Kampala, Uganda | THE INDEPENDENT | Government has given Uganda Revenue Authority (URA) the go ahead to introduce the long awaited Digital Tracking Solution (Digital Tax Stamps).

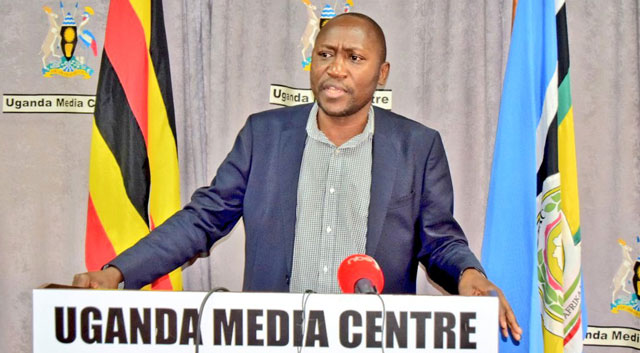

Speaking at a joint press conference Friday with Uganda Manufacturers Association, The Prime Minister’s Office and Ministry of Finance, URA spokesman Vincent Seruma said that the Prime Minister Dr Ruhakana Rugunda had Thursday convened a meeting of key stakeholders that reached a harmonized understanding over the introduction of the Digital Tracking Solution (Digital Tax Stamps).

Seruma revealed that starting today, all taxpayers dealing in gazetted products locally manufactured or imported are expected to have their products affixed with Digital Tax Stamps.

Manufacturers have been given a three months grace period, up to January 31,2020 to finish up all stock in the distribution chain that does not have digital tax stamps.

“In the same grace period , installation of stamp-affixing technology will take place in the manufacturers’ and importers’ production lines. All parties will continue engaging to ensure smooth implementation of this initiative,” Seruma told the press.

The manufacturers biggest issue with the new solution has been on the cost. They argue that while the initiative will help the government generate more taxes, it increases their production costs.

Why Digital tracking

The Digital Tax stamps is another solution that mainly seeks to address challenges of illicit trade, counterfeit products and unfair competition on the market. It is used to track and trace excisable goods. With this digitization, there won’t be need to manually follow up and calculate taxes vis-a-vis sales.

Digital Tracking Solution and Digital Tax Stamps are not only meant to help traders suffering from an unfair competition that comes with contraband goods, but will help the tax collectors generate an extra sh48 billion. URA has a target of Shillings 20.8trillion for the 2019/2020 financial year up from Shillings 16 trillion.

Some of the challenges that the new digital stamps will address include tax evasion and smuggling which arises from cross border trade. All items will now be verified and specified goods traced through a distribution chain. Initial focus will be on beverages and cigarettes.

URA reported recently that Uganda’s soda and bottled water sector currently consists of 256 manufacturers, of which only 46 are on the tax register.

According to the Uganda Manufacturers Association, the soda and bottled water sector currently produces 231,379,200,000 bottles per annum. At a unit price of Shs 625 per bottle , the sectors are expected to have remitted Shs 14.4 trillion in tax per annum.

Only Shs 105 Bn was remitted in FY 2016/17 while Shs 135 Bn was remitted in FY 2017/18.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price