Katuntu’s defence

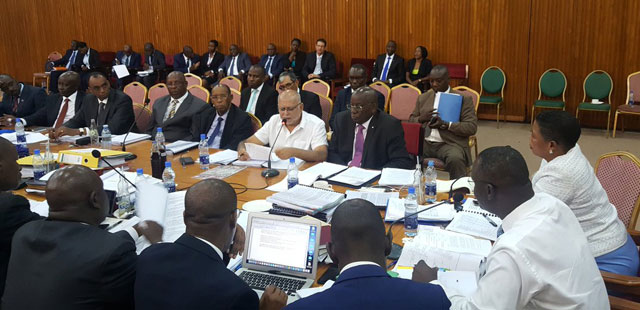

Critics say they expected Katuntu’s committee to name names, causes arrests and resignations.

Governor Tumusiime Mutebile, his deputy Louis Kasekende, former Executive Director Banking Supervision and her deputy, Benedicto Ssekabira are some of the names many expected Katuntu to list and hold accountable.

“The first person who should be put on firing squad is Mutebile,” said former COSASE chairman Semujju Nganda, “How did all this happen under his nose?”

Katuntu, after tabling the report to parliament, appeared keenly aware of the growing criticism against his committee report. He went on an explanatory tour of radio and TV talk shows.

We were guided by the terms of reference, Katuntu has pleaded.

A committee of parliament such as COSASE, he said, must do four things: propose requisite policy changes, recommend legal reforms, suggest measures to improve the governance, and ensure accountability.

He said his team had done all four for Bank of Uganda. Then he listed what he said were the main achievements of the COSASE probe.

In his view, the next step involves the COSASE report being debated in parliament and other arms of government taking an interest in the finding.

It is not the mandate of parliament to conduct a criminal investigation and anyone demanding that is ignorant of the doctrine of separation of power in a democracy, Katuntu has argued.

“We risked being misunderstood if we had gone outside our terms of reference,” he says.

But it appeared he was reading more into his report than most of its readers saw.

“We have indicted the entire board,” Katuntu said at one point while explaining how his committee had held officials accountable.

He was referring to the committee’s observation that the board did not adequately supervise management in the process of liquidating the financial institutions.

As a result, his committee recommended that; “the appointing authority may in the event of any failure on the part of the Board in effective supervision of the management of the Bank consider reviewing their appointment”.

Usually, an indictment is a criminal accusation against an individual or group, in this case, the crime is clearly unclear.

Governor Mutebile is the BoU board chairman and Louis Kasekende is the deputy.

Katuntu’s team also recommended that other BoU officials be held accountable for their commissions and omissions in liquidation banks.

The committee concluded that in liquidating the seven banks, BoU officials did not follow or severally breached the provisions of the Financial Institutions Act (FIA).

According to the FIA, BOU is obliged to take certain steps before selling off assets of a financial institution.

The FIA, for instance, demands that the sale of assets of a bank taken over by BoU should be done in a way that results in marshaling the greatest amount of the financial institution’s assets and protects the interests of depositors; including their interest in the unprotected deposit amounts.

It should also minimise costs to the Deposit Protection Fund and losses to other creditors, and ensure stability of the financial sector.

In determining the amount of assets likely to be realised from the financial institution’s assets, the FIA states that the receiver shall, (a) evaluate the alternatives on a present value basis, using a realistic discount rate, and (b) document the evaluation and the assumptions on which the evaluation is based, including any assumptions with regard to interest rates, asset recovery rates, inflation, asset holding and other costs.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price