity and quality will be affected. The widely-accepted definition of speciality coffee is a brew scoring 80 points or above on the Q scale. Coffee scoring between 80–84.99 is graded “very good”, while coffee between 85 and 89.99 is graded as “excellent”. Batches scoring from 90 to 100 are graded “outstanding”.

“Beyond growing, the current climate change trajectory has an additional effect to our business,” Bariyige says. “As a speciality coffee exporter, I need the right conditions to produce coffee cupping above 84 points. These conditions include slow growth of the cherry to maximise absorption of sugars and slow drying. As we get more hot weather, we will see fast growth which will affect both the absorption of sugars and the size of the cherry. Hot weather will also mean faster drying which has negative effect on the quality of the cup.”

Daniel Habamungu Chinyabuguma, managing director of Muungano Agricultural Cooperative in the Democratic Republic of Congo, says his coffee farmers are seeing more erratic weather patterns, reaping havoc on his business.

“When it rains a lot there are erosions which in turn will carry away the various fields and the hail will also damage the drupes and we lose the yield,” Chinyabuguma says. “When there’s overwhelming sun, it will create major evapotranspiration and the nutrient reserves will be empty and the coffee trees will flower but they will be unable to feed even the drupes so yields are automatically impacted.”

As Arabica grows on mountainsides, heavy rain combined with deforestation and soil erosion makes coffee farms vulnerable to landslides.

Coffee migration

Although most coffee farmers will find global warming challenging, climate change will open up opportunities for other African countries to produce more coffee than before. The January study predicts some areas in East Africa, as well as parts of Southern Africa, benefiting due to increasing minimum temperatures of the coldest month.

Denis Murphy, emeritus professor of biotechnology, University of South Wales says that “a 500km wide band from South Sudan to Cote d’Ivoire” might benefit, “but this is uncertain and we need to study real data from rainfall patterns to hone the predictions”.

“Geopolitically, a lot of this region is pretty challenging in terms of setting up secure cropping systems and supply chains to the coast. Also, it is possible that a few of the current big players like Ethiopia and Uganda will be resilient enough to pull through.”

Mitigating climate change impacts

Many coffee growers will lose out unless they take action to mitigate the effects of climate change.

“I see the solution in promoting agroforestry and increasing the number of coffee trees in an acre,” says Barigye. “Such a farming system is capable of restoring the forest cover while increasing Arabica productivity by at least 69% (from 650 to 1100 trees per acre). The increased productivity will increase the farmer’s capacity to invest in irrigation systems.

“The second solution is to prepare for the worst-case scenario where farmers cannot grow coffee. Such a scenario requires diversification of sources of income to include income generating species that are heat tolerant such as avocado which luckily enough can be intercropped with coffee as part of the agroforestry solution.”

Hoffman agrees that farmers could use shade crops – like avocado, bananas, guava or mango – to help keep the coffee plants cooler and to provide the farmers with other income, some of which they can use to fund climate adaptation measures.

“In some areas of the world shade trees increase bird populations, which feed on insect pests of coffee. Another option is to move coffee plantings to higher elevations, assuming this is feasible and does not interfere with upslope forest conservation efforts,” Hoffman says.

“To help farmers adapt to the changing conditions, they need to know what to do and coffee cooperatives can foster training programmes for coffee growers. Through services offered by cooperatives, grower profits can increase, allowing them to invest more in climate-smart practices.”

Becerril says “the best mitigation is prevention”.

“Healthy plants are more resistant to pests and drought, and have higher yields. Nutrient-rich, biodiverse soils grow healthy plants. Regular post-harvest pruning and shade management regulate on-farm temperatures, prevent soil erosion, and allow plans to direct nutrients to new growth, increasing productivity,” she adds.

Above all, farmers need incomes that allow them to adapt to climate change. Private institutions and banks could provide microfinancing to smallholder coffee farmers to help them finance adaptation. Coffee sellers could help farmers use different strategies to optimise yield, provide more resilient seeds and monitor production.

Africa has some of the highest quality coffee in the world, yet it lacks in productivity compared with other coffee producing continents. Public interventions, such as farmer support programmes and training to improve productivity and sustainability could go a long way. Governments should invest in research to make more resilient crops and climate-friendly policies.

Climate change could see coffee prices rise, quality plummet and premium beans becoming harder to find. The industry and policymakers must take urgent action if they want to avoid these issues trickling down to the consumer.

****

Adapted from African.business

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price