Dfcu provided two lists of some of the assets it acquired from Crane Bank. The first list showed how dfcu valued these assets before it acquired them and the other showed values of the properties a month after dfcu acquired them. dfcu officials said the second valuation was carried out by an independent firm.

Anita Among, the deputy chairperson of COSASE, read out some of the values. She noted that while dfcu valued one of the properties at Shs400 million before the takeover, a month later, an independent valuer hired by the same bank valued the same property at Shs2 billion.

Concerned that this could have applied to all the properties, among asked dfcu for the asset register—a list of all properties acquired from Crane Bank. Officials from dfcu, which acquired the said properties, said they did not have the asset register. They said it was with BoU.

Committee members also raised concerns that dfcu had acquired Crane Bank in the absence of the statutory manager, contrary to the law.

But William Ssekabembe, a senior dfcu official, told the Committee that the bank had several meetings with Katimbo Mugwanya, who BoU had appointed as the statutory manager for Crane Bank to handle the takeover.

“There is no way we would have taken over that bank without certain insights,” Ssekabembe, “I can confirm that we had several meetings and the statutory manager stayed on for several weeks with certain facilities that he was using for some time.”

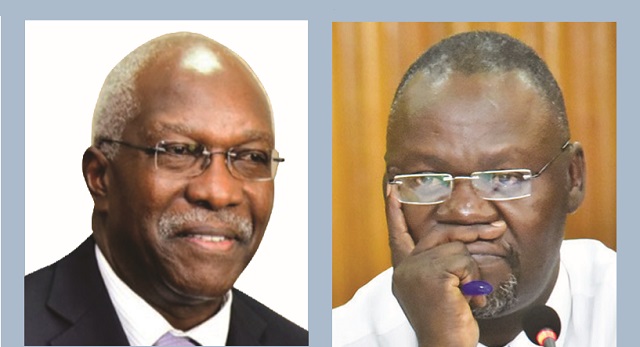

This forced the committee chairman, Abdul Katuntu, to rule that Ssekabembe swears an oath because committee members suspected that he was not telling the truth.

And this was because while appearing before the committee, the statutory manager, Katimbo Mugwanya, had told the committee that he was on his farm the day dfcu took over Crane Bank.

He said that he only received pictures on WhatsApp, the mobile messaging app, showing dfcu staff loading files and other stuff from Crane Bank and taking them.

It is not only Crane Bank that BoU handled in this manner. The committee heard that Bagyenda contacted Crane Bank’s A. Kalan asking to sell them National Bank of Commerce.

NBC shareholders, Mathew Rukikaire, former Prime Minister Amama Mbabazi and Amos Nzeyi raised concerns that despite a 2012 BoU monitoring report indicating that NBC’s total assets were worth Shs21billion, well above the then minimum capital threshold of Shs10 billion, the central bank went ahead and closed their bank.

“BoU asked us to raise a shortfall of Shs7 billion. We raised it in four days. There was now a shortfall of Shs300 million and they did not even give us one day to raise it. We had demonstrated capacity to raise money,” Mbabazi said wondering why, despite this, BoU had gone ahead to close their bank.

The shareholders of Global Trust Bank told the committee that following a demand on July 04, 2014 to recapitalise the bank, the shareholders were not given time to comply and the Bank was shut on July 25, 2014. They said that BoU sold their bank 15 days before they closed it.

Shareholders of Greenland Bank led by Ahmed Nsubuga also raised issues surrounding the liquidation of their bank that remain unresolved 20 years after it was closed. They fingered BoU over the manner in which its assets were sold.

In December 2007, BoU signed an agreement with a grey entity, Nile River Acquisition Company, to sell the debt portfolio of Greenland, ICB and Cooperative banks at US$25 million or Shs.8.9 billion. The loans were worth Shs135 billion.

The sales price offered of Shs8.898 billion represented 26% of the total secured loan portfolio and 7% of total loan portfolio.

Critics say BOU did not raise the maximum amount possible from the sale of these assets in line with section 33(5}(d) of FIS 1993.

Overall, these revelations confirm the fears of Auditor General John Muwanga.

“I observed that there were no guidelines/regulation or policies in place to guide the identification of the purchasers of defunct banks,” the AG noted in his special report on defunct banks, “In the absence of guidelines of the sale of banks, there is a risk that bank assets may be sold at a loss arising from conflict of interest between BOU staff and the potential buyers.”

COSASE based its probe on the Special Audit it asked the AG to undertake following the controversy surrounding the takeover and sale of Crane Bank to DFCU last year.

Having interacted with the BoU management, shareholders of defunct banks and dfcu officials, COSASE invited the BoU board on December 08, 2018.

Asked why the board abdicated their role in the closure of the banks, a member of the BoU board; William Kalema, attempted to shield the board from the mess.

“No, we weren’t involved in mechanics of closing the banks,” Kalema said, “When it comes to mechanics of closing a bank, there isn’t enough time. If we had better supervision, we would have foreseen those problems, in some cases, those problems weren’t revealed. In some cases, the supervision people were taken by surprise.”

This infuriated the legislators. Katuntu noted that that if BoU had a very strong supervision department, it should have seen this thing coming.

“We don’t see any emergency in any (closure) unless your bank supervision wasn’t working or if it was working, it withheld crucial information. From the facts we have, we don’t see any bank that collapsed from nowhere,” Katuntu shot back.

The question now is whether Katuntu’s committee will recommend that the central bank pays for the mess surrounding the closure of these banks. And what the government and the courts do about it.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Out of interest is central banks problem closing the banks or is it selling them improperly and if it is the latter is the 5tn pay up fair or not?