Uganda alone generated roughly US$5.21 billion, approximately 18.23 trillion shillings, from gold exports between Nov 2024 and Oct 2025

Cairo, Egypt | THE INDEPENDENT | Africa is moving to reclaim control over its gold resources as Afreximbank and Egypt’s central bank advance plans for a pan-African bullion institution aimed at retaining more value on the continent.

The two institutions signed a memorandum of understanding on December 29 to explore the creation of an African Gold Bank, a project designed to formalise gold value chains, strengthen central bank reserves, and reduce reliance on overseas refining and trading hubs in Europe, the Middle East, and Asia.

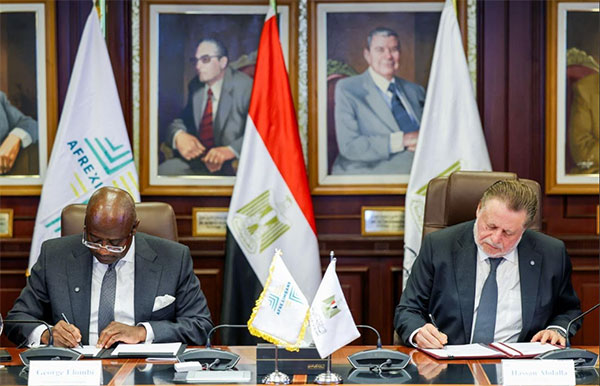

The agreement, signed in Cairo by Afreximbank President George Elombi and Central Bank of Egypt Governor Hassan Abdalla, launches a feasibility study to examine the technical, commercial, and regulatory requirements for developing an integrated gold ecosystem in Egypt. The proposed platform would include an internationally accredited refinery, secure vaulting facilities, and associated financial and trading services within a designated free zone.

If realised, the initiative could transform Africa’s role in the global gold market. While the continent accounts for a large portion of global gold production, much of its output, particularly from Ghana, South Africa, Mali, Burkina Faso, Sudan, the Democratic Republic of Congo, and Uganda, is exported in raw or semi-processed form and refined abroad. This limits value retention and the contribution of gold to domestic financial systems.

Uganda alone generated roughly US$5.21 billion, approximately 18.23 trillion shillings, from gold exports between November 2024 and October 2025, highlighting both the potential and the opportunity for greater value capture.

Africa’s economic sovereignty

For Afreximbank, the initiative supports its mandate to promote value addition, industrialisation, and intra-African trade. The bank has increasingly focused on strategic minerals as a vehicle for strengthening economic resilience, boosting exports, and deepening regional financial integration.

Egypt sees the project as an extension of its strategy to deepen economic ties across Africa and position itself as a regional hub for trade and finance. The country’s potential role as host, pending the outcome of the feasibility study and regulatory approvals, reflects confidence in its infrastructure, institutional capacity, and strategic location at the crossroads of Africa, the Middle East, and Europe.

The Gold Bank initiative is intended to expand beyond Egypt, engaging African governments, central banks, mining companies, and other industry stakeholders. The goal is to harmonise standards, foster institutional collaboration, and support the sustainable trade of gold and related financial services across the continent.

At the signing, Abdalla said the project could evolve into a fully pan-African framework, uniting policymakers and market participants around shared infrastructure for gold trade and financial innovation. Elombi described the agreement as a strategic step toward economic sovereignty, noting that the African Gold Bank would reshape how the continent extracts, refines, manages, and trades gold, with the aim of retaining more value domestically.

By building larger gold reserves within Africa, the initiative could strengthen currency stability, improve convertibility, and reduce vulnerability to external shocks, echoing strategies employed by major economies that rely on bullion holdings to bolster financial systems.

The partnership also underscores the close relationship between Afreximbank and Egypt, its host country and largest shareholder, a connection expected to play a central role as the project moves from concept to execution.

While still in the exploratory stage, the African Gold Bank initiative comes at a time of robust global demand for gold and heightened geopolitical uncertainty, signaling a forward-looking effort to ensure that Africa’s gold contributes to the continent’s economic stability rather than to foreign trading hubs.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price