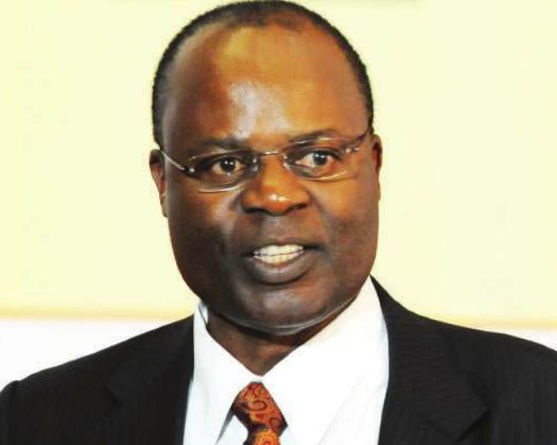

Deputy Governor of Bank of Uganda Louis Kasekende answered questions from The Independent’s Ian Katusiime about the bank’s upcoming golden jubilee anniversary and other economic issues.

Bank of Uganda (BoU) is marking 50 years. Looking back, what does this mean for BoU?

This anniversary gives the Bank of Uganda (BoU) the opportunity to look back over the last half century and make a critical and objective assessment of its performance, so as to derive lessons for the future. It also offers the opportunity to engage with the general public so as to enhance public understanding of the role of the central bank in the economy, and what it can realistically be expected to do. The first 50 years of the BoU’s life have included many turbulent years and difficult challenges, including the murder of its first Governor, in 1971, but I think it is fair to conclude that the BoU has emerged after half a century as one of the strongest public institutions in the country and one which has adopted modern approaches to monetary policy and bank regulation, and successfully applied them in Uganda.

What would you say is the one area BoU has improved markedly in its 50 year journey?

By any objective criteria it is difficult to dispute that the BoU’s monetary policy has improved markedly over the last 50 years. The main objective of monetary policy is to control inflation. In the 1970s and 1980s, inflation was usually in double digits and sometimes in triple digits. Since 1991, when reforms to macroeconomic policy were introduced and the BoU put in place effective measures to control money supply growth, inflation has fallen dramatically. Over the last 20 years, headline inflation has averaged just under 7 percent.

In a country where institutions are still nascent, can BoU fully resist political pressure?

For a central bank, the ultimate test of whether it has been able to resist political pressure can be found in the performance of its monetary policy and the effective oversight over the banking sector. An independent central bank will pursue a monetary policy designed to achieve its inflation policy target; a central bank which cannot resist political pressure is likely to be distracted from that target to pursue other objectives. As I have already mentioned, the BoU’s performance in controlling inflation since it was granted operational independence in the 1995 Constitution has been generally good, with average headline inflation of less than 7 percent. The Bank of Uganda has also effected its supervisory and regulatory regime to foster a sound banking sector, characterised by growth and innovation while maintaining good asset quality. The Central Bank has effectively resolved, supervised Financial Institutions (FIs) and closed some FIs whenever it became inevitable with very minimal disruptions to the sector or loss, if any, to the depositors. That is not the performance of a central bank which cannot resist political pressure.

People say BoU has not done enough on regulating mobile money. What’s your say?

The main purpose of financial regulation is to protect deposits. When a customer purchases mobile money with cash, the mobile money has features which are similar to a demand deposit (it is a means of payment and store of value). As such the priority of the BoU is to ensure that the mobile money purchased by customers is protected; it will not be lost because of fraud or because a mobile money operator goes bankrupt. The system that we have put in place provides this protection. All mobile money sold in Uganda must be backed, 100 percent, by funds in an escrow account which the mobile money operators hold in their partner commercial bank, which is regulated by the BoU. Consequently there will always be funds available to reimburse the holders of mobile money in the event that the mobile money operators cannot meet their obligations.

The BoU is further strengthening the regulatory environment with amendments to the Bank of Uganda Act and a comprehensive National Payments Systems’ law is in the offing.

What is the best way central banks can manage the growth-inflation balance?

The task of the central bank is not to balance inflation and growth because, except in the very short run, there is no trade-off between inflation and real growth. The real growth of the economy, over the medium term, is determined by supply side factors such as labour force growth, growth of the capital stock and productivity improvements. Monetary policy affects the demand side of the economy, not the supply side. The task of monetary policy is to ensure the growth of overall demand in the economy (aggregate demand) is aligned with the growth in the economy’s capacity to supply goods and services (aggregate supply). If demand grows too quickly and outstrips supply, there will be accelerating inflation; conversely if demand grows too slowly, real growth will be depressed.

How prepared is Uganda for external shocks like the upcoming Kenya elections or say the recent Brexit vote?

The Ugandan economy has demonstrated, over the last two years, that it has the resilience to withstand external shocks. In that period we have seen a fall in the prices of many of our commodity exports, serious problems in regional export markets, especially South Sudan and several bouts of turbulence on global financial markets. Together these constituted a major external shock, yet our economy has been able to ride out this shock in reasonably good shape. It has been able to do so primarily because of two factors. First we have a flexible exchange rate, which helps to mitigate the impact of external shocks on the real economy. Second we have a healthy level of foreign exchange reserves with which to protect our balance of payments; currently we hold just under $3 billion of reserves which amounts to four months’ of import cover. If we stick to our proven macroeconomic policy framework (inclusive of fiscal and debt sustainability) and maintain an adequate buffer of foreign exchange reserves, I am confident that we are well prepared to withstand any future external shocks.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price