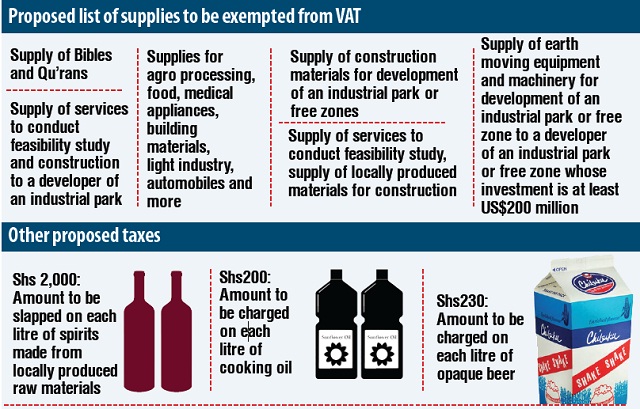

On the other hand, it is also proposing to exempt from tax the income of a developer of an industrial park or free zone whose investment capital is at least US$200 million for a period of 10 years from the date of commencement of construction.

The bill is also proposing that a taxpayer who has carried forward losses for a consecutive period of seven years of income shall pay a tax at a rate of 0.5% of the gross turnover for every year of income in which the loss continues after the seventh year.

The bill also proposes that a person who makes a gross payment for agricultural supplies in excess of Shs1million shall withhold tax on the gross amount of the payment of one per cent.

Big taxpayers want incentives

Patrick Oyuru, the commercial director for Coca-Cola Beverages Africa (Uganda) said the exemption of tax especially those related to profits and new investments is a good initiative by government because it allows investors to weather for a longer period of time as they develop new products and put in place new manufacturing lines.

“It is a concept of sharing the gain and pain,” Oyuru told The Independent. He, however, said that for companies that have been in business for a long time, they need government initiatives that allow them also to continue to invest by giving them small waivers or reduction on excise duty.

He said that they are still appealing to government to reduce excise duty they pay on each litre of their products from 13% to 10% – a move that would see prices reduce and increase sales.

Going forward

The civil society organizations under their umbrella, Tax Justice Alliance Uganda said in a joint statement on April 23, that they welcome the new measures aimed at increasing revenue to fund government programmes.

They, however, suggested that the rate of tax on SACCOs should be progressive in relation to the income portfolios.

On taxing loss making businesses, the group proposes that the businesses that consecutively carry forward losses be reduced to five years in addition to government developing a schedule with an estimate of the rate of return on investment in different sectors.

On taxing online services, the group proposes that, the proposed tax measure be scrapped and deferred until that time when URA will have the technology and technical capacity to administer it.

They also proposed that the taxes on mobile money be waived as it would hinder ongoing efforts towards financial inclusion due to differences in income.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price